Apollo Global Management Mergers and Acquisitions Presentation Deck

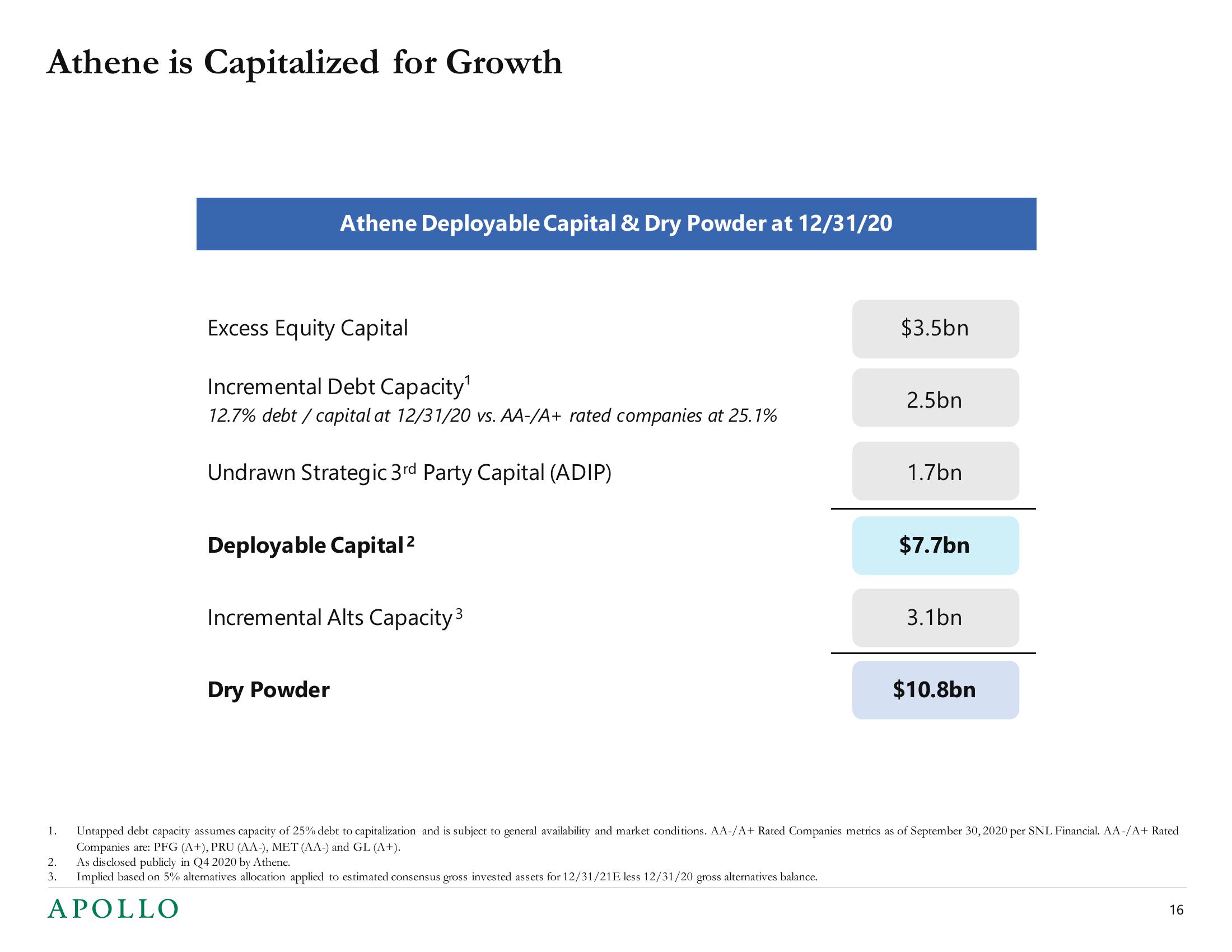

Athene is Capitalized for Growth

1.

2.

3.

Athene Deployable Capital & Dry Powder at 12/31/20

Excess Equity Capital

Incremental Debt Capacity¹

12.7% debt / capital at 12/31/20 vs. AA-/A+ rated companies at 25.1%

Undrawn Strategic 3rd Party Capital (ADIP)

Deployable Capital ²

Incremental Alts Capacity ³

Dry Powder

$3.5bn

2.5bn

1.7bn

$7.7bn

3.1bn

Untapped debt capacity assumes capacity of 25% debt to capitalization and is subject to general availability and market conditions. AA-/A+ Rated Companies metrics as of September 30, 2020 per SNL Financial. AA-/A+ Rated

Companies are: PFG (A+), PRU (AA-), MET (AA-) and GL (A+).

As disclosed publicly in Q4 2020 by Athene.

Implied based on 5% alternatives allocation applied to estimated consensus gross invested assets for 12/31/21E less 12/31/20 gross alternatives balance.

APOLLO

$10.8bn

16View entire presentation