Marti Investor Presentation Deck

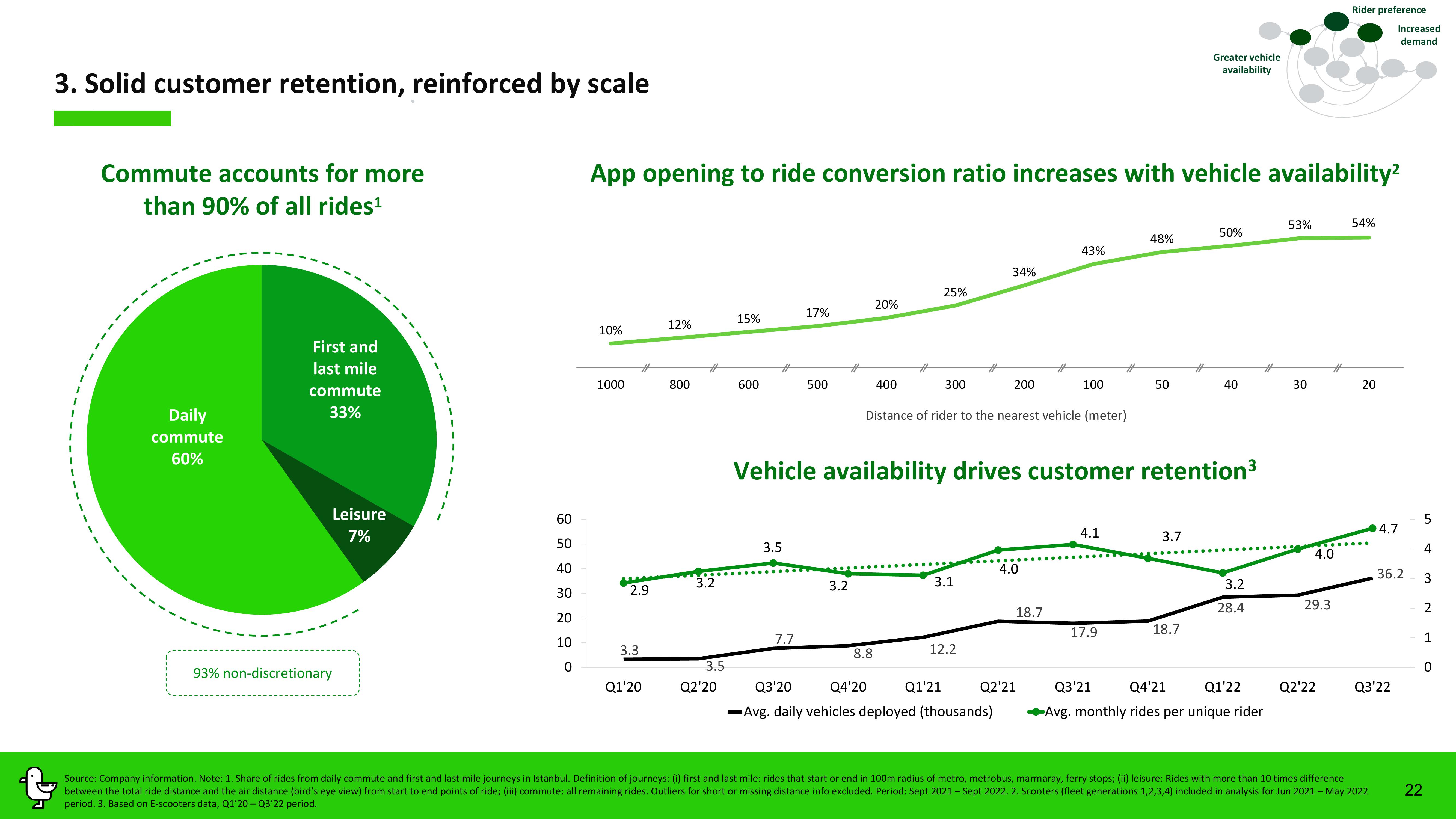

3. Solid customer retention, reinforced by scale

Commute accounts for more

than 90% of all rides¹

Daily

commute

60%

First and

last mile

commute

33%

Leisure

7%

93% non-discretionary

60

50

40

30

20

10

0

10%

1000

App opening to ride conversion ratio increases with vehicle availability²

2.9

3.3

Q1'20

12%

800

3.2

3.5

Q2'20

15%

600

3.5

17%

7.7

500

3.2

20%

400

8.8

25%

300

3.1

Q1'21

Distance of rider to the nearest vehicle (meter)

12.2

34%

Q3'20 Q4'20

-Avg. daily vehicles deployed (thousands)

200

Vehicle availability drives customer retention³

4.0

43%

18.7

100

Q2'21

4.1

48%

17.9

50

Greater vehicle.

availability

3.7

18.7

50%

40

3.2

28.4

Q3'21 Q4'21 Q1'22

Avg. monthly rides per unique rider

53%

30

4.0

29.3

Rider preference

Q2'22

54%

20

4.7

Source: Company information. Note: 1. Share of rides from daily commute and first and last mile journeys in Istanbul. Definition of journeys: (i) first and last mile: rides that start or end in 100m radius of metro, metrobus, marmaray, ferry stops; (ii) leisure: Rides with more than 10 times difference

between the total ride distance and the air distance (bird's eye view) from start to end points of ride; (iii) commute: all remaining rides. Outliers for short or missing distance info excluded. Period: Sept 2021-Sept 2022. 2. Scooters (fleet generations 1,2,3,4) included in analysis for Jun 2021 - May 2022

period. 3. Based on E-scooters data, Q1'20-Q3'22 period.

Increased

demand

Q3'22

36.2

5

4

3

2

1

22

0View entire presentation