Shift SPAC Presentation Deck

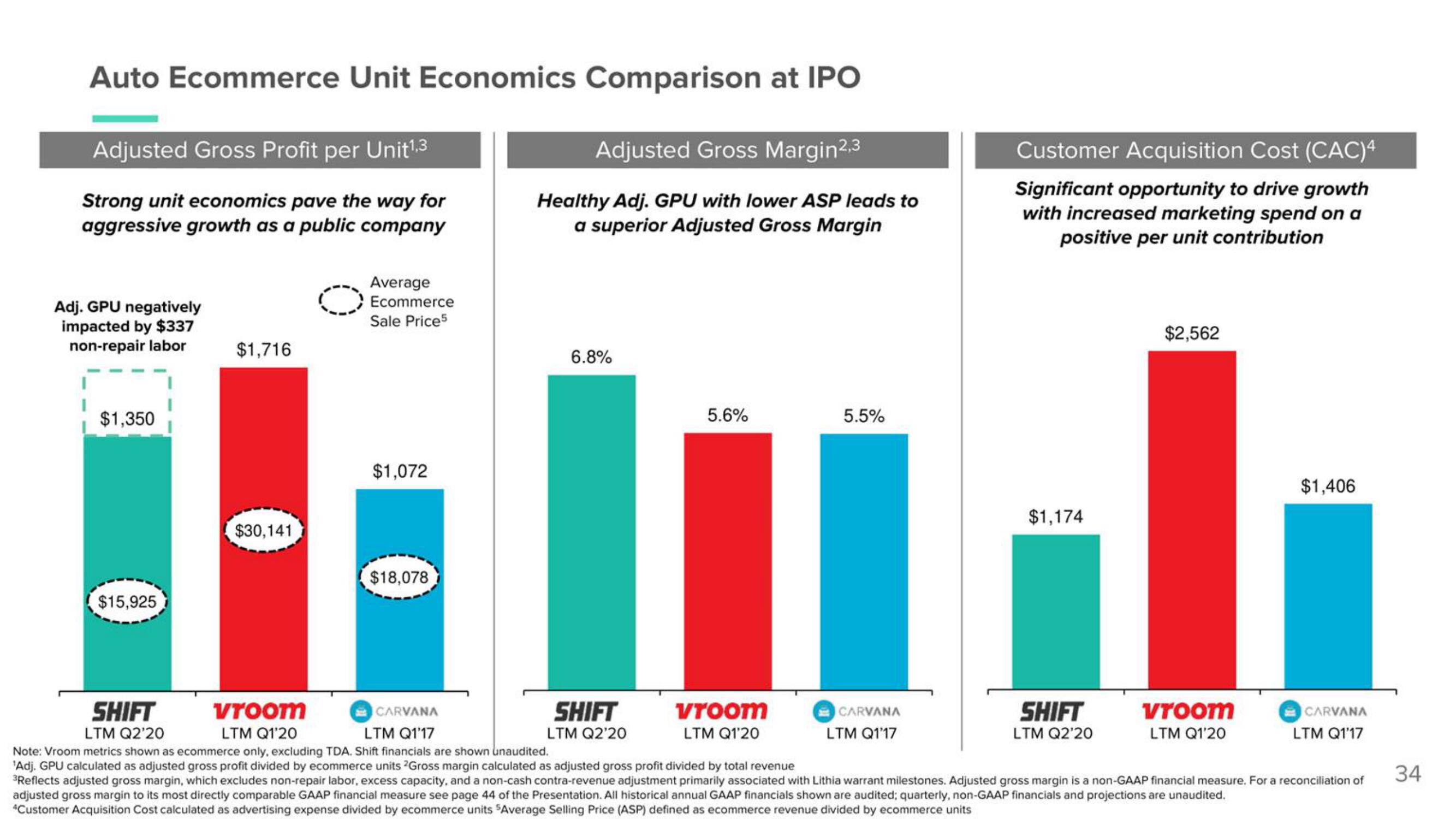

Auto Ecommerce Unit Economics Comparison at IPO

Adjusted Gross Profit per Unit¹,3

Strong unit economics pave the way for

aggressive growth as a public company

Adj. GPU negatively

impacted by $337

non-repair labor

$1,350

$15,925

$1,716

$30,141

Average

Ecommerce

Sale Price5

$1,072

$18,078

Adjusted Gross Margin2,3

Healthy Adj. GPU with lower ASP leads to

a superior Adjusted Gross Margin

6.8%

SHIFT

LTM Q2'20

5.6%

Vroom

LTM Q1'20

5.5%

Customer Acquisition Cost (CAC)4

Significant opportunity to drive growth

with increased marketing spend on a

positive per unit contribution

CARVANA

LTM Q1'17

$1,174

SHIFT

LTM Q2'20

$2,562

SHIFT

Vroom

CARVANA

LTM Q1'20

LTM Q1'17

LTM Q2'20

Note: Vroom metrics shown as ecommerce only, excluding TDA. Shift financials are shown unaudited.

'Adj. GPU calculated as adjusted gross profit divided by ecommerce units 2Gross margin calculated as adjusted gross profit divided by total revenue

³Reflects adjusted gross margin, which excludes non-repair labor, excess capacity, and a non-cash contra-revenue adjustment primarily associated with Lithia warrant milestones. Adjusted gross margin is a non-GAAP financial measure. For a reconciliation of

adjusted gross margin to its most directly comparable GAAP financial measure see page 44 of the Presentation. All historical annual GAAP financials shown are audited; quarterly, non-GAAP financials and projections are unaudited.

*Customer Acquisition Cost calculated as advertising expense divided by ecommerce units "Average Selling Price (ASP) defined as ecommerce revenue divided by ecommerce units

$1,406

vroom

LTM Q1'20

CARVANA

LTM Q1'17

34View entire presentation