Planet SPAC Presentation Deck

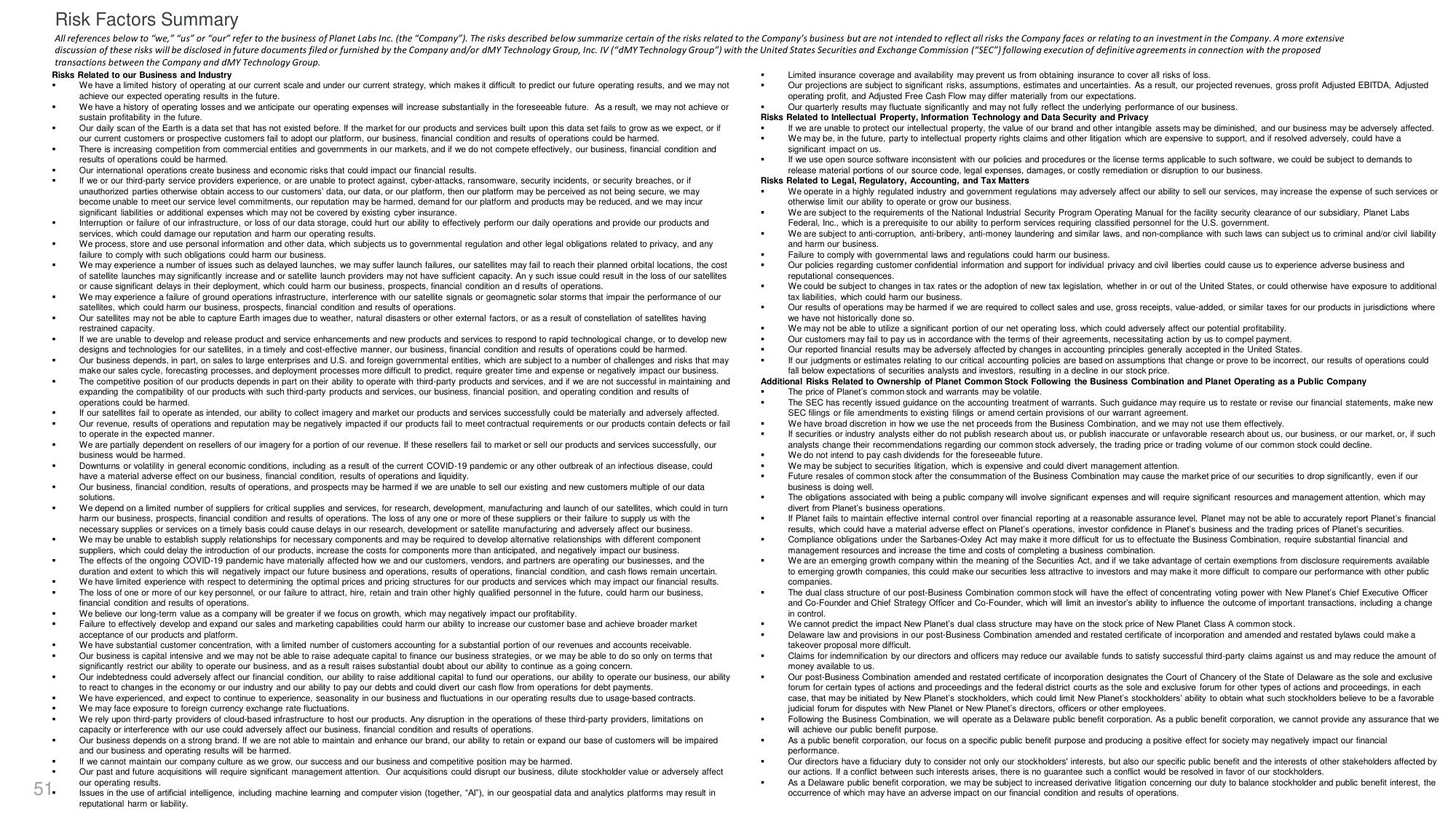

Risk Factors Summary

All references below to "we," "us" or "our" refer to the business of Planet Labs Inc. (the "Company"). The risks described below summarize certain of the risks related to the Company's business but are not intended to reflect all risks the Company faces or relating to an investment in the Company. A more extensive

discussion of these risks will be disclosed in future documents filed or furnished by the Company and/or dMY Technology Group, Inc. IV ("dMY Technology Group") with the United States Securities and Exchange Commission ("SEC") following execution of definitive agreements in connection with the proposed

transactions between the Company and dMY Technology Group.

Risks Related to our Business and Industry

We have a limited history of operating at our current scale and under our current strategy, which makes it difficult to predict our future operating results, and we may not

achieve our expected operating results in the future.

We have a history of operating losses and we anticipate our operating expenses will increase substantially in the foreseeable future. As a result, we may not achieve or

sustain profitability in the future.

Our daily scan of the Earth is a data set that has not existed before. If the market for our products and services built upon this data set fails to grow as we expect, or if

our current customers or prospective customers fail to adopt our platform, our business, financial condition and results of operations could be harmed.

51.

There is increasing competition from commercial entities and governments in our markets, and if we do not compete effectively, our business, financial condition and

results of operations could be harmed.

Our international operations create business and economic risks that could impact our financial results.

If we or our third-party service providers experience, or are unable to protect against, cyber-attacks, ransomware, security incidents, or security breaches, or if

unauthorized parties otherwise obtain access to our customers' data, our data, or our platform, then our platform may be perceived as not being secure, we may

become unable to meet our service level commitments, our reputation may be harmed, demand for our platform and products may be reduced, and we may incur

significant liabilities or additional expenses which may not be covered by existing cyber insurance.

Interruption or failure of our infrastructure, or loss of our data storage, could hurt our ability to effectively perform our daily operations and provide our products and

services, which could damage our reputation and harm our operating results.

We process, store and use personal information and other data, which subjects us to governmental regulation and other legal obligations related to privacy, and any

failure to comply with such obligations could harm our business.

We may experience a number of issues such as delayed launches, we may suffer launch failures, our satellites may fail to reach their planned orbital locations, the cost

of satellite launches may significantly increase and or satellite launch providers may not have sufficient capacity. An y such issue could result in the loss of our satellites

or cause significant delays in their deployment, which could harm our business, prospects, financial condition an d results of operations.

We may experience a failure of ground operations infrastructure, interference with our satellite signals or geomagnetic solar storms that impair the performance of our

satellites, which could harm our business, prospects, financial condition and results of operations.

Our satellites may not be able to capture Earth images due to weather, natural disasters or other external factors, or as a result of constellation of satellites having

restrained capacity.

If we are unable to develop and release product and service enhancements and new products and services to respond to rapid technological change, or to develop new

designs and technologies for our satellites, in a timely and cost-effective manner, our business, financial condition and results of operations could be harmed.

Our business depends, in part, on sales to large enterprises and U.S. and foreign governmental entities, which are subject to a number of challenges and risks that may

make our sales cycle, forecasting processes, and deployment processes more difficult to predict, require greater time and expense or negatively impact our business.

The competitive position of our products depends in part on their ability to operate with third-party products and services, and if we are not successful in maintaining and

expanding the compatibility of our products with such third-party products and services, our business, financial position, and operating condition and results of

operations could be harmed.

If our satellites fail to operate as intended, our ability to collect imagery and market our products and services successfully could be materially and adversely affected.

Our revenue, results of operations and reputation may be negatively impacted if our products fail to meet contractual requirements or our products contain defects or fail

to operate in the expected manner.

We are partially dependent on resellers of our imagery for a portion of our revenue. If these resellers fail to market or sell our products and services successfully, our

business would be harmed.

Downturns or volatility in general economic conditions, including as a result of the current COVID-19 pandemic or any other outbreak of an infectious disease, could

have a material adverse effect on our business, financial condition, results of operations and liquidity.

Our business, financial condition, results of operations, and prospects may be harmed if we are unable to sell our existing and new customers multiple of our data

solutions.

We depend on a limited number of suppliers for critical supplies and services, for research, development, manufacturing and launch of our satellites, which could in turn

harm our business, prospects, financial condition and results of operations. The loss of any one or more of these suppliers or their failure to supply us with the

necessary supplies or services on a timely basis could cause delays in our research, development or satellite manufacturing and adversely affect our business.

We may be unable to establish supply relationships for necessary components and may be required to develop alternative relationships with different component

suppliers, which could delay the introduction of our products, increase the costs for components more than anticipated, and negatively impact our business.

The effects of the ongoing COVID-19 pandemic have materially affected how we and our customers, vendors, and partners are operating our businesses, and the

duration and extent to which this will negatively impact our future business and operations, results of operations, financial condition, and cash flows remain uncertain.

We have limited experience with respect to determining the optimal prices and pricing structures for our products and services which may impact our financial results.

The loss of one or more of our key personnel, or our failure to attract, hire, retain and train other highly qualified personnel in the future, could harm our business,

financial condition and results of operations.

We believe our long-term value as a company will be greater if we focus on growth, which may negatively impact our profitability.

Failure to effectively develop and expand our sales and marketing capabilities could harm our ability to increase our customer base and achieve broader market

acceptance of our products and platform.

We have substantial customer concentration, with a limited number of customers accounting for a substantial portion of our revenues and accounts receivable.

Our business is capital intensive and we may not be able to raise adequate capital to finance our business strategies, or we may be able to do so only on terms that

significantly restrict our ability to operate our business, and as a result raises substantial doubt about our ability to continue as a going concern.

Our indebtedness could adversely affect our financial condition, our ability to raise additional capital to fund our operations, our ability to operate our business, our ability

to react to changes in the economy or our industry and our ability to pay our debts and could divert our cash flow from operations for debt payments.

We have experienced, and expect to continue experience, seasonality in our business and fluctuations in our operating results due to usage-based contracts.

We may face exposure to foreign currency exchange rate fluctuations.

We rely upon third-party providers of cloud-based infrastructure to host our products. Any disruption in the operations of these third-party providers, limitations on

capacity or interference with our use could adversely affect our business, financial condition and results of operations.

Our business depends on a strong brand. If we are not able to maintain and enhance our brand, our ability to retain or expand our base of customers will be impaired

and our business and operating results will be harmed.

If we cannot maintain our company culture as we grow, our success and our business and competitive position may be harmed.

Our past and future acquisitions will require significant management attention. Our acquisitions could disrupt our business, dilute stockholder value or adversely affect

our operating results.

Issues in the use of artificial intelligence, including machine learning and computer vision (together, "Al"), in our geospatial data and analytics platforms may result in

reputational harm or liability.

Limited insurance coverage and availability may prevent us from obtaining insurance to cover all risks of loss.

Our projections are subject to significant risks, assumptions, estimates and uncertainties. As a result, our projected revenues, gross profit Adjusted EBITDA, Adjusted

operating profit, and Adjusted Free Cash Flow may differ materially from our expectations.

Our quarterly results may fluctuate significantly and may not fully reflect the underlying performance of our business.

Risks Related to Intellectual Property, Information Technology and Data Security and Privacy

If we are unable to protect our intellectual property, the value of our brand and other intangible assets may be diminished, and our business may be adversely affected.

We may be, in the future, party to intellectual property rights claims and other litigation which are expensive to support, and if resolved adversely, could have a

significant impact on us.

If we use open source software inconsistent with our policies and procedures or the license terms applicable to such software, we could be subject to demands to

release material portions of our source code, legal expenses, damages, or costly remediation or disruption to our business.

Risks Related to Legal, Regulatory, Accounting, and Tax Matters

We operate in a highly regulated industry and government regulations may adversely affect our ability to sell our services, may increase the expense of such services or

otherwise limit our ability to operate or grow our business.

.

We are subject to the requirements of the National Industrial Security Program Operating Manual for the facility security clearance of our subsidiary, Planet Labs

Federal, Inc., which is a prerequisite to our ability to perform services requiring classified personnel for the U.S. government.

We are subject to anti-corruption, anti-bribery, anti-money laundering and similar laws, and non-compliance with such laws can subject us to criminal and/or civil liability

and harm our business.

Failure to comply with governmental laws and regulations could harm our business.

Our policies regarding customer confidential information and support for individual privacy and civil liberties could cause us to experience adverse business and

reputational consequences.

We could be subject to changes in tax rates or the adoption of new tax legislation, whether in or out of the United States, or could otherwise have exposure to additional

tax liabilities, which could harm our business.

Our results of operations may be harmed if we are required to collect sales and use, gross receipts, value-added, or similar taxes for our products in jurisdictions where

we have not historically done so.

We may not be able to utilize a significant portion of our net operating loss, which could adversely affect our potential profitability.

Our customers may fail to pay us in accordance with the terms of their agreements, necessitating action by us to compel payment.

Our reported financial results may be adversely affected by changes in accounting principles generally accepted the United States.

If our judgments or estimates relating to our critical accounting policies are based on assumptions that change or prove to be incorrect, our results of operations could

fall below expectations of securities analysts and investors, resulting in a decline in our stock price.

Additional Risks Related to Ownership of Planet Common Stock Following the Business Combination and Planet Operating as a Public Company

The price of Planet's common stock and warrants may be volatile.

The SEC has recently issued guidance on the accounting treatment of warrants. Such guidance may require us to restate or revise our financial statements, make new

SEC filings or file amendments to existing filings or amend certain provisions of our warrant agreement.

We have broad discretion in how we use the net proceeds from the Business Combination, and we may not use them effectively.

If securities or industry analysts either do not publish research about us, or publish inaccurate or unfavorable research about us, our business, or our market, or, if such

analysts change their recommendations regarding our common stock adversely, the trading price or trading volume of our common stock could decline.

We do not intend to pay cash dividends for the foreseeable future.

We may be subject to securities litigation, which is expensive and could divert management attention.

Future resales of common stock after the consummation of the Business Combination may cause the market price of our securities to drop significantly, even if our

business is doing well.

The obligations associated with being a public company will involve significant expenses and will require significant resources and management attention, which may

divert from Planet's business operations.

If Planet fails to maintain effective internal control over financial reporting at a reasonable assurance level, Planet may not be able to accurately report Planet's financial

results, which could have a material adverse effect on Planet's operations, investor confidence in Planet's business and the trading prices of Planet's securities.

Compliance obligations under the Sarbanes-Oxley Act may make it more difficult for us to effectuate the Business Combination, require substantial financial and

management resources and increase the time and costs of completing a business combination.

We are an emerging growth company within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available

to emerging growth companies, this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public

companies.

The dual class structure of our post-Business Combination common stock will have the effect of concentrating voting power with New Planet's Chief Executive Officer

and Co-Founder and Chief Strategy Officer and Co-Founder, which will limit an investor's ability to influence the outcome of important transactions, including a change

in control.

We cannot predict the impact New Planet's dual class structure may have on the stock price of New Planet Class A common stock.

Delaware law and provisions in our post-Business Combination amended and restated certificate of incorporation and amended and restated bylaws could make a

takeover proposal more difficult.

Claims for indemnification by our directors and officers may reduce our available funds to satisfy successful third-party claims against us and may reduce the amount of

money available to us.

Our post-Business Combination amended and restated certificate of incorporation designates the Court of Chancery of the State of Delaware as the sole and exclusive

forum for certain types of actions and proceedings and the federal district courts as the sole and exclusive forum for other types of actions and proceedings, in each

case, that may be initiated by New Planet's stockholders, which could limit New Planet's stockholders' ability to obtain what such stockholders believe to be a favorable

judicial forum for disputes with New Planet or New Planet's directors, officers other employees.

Following the Business Combination, we will operate as a Delaware public benefit corporation. As a public benefit corporation, we cannot provide any assurance that we

will achieve our public benefit purpose.

As a public benefit corporation, our focus on a specific public benefit purpose and producing a positive effect for society may negatively impact our financial

performance.

Our directors have a fiduciary duty to consider not only our stockholders' interests, but also our specific public benefit and the interests of other stakeholders affected by

our actions. If a conflict between such interests arises, there is no guarantee such a conflict would be resolved in favor of our stockholders.

As a Delaware public benefit corporation, we may be subject to increased derivative litigation concerning our duty to balance stockholder and public benefit interest, the

occurrence of which may have an adverse impact on our financial condition and results of operations.View entire presentation