Rally SPAC Presentation Deck

Investor Incentives

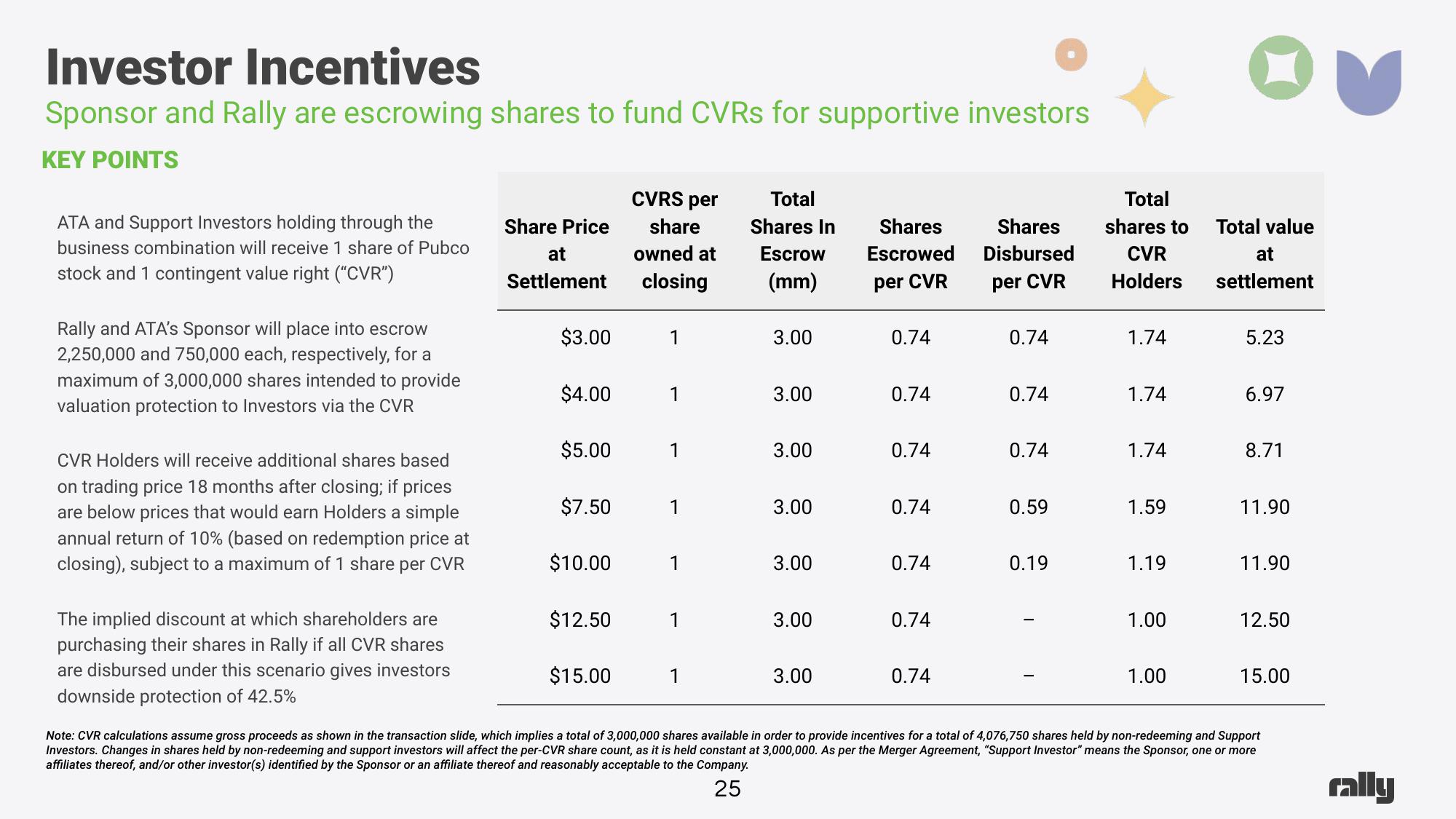

Sponsor and Rally are escrowing shares to fund CVRs for supportive investors

KEY POINTS

ATA and Support Investors holding through the

business combination will receive 1 share of Pubco

stock and 1 contingent value right ("CVR")

Rally and ATA's Sponsor will place into escrow

2,250,000 and 750,000 each, respectively, for a

maximum of 3,000,000 shares intended to provide

valuation protection to Investors via the CVR

CVR Holders will receive additional shares based

on trading price 18 months after closing; if prices

are below prices that would earn Holders a simple

annual return of 10% (based on redemption price at

closing), subject to a maximum of 1 share per CVR

The implied discount at which shareholders are

purchasing their shares in Rally if all CVR shares

are disbursed under this scenario gives investors

downside protection of 42.5%

Share Price

at

Settlement

$3.00

$4.00

$5.00

$7.50

$10.00

$12.50

$15.00

CVRS per

share

owned at

closing

1

1

1

1

1

1

Total

Shares In

Escrow

(mm)

3.

3.00

3.00

3.00

3.00

3.00

3.00

Shares

Shares

Escrowed Disbursed

per CVR

per CVR

0.74

0.74

0.74

0.74

0.74

0.74

0.74

0.74

0.74

0.74

0.59

0.19

Total

shares to

CVR

Holders

1.74

1.74

1.74

1.59

1.19

1.00

1.00

Total value

at

settlement

5.23

6.97

8.71

11.90

11.90

12.50

15.00

Note: CVR calculations assume gross proceeds as shown in the transaction slide, which implies a total of 3,000,000 shares available in order to provide incentives for a total of 4,076,750 shares held by non-redeeming and Support

Investors. Changes in shares held by non-redeeming and support investors will affect the per-CVR share count, as it is held constant at 3,000,000. As per the Merger Agreement, "Support Investor" means the Sponsor, one or more

affiliates thereof, and/or other investor(s) identified by the Sponsor or an affiliate thereof and reasonably acceptable to the Company.

25

rallyView entire presentation