DigitalOcean Results Presentation Deck

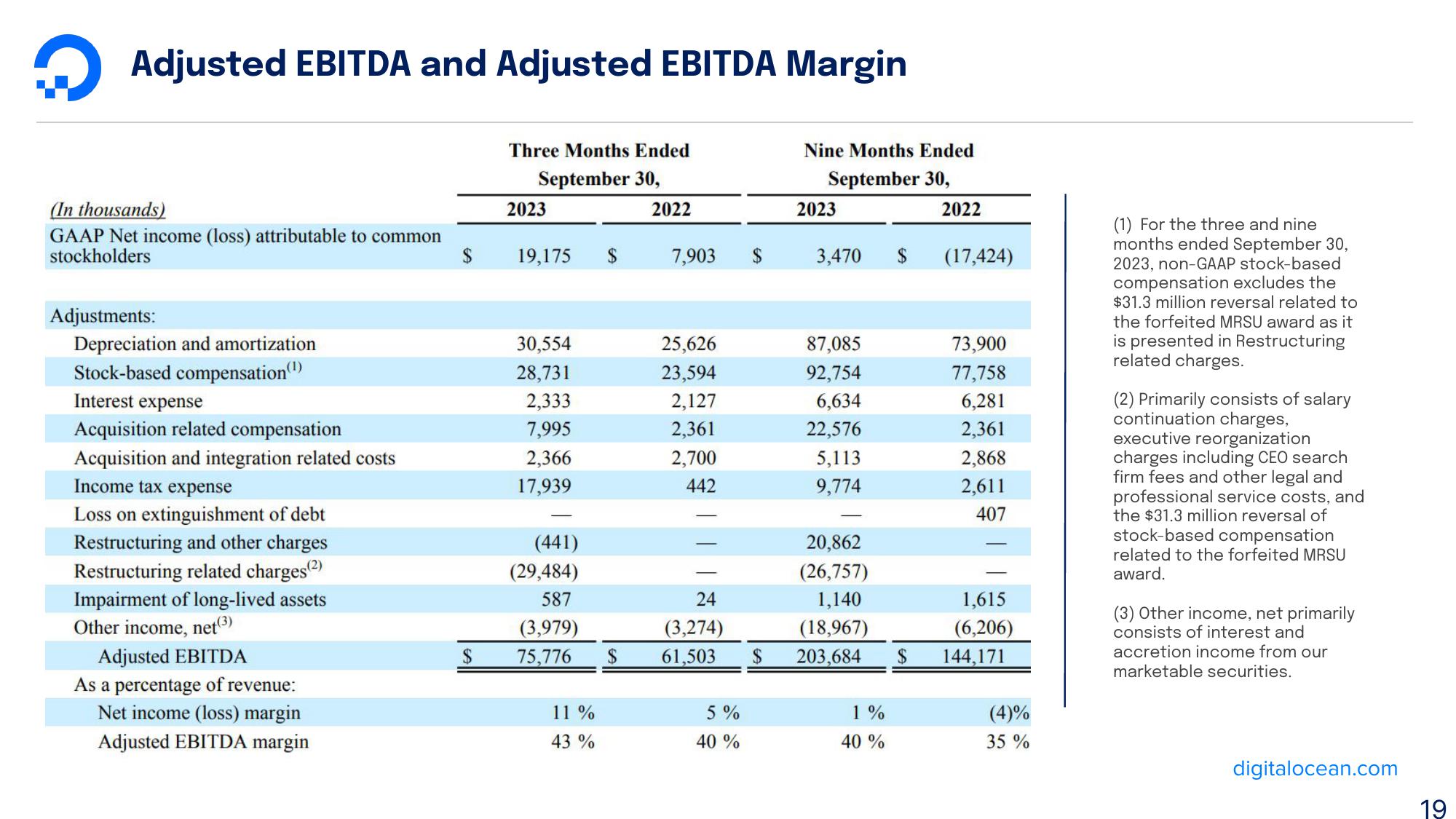

ņ Adjusted EBITDA and Adjusted EBITDA Margin

(In thousands)

GAAP Net income (loss) attributable to common

stockholders

Adjustments:

Depreciation and amortization

Stock-based compensation(¹)

Interest expense

Acquisition related compensation

Acquisition and integration related costs

Income tax expense

Loss on extinguishment of debt

Restructuring and other charges

Restructuring related charges (2)

Impairment of long-lived assets

Other income, net (³)

Adjusted EBITDA

As a percentage of revenue:

Net income (loss) margin

Adjusted EBITDA margin

$

$

Three Months Ended

September 30,

2023

19,175 $

30,554

28,731

2,333

7,995

2,366

17,939

(441)

(29,484)

587

(3,979)

75,776

11 %

43%

$

2022

7,903

25,626

23,594

2,127

2,361

2,700

442

Nine Months Ended

September 30,

5%

40%

2023

3,470

87,085

92,754

6,634

22,576

5,113

9,774

20,862

(26,757)

24

1,140

(18,967)

61,503 $ 203,684 $

(3,274)

$

1%

40 %

2022

(17,424)

73,900

77,758

6,281

2,361

2,868

2,611

407

1,615

(6,206)

144,171

(4)%

35 %

(1) For the three and nine

months ended September 30,

2023, non-GAAP stock-based

compensation excludes the

$31.3 million reversal related to

the forfeited MRSU award as it

is presented in Restructuring

related charges.

(2) Primarily consists of salary

continuation charges,

executive reorganization

charges including CEO search

firm fees and other legal and

professional service costs, and

the $31.3 million reversal of

stock-based compensation

related to the forfeited MRSU

award.

(3) Other income, net primarily

consists of interest and

accretion income from our

marketable securities.

digitalocean.com

19View entire presentation