J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

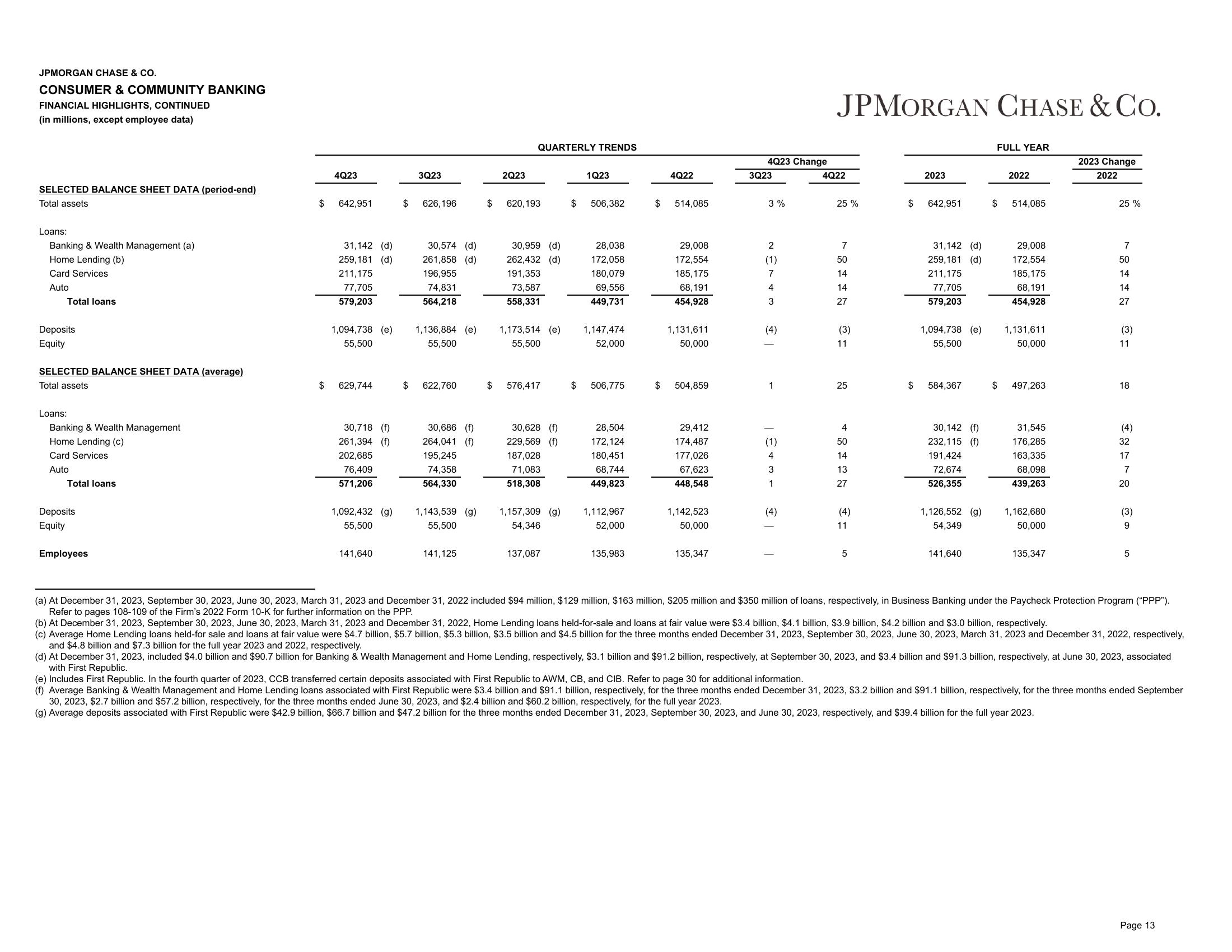

CONSUMER & COMMUNITY BANKING

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except employee data)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans:

Banking & Wealth Management (a)

Home Lending (b)

Card Services

Auto

Total loans

Deposits

Equity

SELECTED BALANCE SHEET DATA (average)

Total assets

Loans:

Banking & Wealth Management

Home Lending (c)

Card Services

Auto

Total loans

Deposits

Equity

Employees

4Q23

$ 642,951

$

31,142 (d)

259,181 (d)

211,175

77,705

579,203

629,744

30,718 (f)

261,394 (f)

202,685

76,409

571,206

$

3Q23

1,094,738 (e) 1,136,884 (e)

55,500

55,500

141,640

626, 196

30,574 (d)

261,858 (d)

196,955

74,831

564,218

$ 622,760

30,686 (f)

264,041 (f)

195,245

74,358

564,330

1,092,432 (g) 1,143,539 (g)

55,500

55,500

141,125

$

2Q23

QUARTERLY TRENDS

620,193

30,959 (d)

262,432 (d)

191,353

73,587

558,331

1,173,514 (e)

55,500

$ 576,417

30,628 (f)

229,569 (f)

187,028

71,083

518,308

1,157,309 (g)

54,346

137,087

$

$

1Q23

506,382

28,038

172,058

180,079

69,556

449,731

1,147,474

52,000

506,775

28,504

172,124

180,451

68,744

449,823

1,112,967

52,000

135,983

4Q22

$ 514,085

$

29,008

172,554

185,175

68,191

454,928

1,131,611

50,000

504,859

29,412

174,487

177,026

67,623

448,548

1,142,523

50,000

135,347

4Q23 Change

3Q23

3%

2

(1)

7

4

3

(4)

1

1 +3+

(1)

(4)

JPMORGAN CHASE & Co.

4Q22

25%

7

50

14

14

27

(3)

11

25

4

50

14

13

27

(4)

11

5

2023

$ 642,951

$

31,142 (d)

259,181 (d)

211,175

77,705

579,203

1,094,738 (e)

55,500

584,367

30,142 (f)

232,115 (f)

191,424

72,674

526,355

1,126,552 (g)

54,349

141,640

FULL YEAR

$

2022

514,085

29,008

172,554

185,175

68,191

454,928

1,131,611

50,000

$ 497,263

31,545

176,285

163,335

68,098

439,263

1,162,680

50,000

135,347

2023 Change

2022

25%

7

50

14

14

27

(3)

11

18

(4)

32

17

7

20

(3)

9

5

(a) At December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022 included $94 million, $129 million, $163 million, $205 million and $350 million of loans, respectively, in Business Banking under the Paycheck Protection Program ("PPP").

Refer to pages 108-109 of the Firm's 2022 Form 10-K for further information on the PPP.

(b) At December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, Home Lending loans held-for-sale and loans at fair value were $3.4 billion, $4.1 billion, $3.9 billion, $4.2 billion and $3.0 billion, respectively.

(c) Average Home Lending loans held-for sale and loans at fair value were $4.7 billion, $5.7 billion, $5.3 billion, $3.5 billion and $4.5 billion for the three months ended December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, respectively,

and $4.8 billion and $7.3 billion for the full year 2023 and 2022, respectively.

(d) At December 31, 2023, included $4.0 billion and $90.7 billion for Banking & Wealth Management and Home Lending, respectively, $3.1 billion and $91.2 billion, respectively, at September 30, 2023, and $3.4 billion and $91.3 billion, respectively, at June 30, 2023, associated

with First Republic.

(e) Includes First Republic. In the fourth quarter of 2023, CCB transferred certain deposits associated with First Republic to AWM, CB, and CIB. Refer to page 30 for additional information.

(f) Average Banking & Wealth Management and Home Lending loans associated with First Republic were $3.4 billion and $91.1 billion, respectively, for the three months ended December 31, 2023, $3.2 billion and $91.1 billion, respectively, for the three months ended September

30, 2023, $2.7 billion and $57.2 billion, respectively, for the three months ended June 30, 2023, and $2.4 billion and $60.2 billion, respectively, for the full year 2023.

(g) Average deposits associated with First Republic were $42.9 billion, $66.7 billion and $47.2 billion for the three months ended December 31, 2023, September 30, 2023, and June 30, 2023, respectively, and $39.4 billion for the full year 2023.

Page 13View entire presentation