Opendoor Investor Presentation Deck

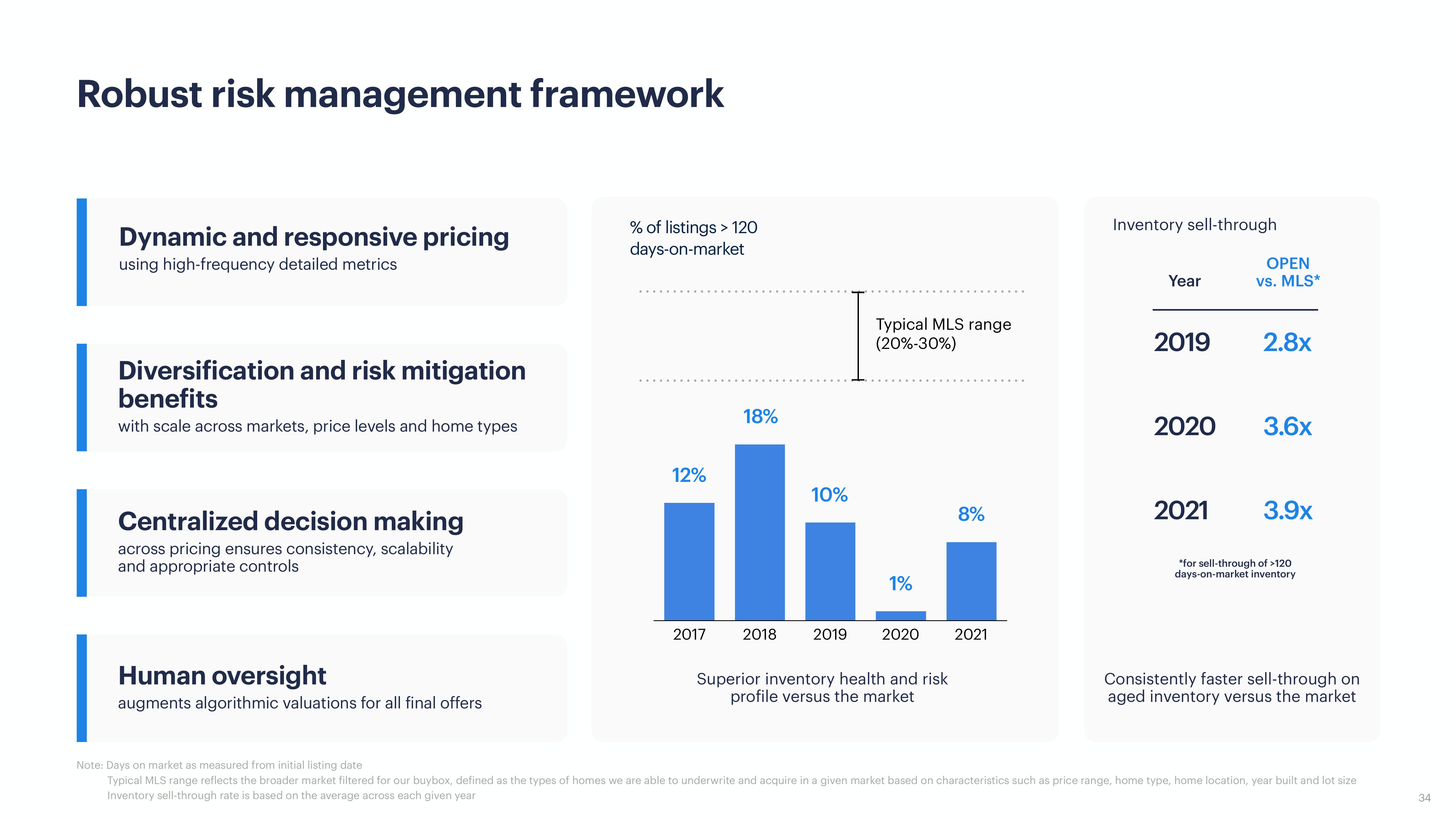

Robust risk management framework

Dynamic and responsive pricing

using high-frequency detailed metrics

Diversification and risk mitigation

benefits

with scale across markets, price levels and home types

Centralized decision making

across pricing ensures consistency, scalability

and appropriate controls

Human oversight

augments algorithmic valuations for all final offers

% of listings > 120

days-on-market

12%

2017

18%

2018

10%

Typical MLS range

(20%-30%)

1%

2019 2020

Superior inventory health and risk

profile versus the market

8%

2021

Inventory sell-through

Year

2019

2020

2021

OPEN

vs. MLS*

2.8x

3.6x

3.9x

*for sell-through of >120

days-on-market inventory

Consistently faster sell-through on

aged inventory versus the market

Note: Days on market as measured from initial listing date

Typical MLS range reflects the broader market filtered for our buybox, defined as the types of homes we are able to underwrite and acquire in a given market based on characteristics such as price range, home type, home location, year built and lot size

Inventory sell-through rate is based on the average across each given year

34View entire presentation