Getaround SPAC Presentation Deck

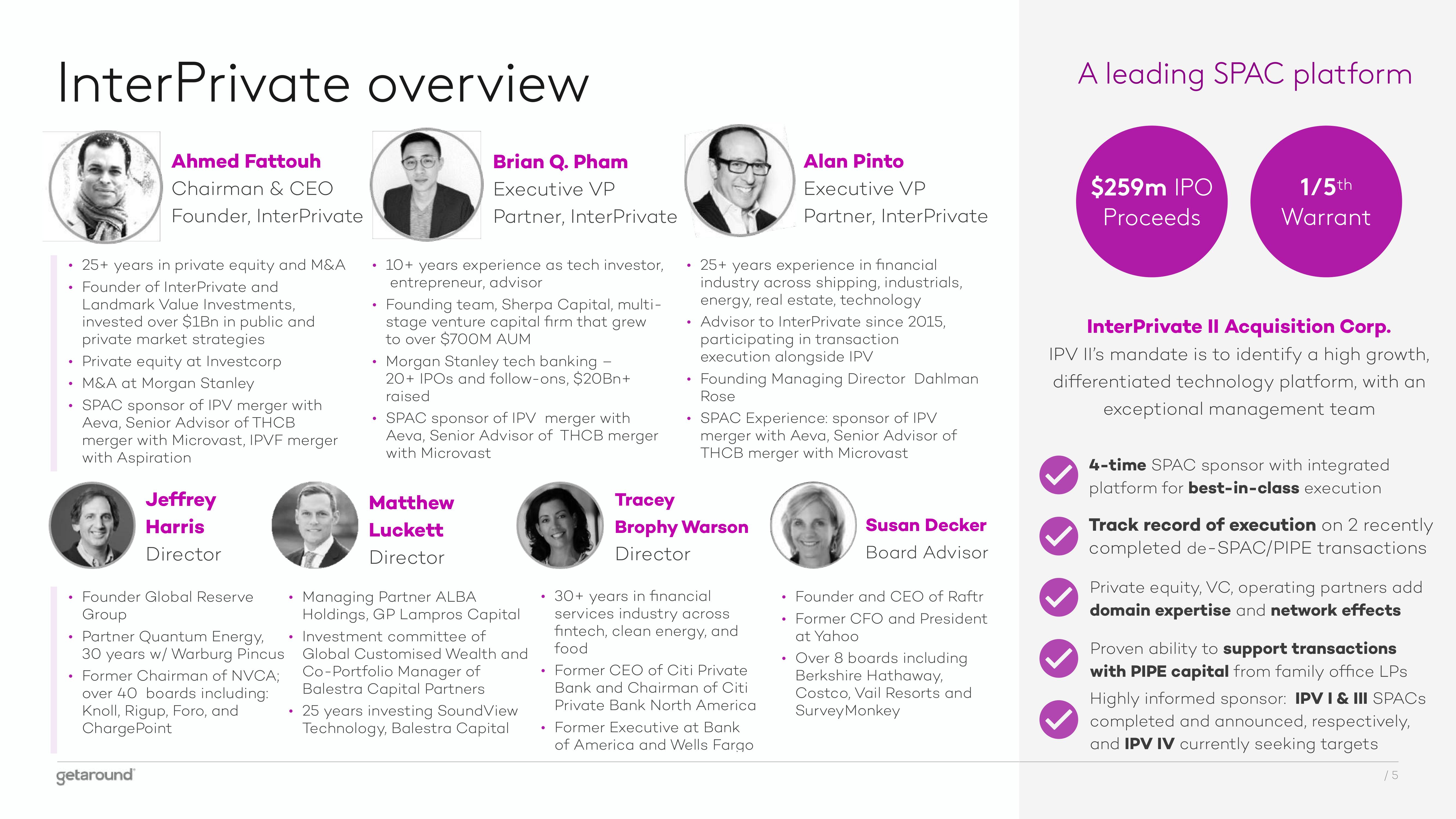

InterPrivate overview

Ahmed Fattouh

Chairman & CEO

Founder, InterPrivate

• 25+ years in private equity and M&A

• Founder of Inter Private and

Landmark Value Investments,

invested over $1Bn in public and

private market strategies

• Private equity at Investcorp

• M&A at Morgan Stanley

• SPAC sponsor of IPV merger with

Aeva, Senior Advisor of THCB

merger with Microvast, IPVF merger

with Aspiration

Jeffrey

Harris

Director

. Founder Global Reserve

Group

• Partner Quantum Energy,

30 years w/ Warburg Pincus

getaround

• Former Chairman of NVCA;

over 40 boards including:

Knoll, Rigup, Foro, and

Charge Point

Brian Q. Pham

Executive VP

Partner, InterPrivate

• 10+ years experience as tech investor,

entrepreneur, advisor

Founding team, Sherpa Capital, multi-

stage venture capital firm that grew

to over $700M AUM

Morgan Stanley tech banking

20+ IPOs and follow-ons, $20Bn+

raised

Matthew

Luckett

Director

SPAC sponsor of IPV merger with

Aeva, Senior Advisor of THCB merger

with Microvast

Managing Partner ALBA

Holdings, GP Lampros Capital

• Investment committee of

Global Customised Wealth and

Co-Portfolio Manager of

Balestra Capital Partners

-

• 25 years investing SoundView

Technology, Balestra Capital

• 25+ years experience in financial

industry across shipping, industrials,

energy, real estate, technology

.

Advisor to Inter Private since 2015,

participating in transaction

execution alongside IPV

Founding Managing Director Dahlman

Rose

• SPAC Experience: sponsor of IPV

merger with Aeva, Senior Advisor of

THCB merger with Microvast

Tracey

Brophy Warson

Director

30+ years in financial

services industry across

fintech, clean energy, and

food

Alan Pinto

Executive VP

Partner, Inter Private

• Former CEO of Citi Private

Bank and Chairman of Citi

Private Bank North Americal

Former Executive at Bank

of America and Wells Fargo

.

Susan Decker

Board Advisor

Founder and CEO of Raftr

• Former CFO and President

at Yahoo

• Over 8 boards including

Berkshire Hathaway,

Costco, Vail Resorts and

SurveyMonkey

A leading SPAC platform

$259m IPO

Proceeds

1/5th

Warrant

InterPrivate Il Acquisition Corp.

IPV II's mandate is to identify a high growth,

differentiated technology platform, with an

exceptional management team

4-time SPAC sponsor with integrated

platform for best-in-class execution

Track record of execution on 2 recently

completed de-SPAC/PIPE transactions

Private equity, VC, operating partners add

domain expertise and network effects

Proven ability to support transactions

with PIPE capital from family office LPs

Highly informed sponsor: IPV I & III SPACS

completed and announced, respectively,

and IPV IV currently seeking targets

/5View entire presentation