jetBlue Results Presentation Deck

MAINTAINING RELATIVE BALANCE SHEET STRENGTH

jetBlue

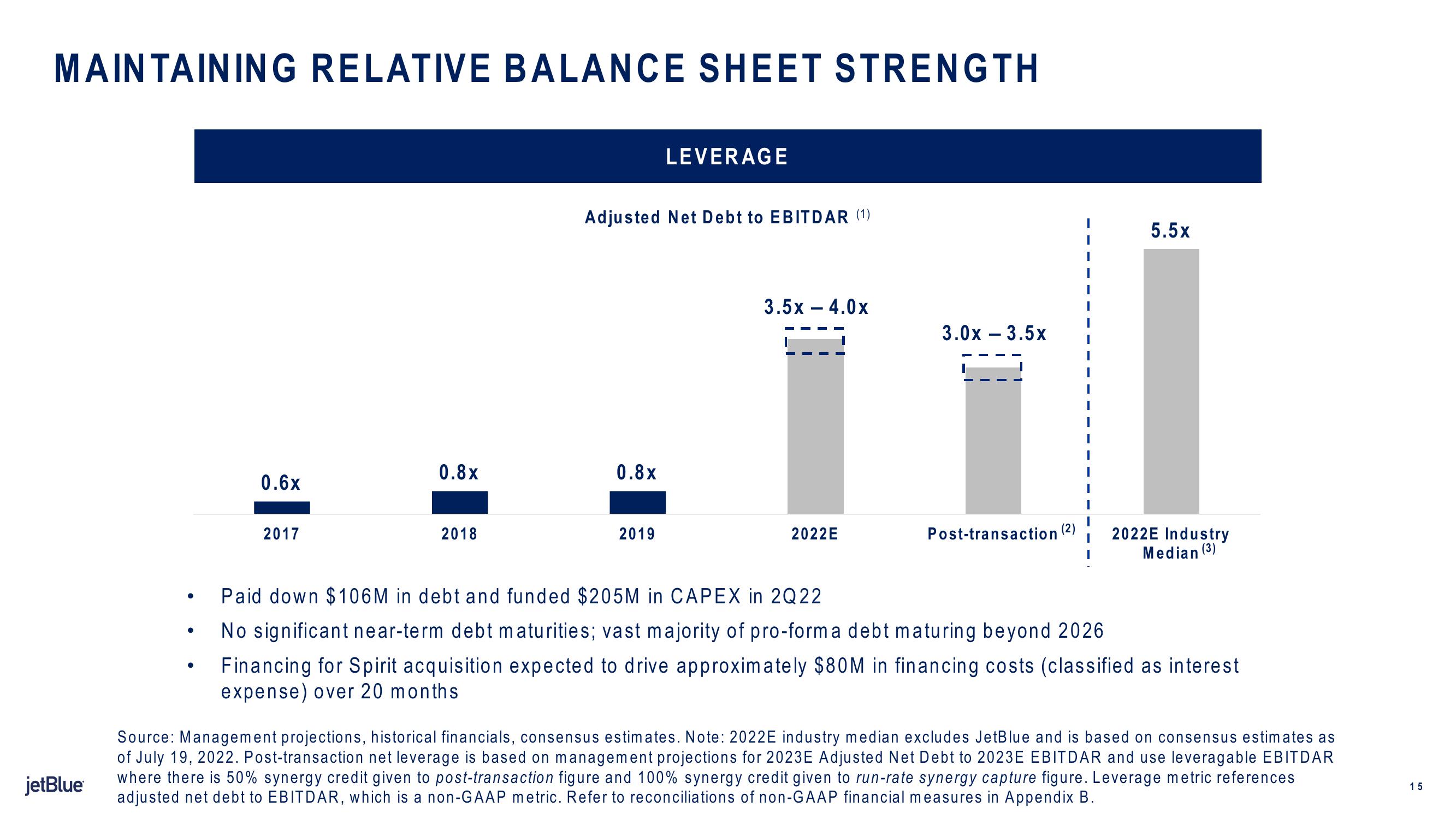

0.6x

2017

0.8x

2018

Adjusted Net Debt to EBITDAR (1)

0.8x

LEVERAGE

2019

3.5x - 4.0x

3.0x - 3.5x

ÏÏ

2022E

Post-transaction (2)

5.5x

2022E Industry

Median (3)

Paid down $106M in debt and funded $205M in CAPEX in 2Q22

No significant near-term debt maturities; vast majority of pro-form a debt maturing beyond 2026

Financing for Spirit acquisition expected to drive approximately $80M in financing costs (classified as interest

expense) over 20 months

Source: Management projections, historical financials, consensus estimates. Note: 2022E industry median excludes JetBlue and is based on consensus estimates as

of July 19, 2022. Post-transaction net leverage is based on management projections for 2023E Adjusted Net Debt to 2023E EBITDAR and use leveragable EBITDAR

where there is 50% synergy credit given to post-transaction figure and 100% synergy credit given to run-rate synergy capture figure. Leverage metric references

adjusted net debt to EBITDAR, which is a non-GAAP metric. Refer to reconciliations of non-GAAP financial measures in Appendix B.

15View entire presentation