Shift SPAC Presentation Deck

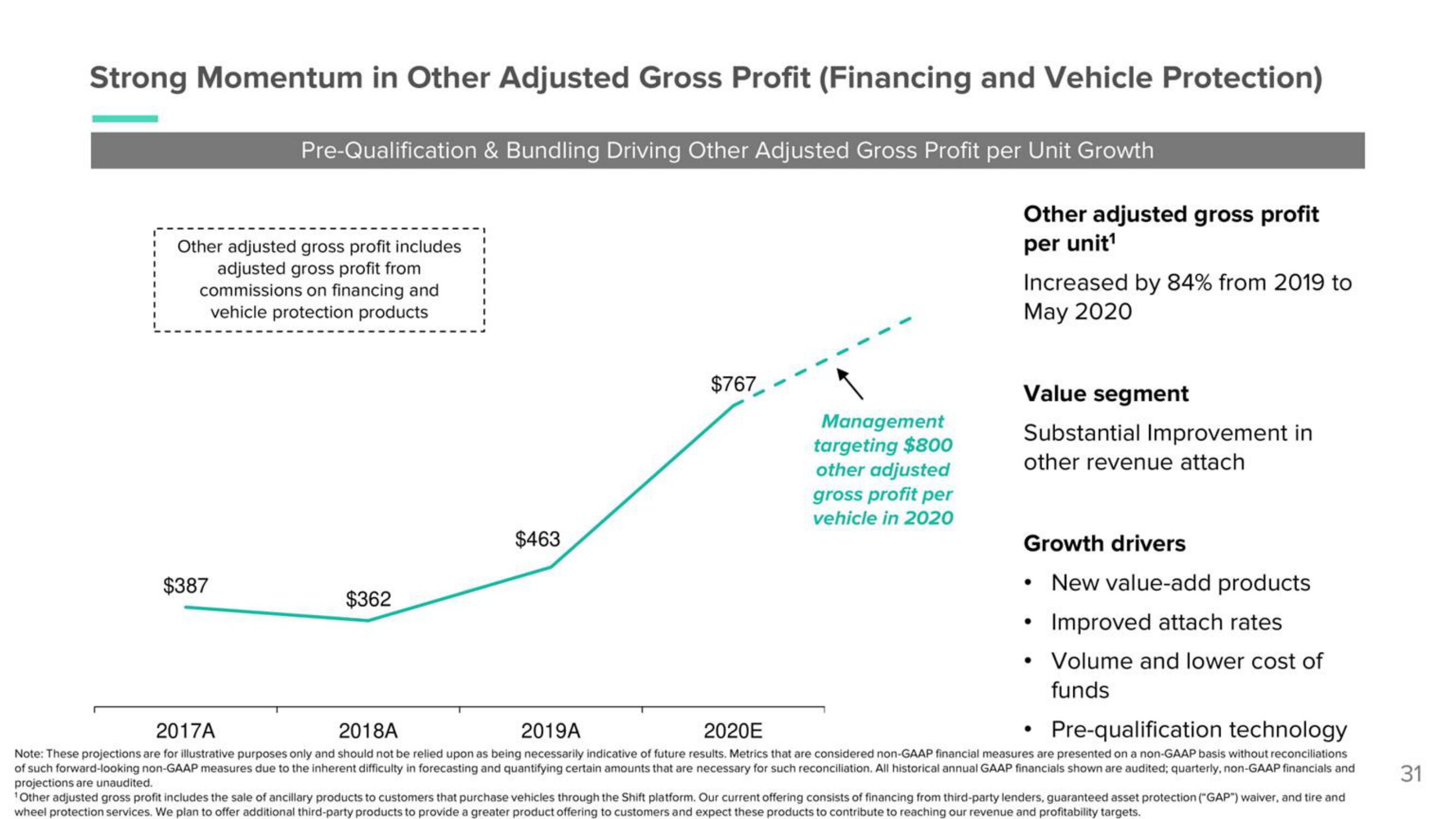

Strong Momentum in Other Adjusted Gross Profit (Financing and Vehicle Protection)

Pre-Qualification & Bundling Driving Other Adjusted Gross Profit per Unit Growth

Other adjusted gross profit includes

adjusted gross profit from

commissions on financing and

vehicle protection products

$387

$362

$463

$767

Management

targeting $800

other adjusted

gross profit per

vehicle in 2020

Other adjusted gross profit

per unit¹

Increased by 84% from 2019 to

May 2020

Value segment

Substantial Improvement in

other revenue attach

Growth drivers

• New value-add products

Improved attach rates.

Volume and lower cost of

funds

●

2017A

2018A

2019A

2020E

• Pre-qualification technology

Note: These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. Metrics that are considered non-GAAP financial measures are presented on a non-GAAP basis without reconciliations

of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. All historical annual GAAP financials shown are audited; quarterly, non-GAAP financials and

projections are unaudited.

¹Other adjusted gross profit includes the sale of ancillary products to customers that purchase vehicles through the Shift platform. Our current offering consists of financing from third-party lenders, guaranteed asset protection ("GAP") waiver, and tire and

wheel protection services. We plan to offer additional third-party products to provide a greater product offering to customers and expect these products to contribute to reaching our revenue and profitability targets.

31View entire presentation