Engine No. 1 Activist Presentation Deck

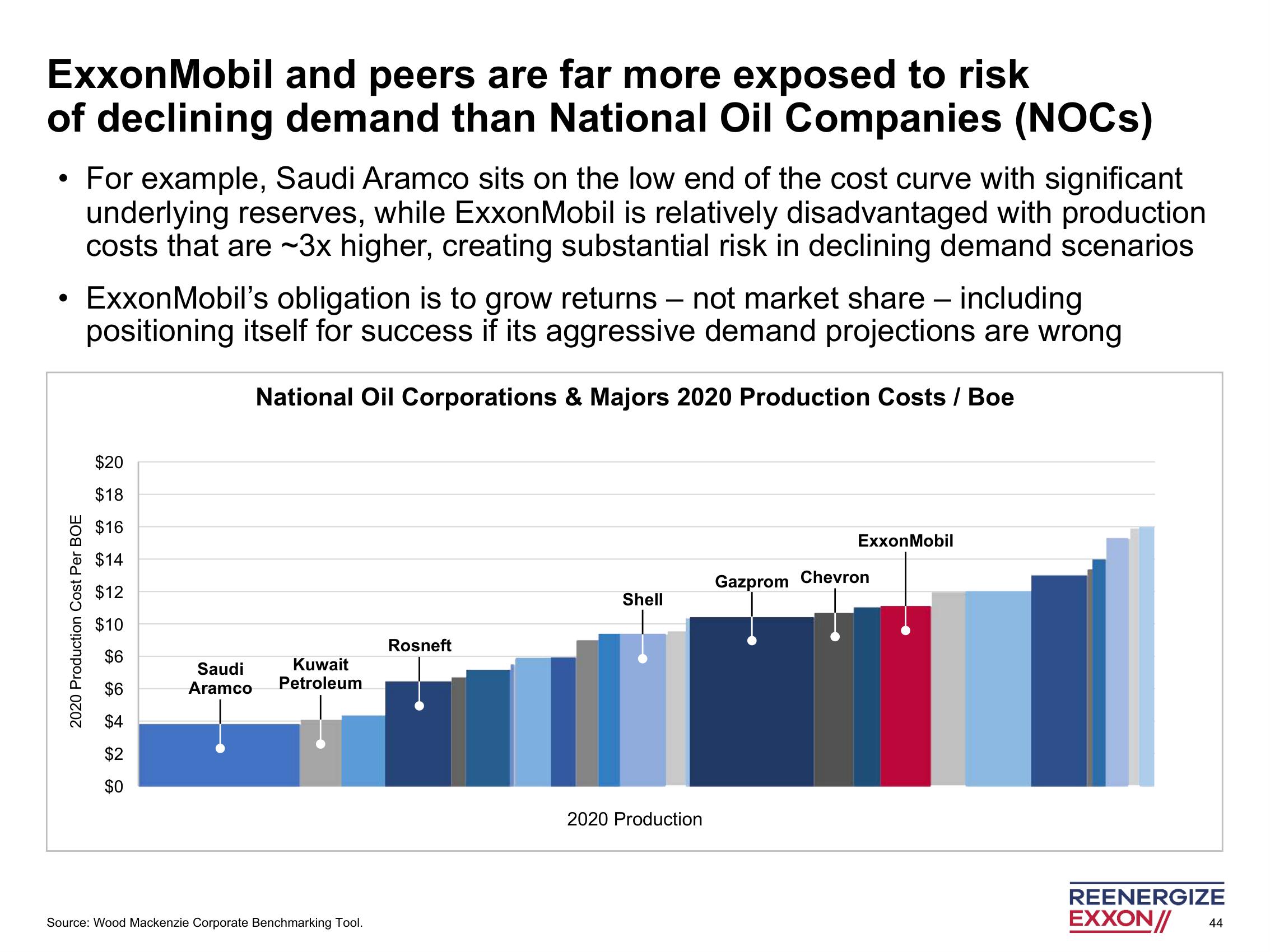

ExxonMobil and peers are far more exposed to risk

of declining demand than National Oil Companies (NOCs)

• For example, Saudi Aramco sits on the low end of the cost curve with significant

underlying reserves, while ExxonMobil is relatively disadvantaged with production

costs that are ~3x higher, creating substantial risk in declining demand scenarios

ExxonMobil's obligation is to grow returns not market share - including

positioning itself for success if its aggressive demand projections are wrong

National Oil Corporations & Majors 2020 Production Costs / Boe

●

2020 Production Cost Per BOE

$20

$18

$16

$14

$12

$10

$6

$6

$4

$2

$0

Saudi

Kuwait

Aramco Petroleum

Source: Wood Mackenzie Corporate Benchmarking Tool.

Rosneft

Shell

2020 Production

ExxonMobil

Gazprom Chevron

REENERGIZE

EXXON//

44View entire presentation