OpenText Investor Presentation Deck

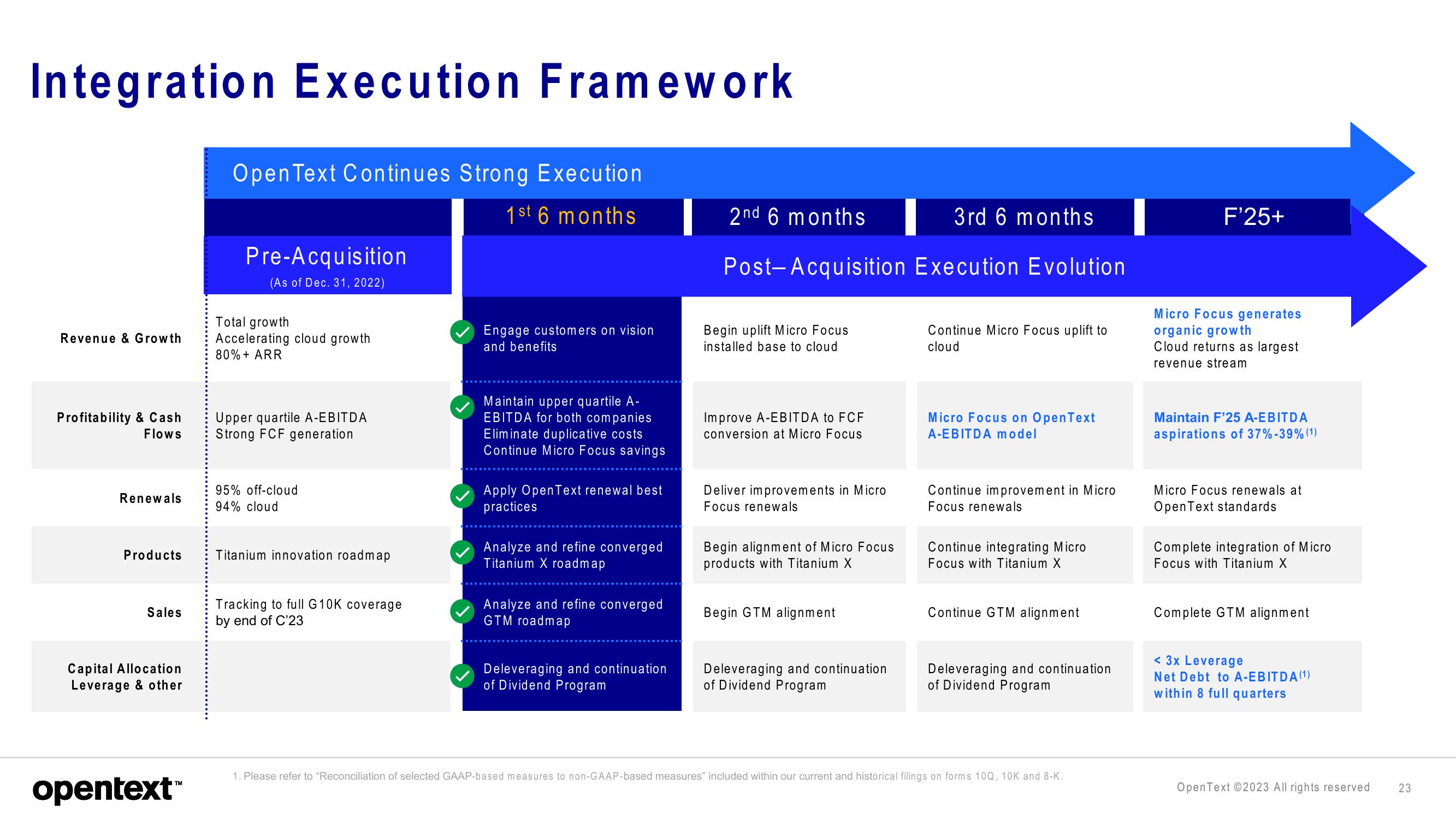

Integration Execution Framework

Revenue & Growth

Profitability & Cash

Flows

Renewals

Products

Sales

Capital Allocation

Leverage & other

opentext

TM

Open Text Continues Strong Execution

1st 6 months

Pre-Acquisition

(As of Dec. 31, 2022)

Total growth

Accelerating cloud growth

80% + ARR

Upper quartile A-EBITDA

Strong FCF generation

95% off-cloud

94% cloud

Titanium innovation roadmap

Tracking to full G10K coverage

by end of C'23

Engage customers on vision

and benefits

Maintain upper quartile A-

EBITDA for both companies

Eliminate duplicative costs

Continue Micro Focus savings

Apply Open Text renewal best

practices

Analyze and refine converged

Titanium X roadmap

Analyze and refine converged

GTM roadmap

Deleveraging and continuation

of Dividend Program

2nd 6 months

Post-Acquisition

Begin uplift Micro Focus

installed base to cloud

Improve A-EBITDA to FCF

conversion at Micro Focus

Deliver improvements in Micro

Focus renewals

Begin alignment of Micro Focus

products with Titanium X

Begin GTM alignment

Deleveraging and continuation

of Dividend Program

3rd 6 months

Execution Evolution

Continue Micro Focus uplift to

cloud

Micro Focus on OpenText

A-EBITDA model

Continue improvement in Micro

Focus renewals

Continue integrating Micro

Focus with Titanium X

Continue GTM alignment

Deleveraging and continuation

of Dividend Program

1. Please refer to "Reconciliation of selected GAAP-based measures to non-GAAP-based measures" included within our current and historical filings on forms 100, 10K and 8-K.

F'25+

Micro Focus generates

organic growth

Cloud returns as largest

revenue stream

Maintain F'25 A-EBITDA

aspirations of 37% -39% (1)

Micro Focus renewals at

Open Text standards

Complete integration of Micro

Focus with Titanium X

Complete GTM alignment

< 3x Leverage

Net Debt to A-EBITDA (1)

within 8 full quarters

OpenText ©2023 All rights reserved

23View entire presentation