SoftBank Results Presentation Deck

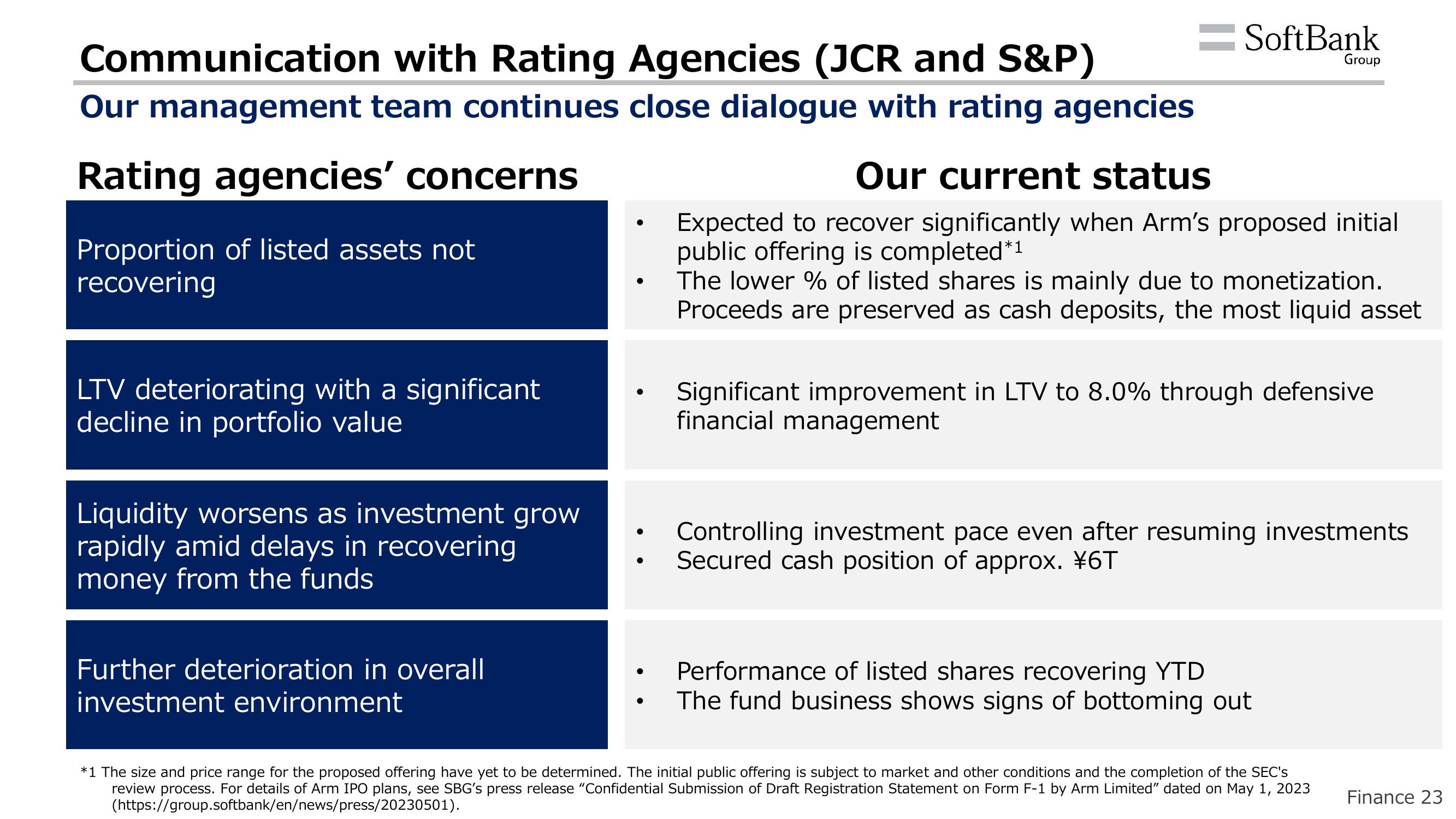

Communication with Rating Agencies (JCR and S&P)

Our management team continues close dialogue with rating agencies

Rating agencies' concerns

Proportion of listed assets not

recovering

LTV deteriorating with a significant

decline in portfolio value

Liquidity worsens as investment grow

rapidly amid delays in recovering

money from the funds

Further deterioration in overall

investment environment

●

●

=SoftBank

Our current status

Expected to recover significantly when Arm's proposed initial

public offering is completed*1

Group

The lower % of listed shares is mainly due to monetization.

Proceeds are preserved as cash deposits, the most liquid asset

Significant improvement in LTV to 8.0% through defensive

financial management

Controlling investment pace even after resuming investments

Secured cash position of approx. ¥6T

Performance of listed shares recovering YTD

The fund business shows signs of bottoming out

*1 The size and price range for the proposed offering have yet to be determined. The initial public offering is subject to market and other conditions and the completion of the SEC's

review process. For details of Arm IPO plans, see SBG's press release "Confidential Submission of Draft Registration Statement on Form F-1 by Arm Limited" dated on May 1, 2023

(https://group.softbank/en/news/press/20230501).

Finance 23View entire presentation