Sonder Restructuring Presentation Deck

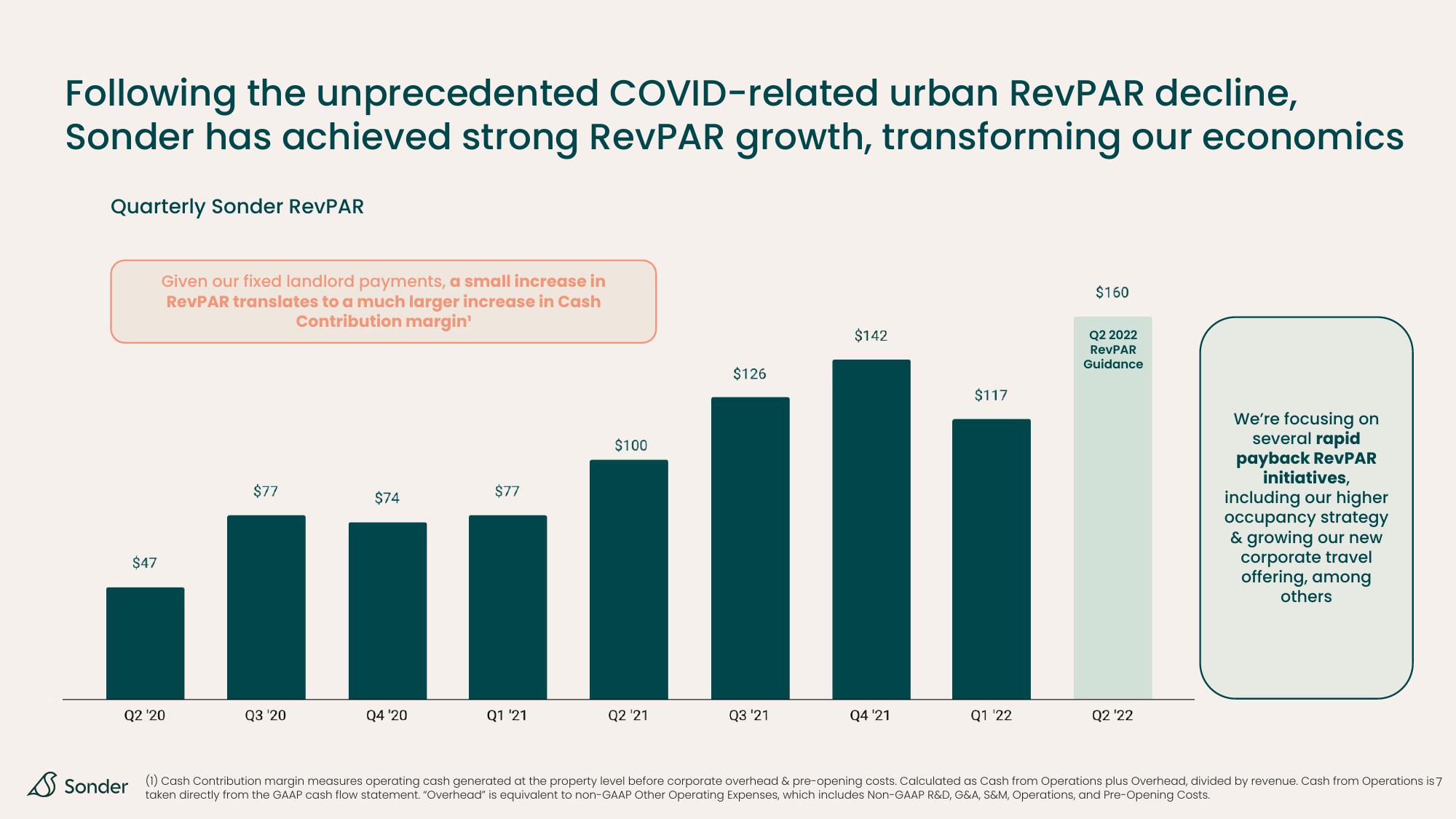

Following the unprecedented COVID-related urban RevPAR decline,

Sonder has achieved strong RevPAR growth, transforming our economics

Quarterly Sonder RevPAR

$47

Given our fixed landlord payments, a small increase in

RevPAR translates to a much larger increase in Cash

Contribution margin'

Q2 '20

$77

Q3 '20

$74

Q4 '20

$77

Q1 '21

$100

Q2 '21

$126

Q3 '21

$142

Q4 '21

$117

Q1 '22

$160

Q2 2022

RevPAR

Guidance

Q2 '22

We're focusing on

several rapid

payback RevPAR

initiatives,

including our higher

occupancy strategy

& growing our new

corporate travel

offering, among

others

Sonder (1) Cash Contribution margin measures operating cash generated at the property level before corporate overhead & pre-opening costs. Calculated as Cash from Operations plus Overhead, divided by revenue. Cash from Operations is 7

taken directly from the GAAP cash flow statement. "Overhead" is equivalent to non-GAAP Other Operating Expenses, which includes Non-GAAP R&D, G&A, S&M, Operations, and Pre-Opening Costs.View entire presentation