BlackRock Investor Day Presentation Deck

3

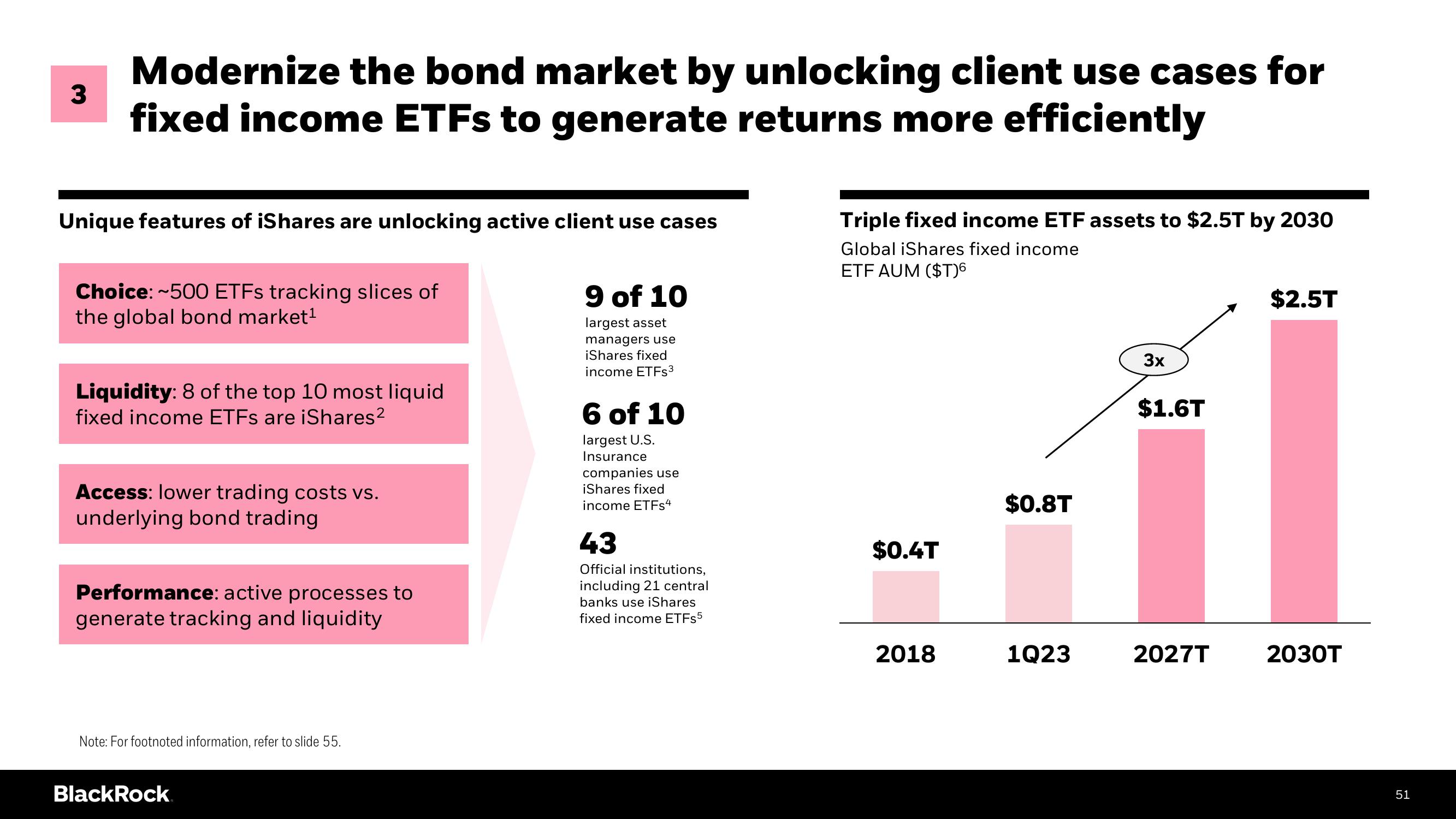

Modernize the bond market by unlocking client use cases for

fixed income ETFs to generate returns more efficiently

Unique features of iShares are unlocking active client use cases

Choice: ~500 ETFs tracking slices of

the global bond market¹

Liquidity: 8 of the top 10 most liquid

fixed income ETFs are iShares²

Access: lower trading costs vs.

underlying bond trading

Performance: active processes to

generate tracking and liquidity

Note: For footnoted information, refer to slide 55.

BlackRock

9 of 10

largest asset

managers use

iShares fixed

income ETFs³

6 of 10

largest U.S.

Insurance

companies use

iShares fixed

income ETFs4

43

Official institutions,

including 21 central

banks use iShares

fixed income ETFs5

Triple fixed income ETF assets to $2.5T by 2030

Global iShares fixed income

ETF AUM ($T)6

$0.4T

2018

$0.8T

1Q23

3x

$1.6T

2027T

$2.5T

2030T

51View entire presentation