UBS Results Presentation Deck

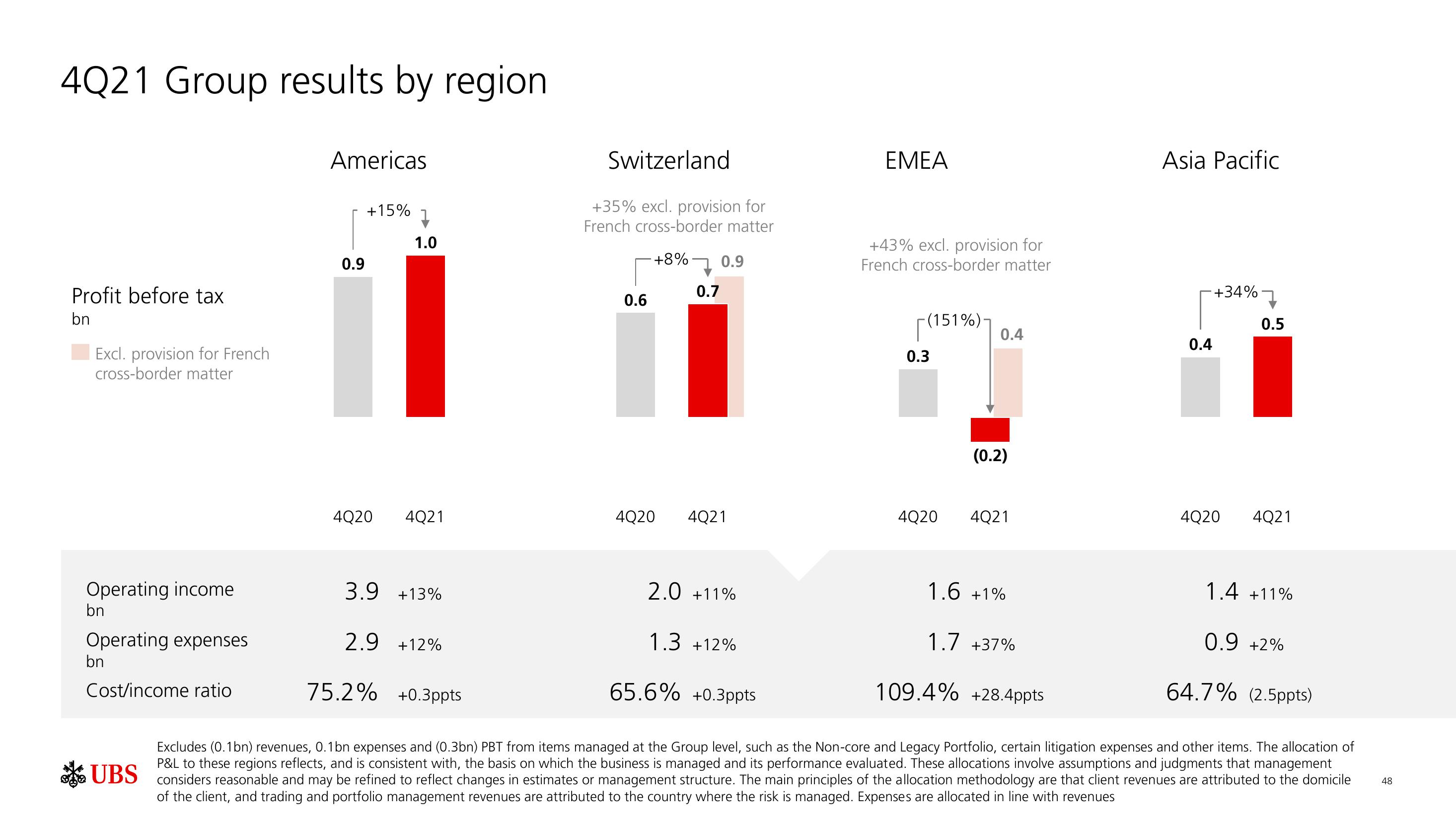

4Q21 Group results by region

Profit before tax

bn

Excl. provision for French

cross-border matter

Operating income

bn

Operating expenses

bn

Americas

Cost/income ratio

0.9

+15%

↓

1.0

4Q20 4Q21

3.9 +13%

2.9 +12%

Switzerland

+35% excl. provision for

French cross-border matter

+8%

0.6

4Q20

0.7

0.9

4Q21

2.0 +11%

1.3 +12%

EMEA

+43% excl. provision for

French cross-border matter

[(151%)

0.3

4Q20

0.4

(0.2)

4Q21

1.6 +1%

1.7 +37%

Asia Pacific

0.4

+34%

4Q20

7

0.5

4Q21

1.4 +11%

0.9 +2%

75.2% +0.3ppts

65.6% +0.3ppts

109.4% +28.4ppts

Excludes (0.1bn) revenues, 0.1bn expenses and (0.3bn) PBT from items managed at the Group level, such as the Non-core and Legacy Portfolio, certain litigation expenses and other items. The allocation of

P&L to these regions reflects, and is consistent with, the basis on which the business is managed and its performance evaluated. These allocations involve assumptions and judgments that management

UBS considers reasonable and may be refined to reflect changes in estimates or management structure. The main principles of the allocation methodology are that client revenues are attributed to the domicile

of the client, and trading and portfolio management revenues are attributed to the country where the risk is managed. Expenses are allocated in line with revenues

64.7% (2.5ppts)

48View entire presentation