Uber Results Presentation Deck

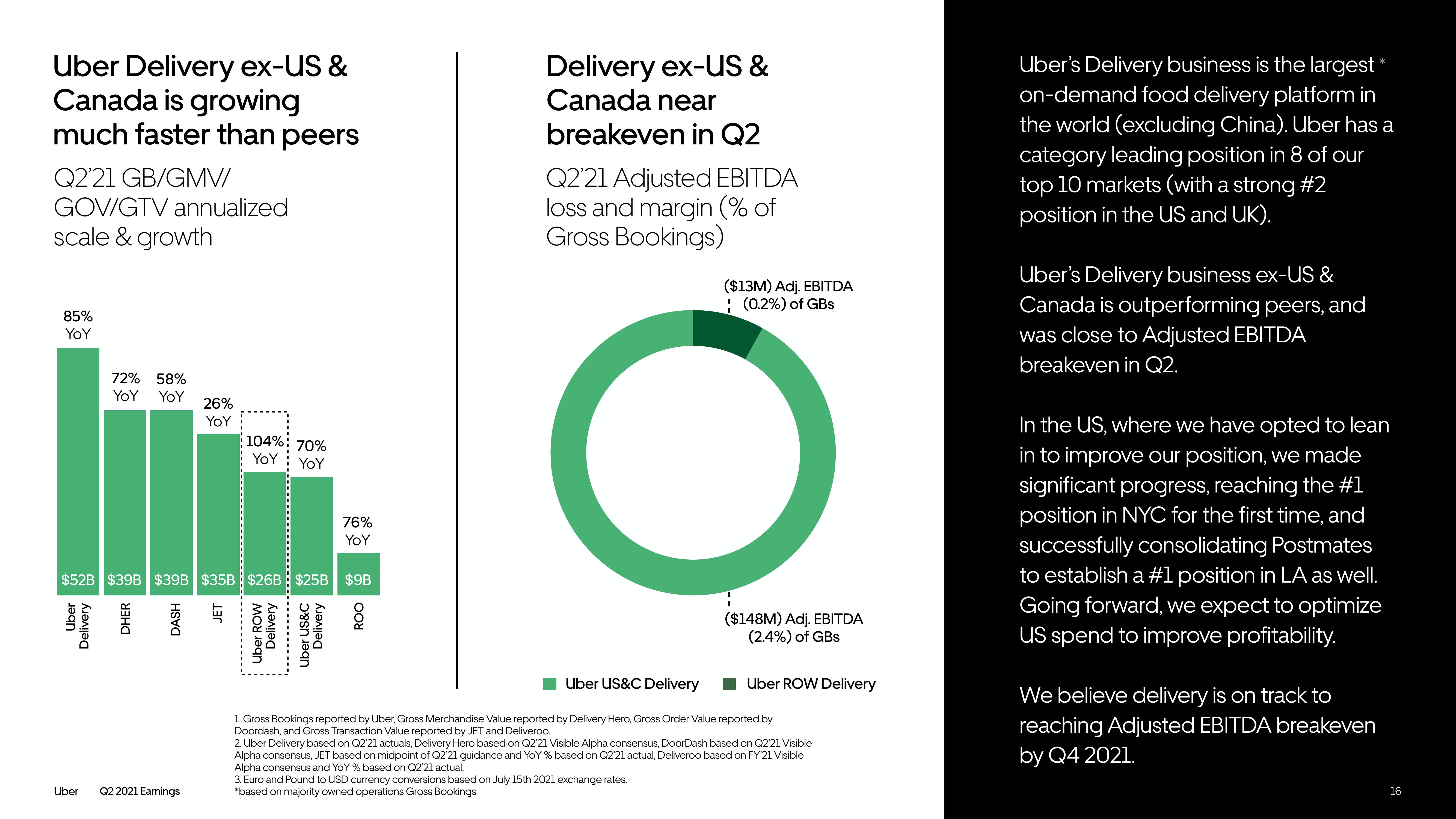

Uber Delivery ex-US &

Canada is growing

much faster than peers

Q2'21 GB/GMV/

GOV/GTV annualized

scale & growth

85%

YoY

72% 58%

YoY YoY

Uber

26%

YoY

Q2 2021 Earnings

104% 70%

YOY

YoY

$52B $39B $39B $35B $26B $25B $9B

E

8

Uber ROW

Delivery

----------

76%

YoY

Uber US&C

Delivery

Delivery ex-US &

Canada near

breakeven in Q2

Q2'21 Adjusted EBITDA

loss and margin (% of

Gross Bookings)

($13M) Adj. EBITDA

(0.2%) of GBs

O

($148M) Adj. EBITDA

(2.4%) of GBs

Uber US&C Delivery

1. Gross Bookings reported by Uber, Gross Merchandise Value reported by Delivery Hero, Gross Order Value reported by

Doordash, and Gross Transaction Value reported by JET and Deliveroo.

2. Uber Delivery based on Q2'21 actuals, Delivery Hero based on Q2'21 Visible Alpha consensus, DoorDash based on Q2'21 Visible

Alpha consensus, JET based on midpoint of Q2'21 guidance and YoY % based on Q2'21 actual, Deliveroo based on FY'21 Visible

Alpha consensus and YoY % based on Q2'21 actual.

3. Euro and Pound to USD currency conversions based on July 15th 2021 exchange rates.

*based on majority owned operations Gross Bookings

Uber ROW Delivery

Uber's Delivery business is the largest *

on-demand food delivery platform in

the world (excluding China). Uber has a

category leading position in 8 of our

top 10 markets (with a strong #2

position in the US and UK).

Uber's Delivery business ex-US &

Canada is outperforming peers, and

was close to Adjusted EBITDA

breakeven in Q2.

In the US, where we have opted to lean

in to improve our position, we made

significant progress, reaching the #1

position in NYC for the first time, and

successfully consolidating Postmates

to establish a #1 position in LA as well.

Going forward, we expect to optimize

US spend to improve profitability.

We believe delivery is on track to

reaching Adjusted EBITDA breakeven

by Q4 2021.

16View entire presentation