Apollo Global Management Investor Day Presentation Deck

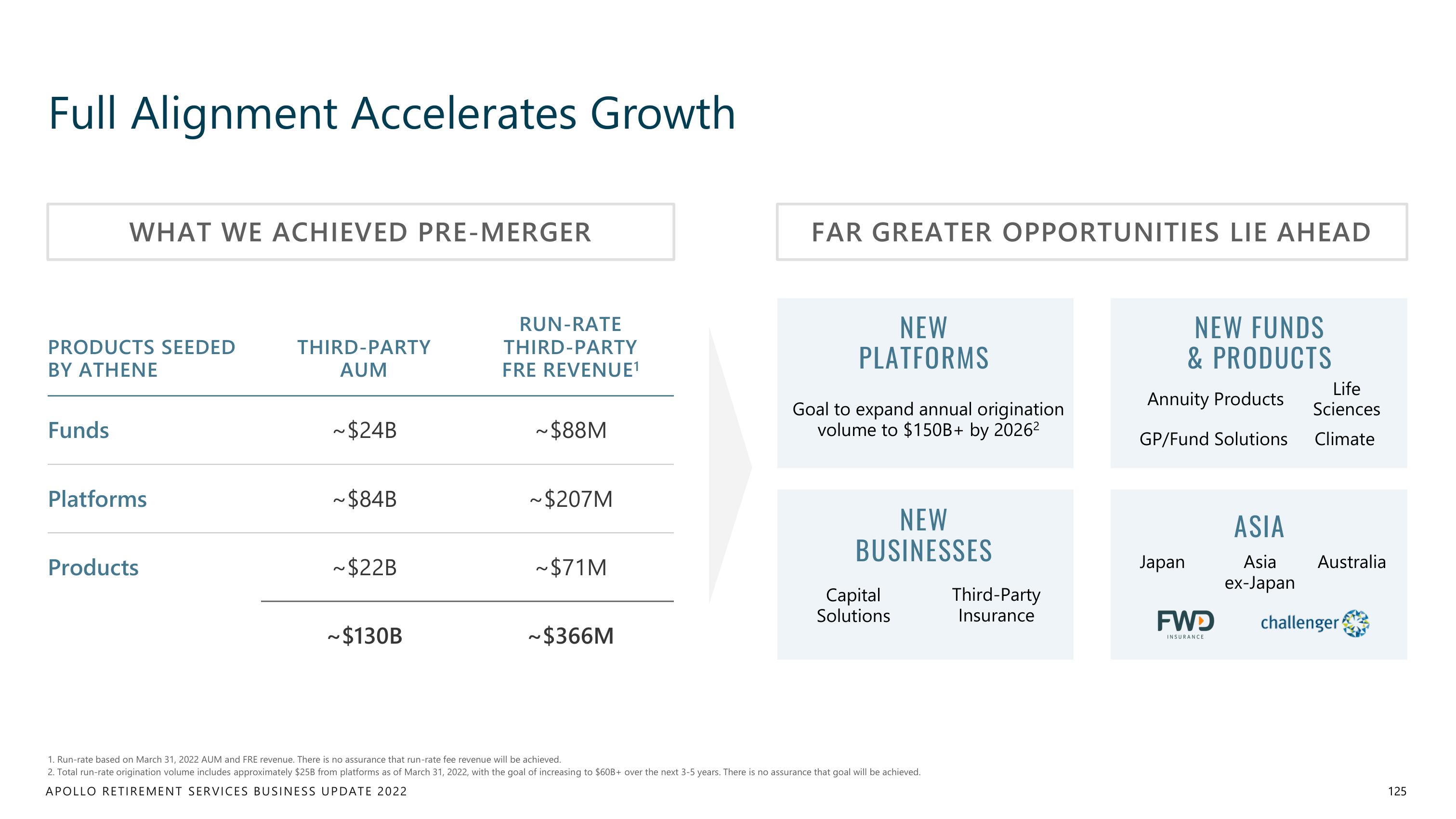

Full Alignment Accelerates Growth

WHAT WE ACHIEVED PRE-MERGER

PRODUCTS SEEDED

BY ATHENE

Funds

Platforms

Products

THIRD-PARTY

AUM

~$24B

~$84B

~$22B

~$130B

RUN-RATE

THIRD-PARTY

FRE REVENUE¹

~$88M

~$207M

~$71M

~$366M

FAR GREATER OPPORTUNITIES LIE AHEAD

NEW

PLATFORMS

Goal to expand annual origination

volume to $150B+ by 2026²

NEW

BUSINESSES

Capital

Solutions

1. Run-rate based on March 31, 2022 AUM and FRE revenue. There is no assurance that run-rate fee revenue will be achieved.

2. Total run-rate origination volume includes approximately $25B from platforms as of March 31, 2022, with the goal of increasing to $60B+ over the next 3-5 years. There is no assurance that goal will be achieved.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

Third-Party

Insurance

NEW FUNDS

& PRODUCTS

Annuity Products

GP/Fund Solutions

Japan

FWD

INSURANCE

ASIA

Asia

ex-Japan

Life

Sciences

Climate

Australia

challenger

125View entire presentation