Snap Inc Results Presentation Deck

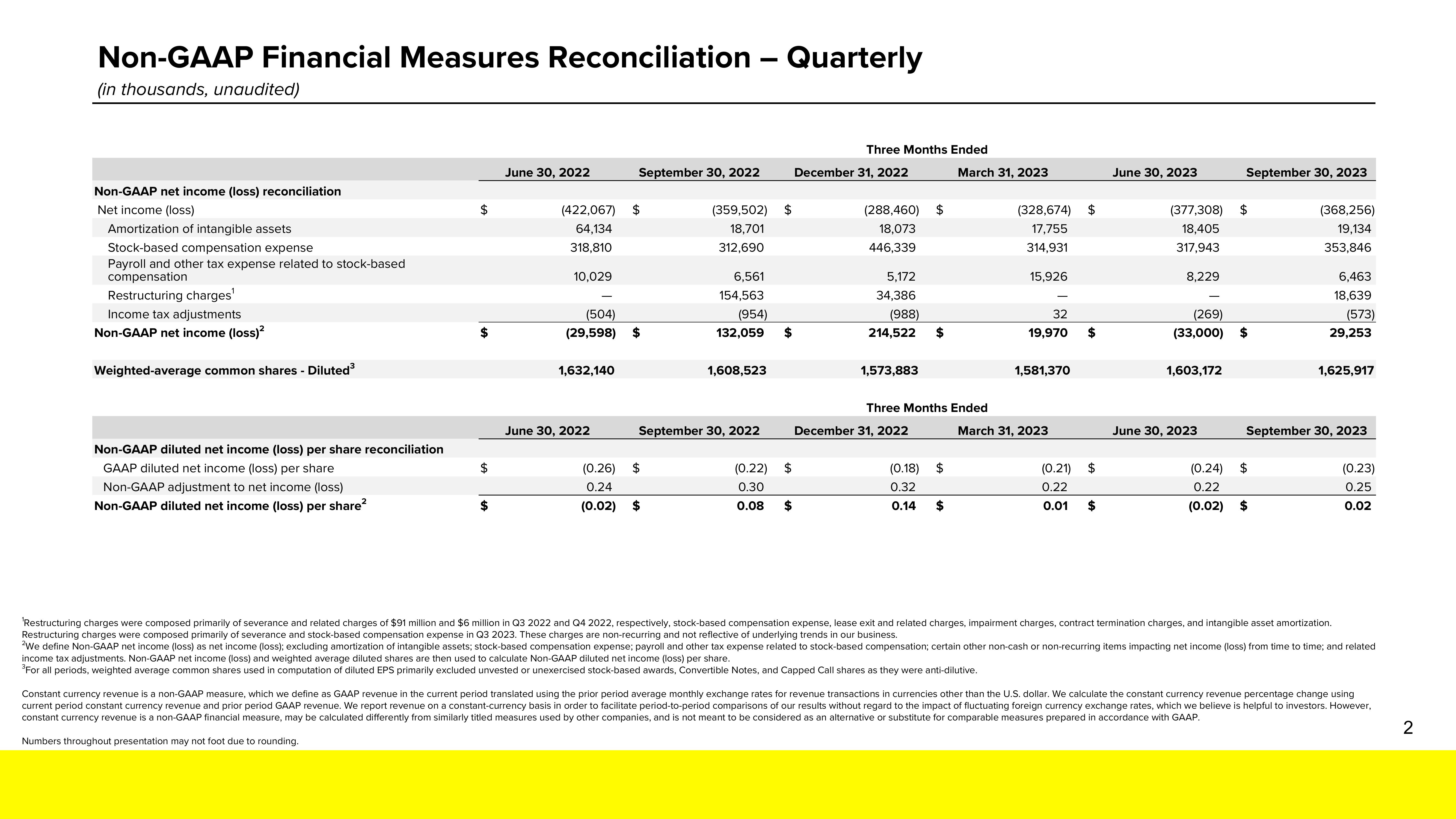

Non-GAAP Financial Measures Reconciliation - Quarterly

(in thousands, unaudited)

Non-GAAP net income (loss) reconciliation

Net income (loss)

Amortization of intangible assets

Stock-based compensation expense

Payroll and other tax expense related to stock-based

compensation

Restructuring charges¹

Income tax adjustments

Non-GAAP net income (loss)²

Weighted-average common shares - Diluted³

Non-GAAP diluted net income (loss) per share reconciliation

GAAP diluted net income (loss) per share

Non-GAAP adjustment to net income (loss)

Non-GAAP diluted net income (loss) per share²

$

$

$

$

June 30, 2022

(422,067)

64,134

318,810

10,029

1,632,140

(504)

(29,598) $

June 30, 2022

September 30, 2022

(0.26)

0.24

(0.02)

$

$

(359,502)

18,701

312,690

$

6,561

154,563

(954)

132,059

September 30, 2022

1,608,523

$

$

$

(0.22)

0.30

0.08 $

Three Months Ended

March 31, 2023

December 31, 2022

(288,460)

18,073

446,339

5,172

34,386

(988)

214,522

1,573,883

December 31, 2022

$

Three Months Ended

(0.18)

0.32

0.14

$

$

$

(328,674)

17,755

314,931

15,926

32

19,970

1,581,370

March 31, 2023

(0.21)

0.22

0.01

$

$

$

$

June 30, 2023

(377,308)

18,405

317,943

8,229

1,603,172

(269)

(33,000) $

June 30, 2023

September 30, 2023

(0.24)

0.22

(0.02)

$

$

(368,256)

19,134

353,846

$

6,463

18,639

(573)

29,253

September 30, 2023

1,625,917

(0.23)

0.25

0.02

'Restructuring charges were composed primarily of severance and related charges of $91 million and $6 million in Q3 2022 and Q4 2022, respectively, stock-based compensation expense, lease exit and related charges, impairment charges, contract termination charges, and intangible asset amortization.

Restructuring charges were composed primarily of severance and stock-based compensation expense in Q3 2023. These charges are non-recurring and not reflective of underlying trends in our business.

We define Non-GAAP net income (loss) as net income (loss); excluding amortization of intangible assets; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; certain other non-cash or non-recurring items impacting net income (loss) from time to time; and related

income tax adjustments. Non-GAAP net income (loss) and weighted average diluted shares are then used to calculate Non-GAAP diluted net income (loss) per share.

³For all periods, weighted average common shares used in computation of diluted EPS primarily excluded unvested or unexercised stock-based awards, Convertible Notes, and Capped Call shares as they were anti-dilutive.

Constant currency revenue is a non-GAAP measure, which we define as GAAP revenue in the current period translated using the prior period average monthly exchange rates for revenue transactions in currencies other than the U.S. dollar. We calculate the constant currency revenue percentage change using

current period constant currency revenue and prior period GAAP revenue. We report revenue on a constant-currency basis in order to facilitate period-to-period comparisons of our results without regard to the impact of fluctuating foreign currency exchange rates, which we believe is helpful to investors. However,

constant currency revenue is a non-GAAP financial measure, may be calculated differently from similarly titled measures used by other companies, and i not meant to be considered as an alternative or substitute for comparable measures prepared in accordance with GAAP.

Numbers throughout presentation may not foot due to rounding.

2View entire presentation