Quanergy SPAC Presentation Deck

Transaction summary and pro forma ownership

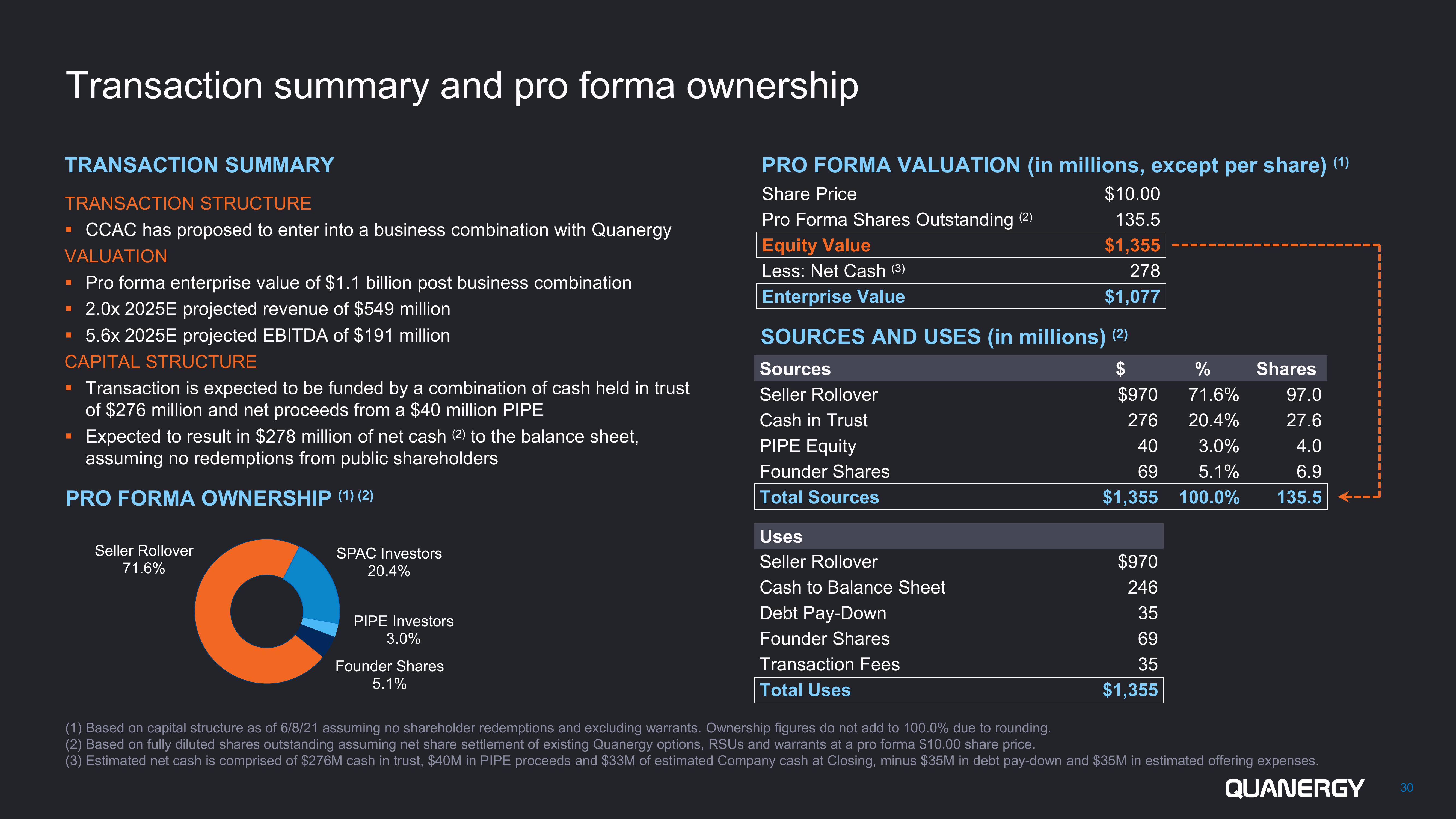

TRANSACTION SUMMARY

TRANSACTION STRUCTURE

▪ CCAC has proposed to enter into a business combination with Quanergy

VALUATION

▪ Pro forma enterprise value of $1.1 billion post business combination

▪ 2.0x 2025E projected revenue of $549 million

▪ 5.6x 2025E projected EBITDA of $191 million

CAPITAL STRUCTURE

▪ Transaction is expected to be funded by a combination of cash held in trust

of $276 million and net proceeds from a $40 million PIPE

Expected to result in $278 million of net cash (2) to the balance sheet,

assuming no redemptions from public shareholders

PRO FORMA OWNERSHIP (1) (2)

■

O

Seller Rollover

71.6%

SPAC Investors

20.4%

PIPE Investors

3.0%

Founder Shares

5.1%

PRO FORMA VALUATION (in millions, except per share) (1)

Share Price

Pro Forma Shares Outstanding (2)

Equity Value

Less: Net Cash (3)

Enterprise Value

SOURCES AND USES (in millions) (2)

$

Sources

Seller Rollover

Cash in Trust

PIPE Equity

Founder Shares

Total Sources

$10.00

135.5

$1,355

278

$1,077

Uses

Seller Rollover

Cash to Balance Sheet

Debt Pay-Down

Founder Shares

Transaction Fees

Total Uses

$970

276

40

69

$1,355

$970

246

35

69

35

$1,355

%

71.6%

20.4%

3.0%

5.1%

100.0%

Shares

97.0

27.6

4.0

6.9

135.5

(1) Based on capital structure as of 6/8/21 assuming no shareholder redemptions and excluding warrants. Ownership figures do not add to 100.0% due to rounding.

(2) Based on fully diluted shares outstanding assuming net share settlement of existing Quanergy options, RSUS and warrants at a pro forma $10.00 share price.

(3) Estimated net cash is comprised of $276M cash in trust, $40M in PIPE proceeds and $33M of estimated Company cash at Closing, minus $35M in debt pay-down and $35M in estimated offering expenses.

QUANERGY

30View entire presentation