PJT Partners Investment Banking Pitch Book

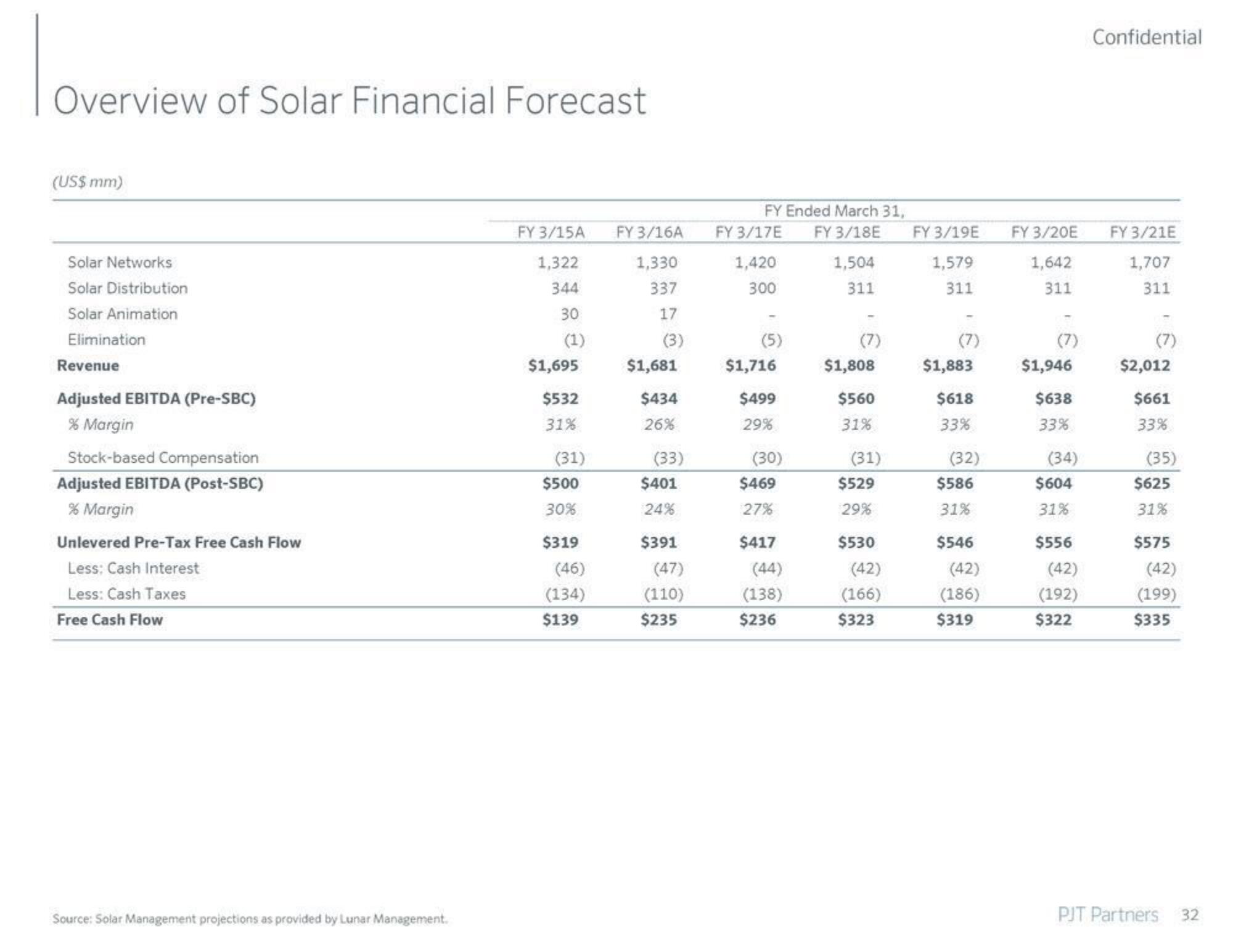

Overview of Solar Financial Forecast

(US$ mm)

Solar Networks

Solar Distribution

Solar Animation

Elimination

Revenue

Adjusted EBITDA (Pre-SBC)

% Margin

Stock-based Compensation

Adjusted EBITDA (Post-SBC)

% Margin

Unlevered Pre-Tax Free Cash Flow

Less: Cash Interest

Less: Cash Taxes

Free Cash Flow

Source: Solar Management projections as provided by Lunar Management.

FY 3/15A

1,322

344

30

(1)

$1,695

$532

31%

(31)

$500

30%

$319

(46)

(134)

$139

FY 3/16A

1,330

337

17

(3)

$1,681

$434

26%

(33)

$401

24%

$391

(47)

(110)

$235

FY Ended March 31,

FY 3/17E FY 3/18E

1,420

300

(5)

$1,716

$499

29%

(30)

$469

27%

$417

(44)

(138)

$236

1,504

311

(7)

$1,808

$560

31%

(31)

$529

29%

$530

(42)

(166)

$323

FY 3/19E FY 3/20E

1,579

1,642

311

311

(7)

$1,883

$618

33%

(32)

$586

31%

$546

(42)

(186)

$319

(7)

$1,946

$638

33%

(34)

$604

31%

$556

(42)

(192)

$322

Confidential

FY 3/21E

1,707

311

(7)

$2,012

$661

33%

(35)

$625

31%

$575

(42)

(199)

$335

PJT Partners

32View entire presentation