Asos Results Presentation Deck

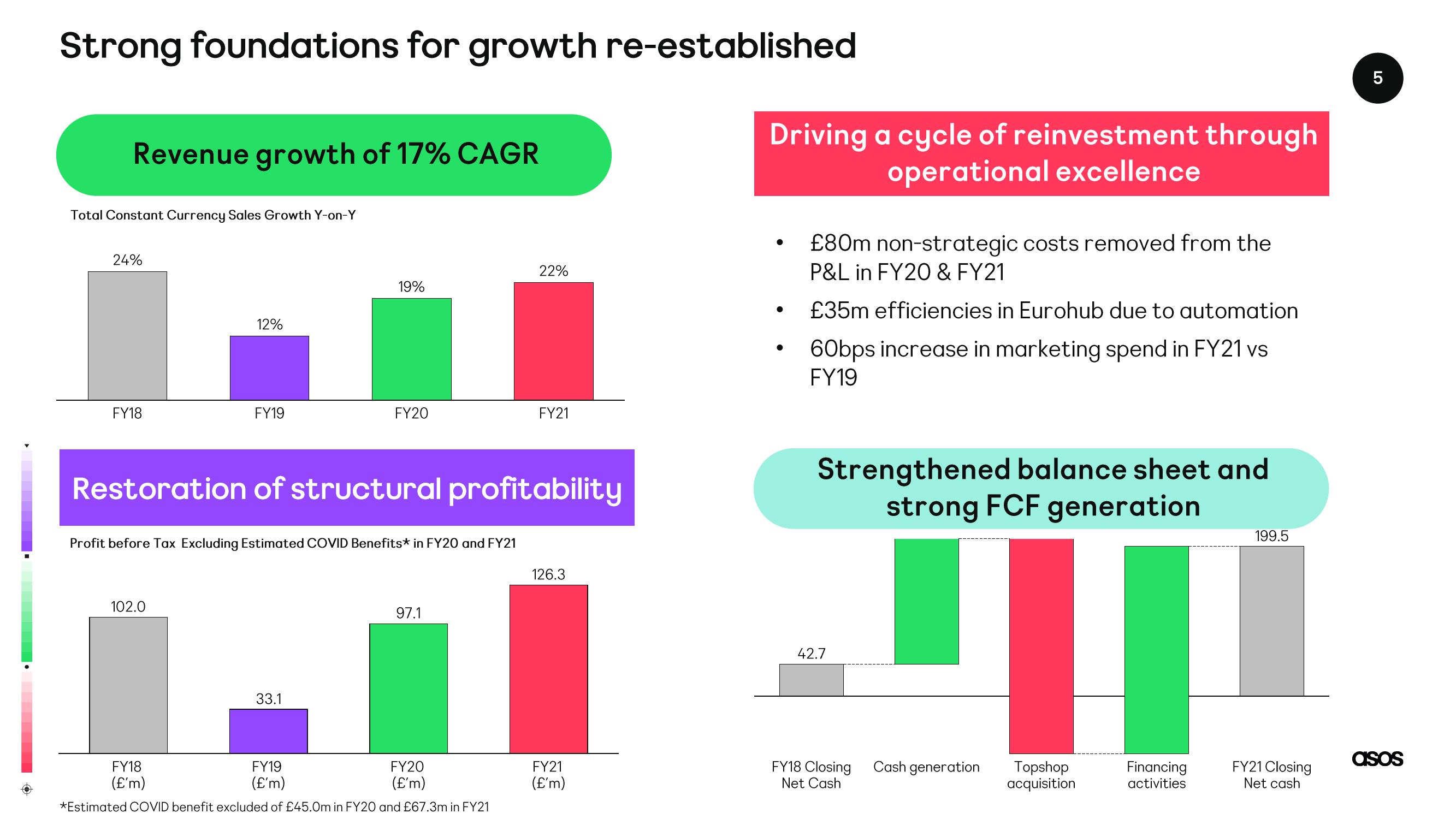

Strong foundations for growth re-established

Revenue growth of 17% CAGR

Total Constant Currency Sales Growth Y-on-Y

24%

FY18

12%

102.0

FY19

FY18

(£'m)

19%

Profit before Tax Excluding Estimated COVID Benefits* in FY20 and FY21

FY20

Restoration of structural profitability

33.1

97.1

FY19

(£'m)

*Estimated COVID benefit excluded of £45.0m in FY20 and £67.3m in FY21

FY20

(£'m)

22%

FY21

126.3

FY21

(£'m)

Driving a cycle of reinvestment through

operational excellence

●

●

£80m non-strategic costs removed from the

P&L in FY20 & FY21

£35m efficiencies in Eurohub due to automation

60bps increase in marketing spend in FY21 vs

FY19

Strengthened balance sheet and

strong FCF generation

"

42.7

FY18 Closing

Net Cash

Cash generation

Topshop

acquisition

Financing

activities

199.5

FY21 Closing

Net cash

LO

5

asosView entire presentation