2011 and Fourth Quarter Results

Risk Review

Morten Friis

Chief Risk Officer

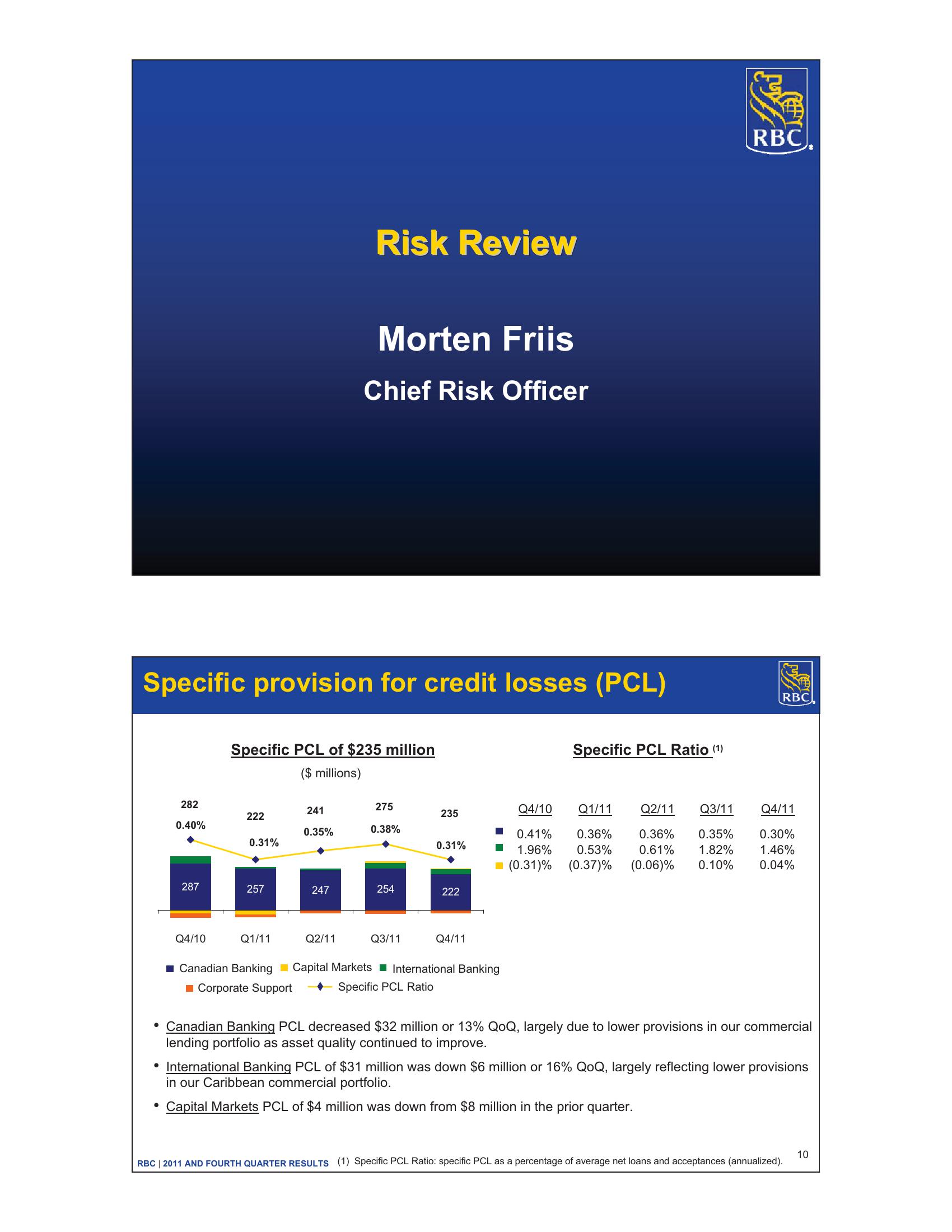

Specific provision for credit losses (PCL)

Specific PCL of $235 million

($ millions)

Specific PCL Ratio (1)

RBC

RBC

282

275

241

Q4/10

235

222

0.40%

0.35%

0.38%

0.31%

0.31%

0.41%

1.96%

(0.31)%

Q1/11 Q2/11 Q3/11

0.36% 0.36% 0.35%

0.53% 0.61% 1.82%

(0.37)% (0.06)%

Q4/11

0.30%

1.46%

0.10%

0.04%

287

257

247

254

222

Q4/10

Q1/11

Q2/11

Q3/11

Q4/11

Capital Markets

International Banking

■Canadian Banking

Corporate Support

Specific PCL Ratio

• Canadian Banking PCL decreased $32 million or 13% QoQ, largely due to lower provisions in our commercial

lending portfolio as asset quality continued to improve.

• International Banking PCL of $31 million was down $6 million or 16% QoQ, largely reflecting lower provisions

in our Caribbean commercial portfolio.

Capital Markets PCL of $4 million was down from $8 million in the prior quarter.

RBC 2011 AND FOURTH QUARTER RESULTS (1) Specific PCL Ratio: specific PCL as a percentage of average net loans and acceptances (annualized).

10View entire presentation