Ginkgo Investor Conference Presentation Deck

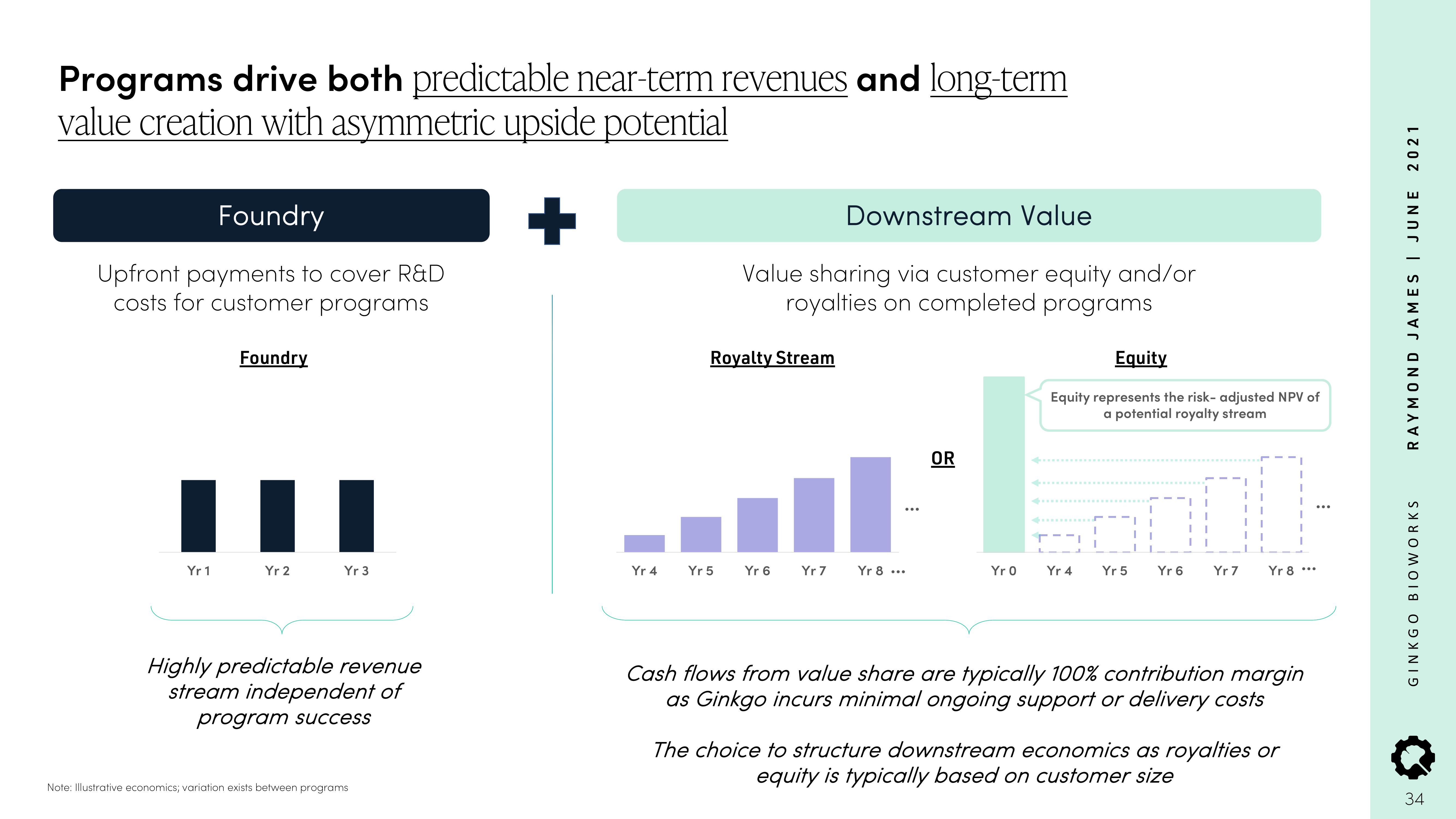

Programs drive both predictable near-term revenues and long-term

value creation with asymmetric upside potential

Foundry

Upfront payments to cover R&D

costs for customer programs

Yr 1

Foundry

Yr 2

Yr 3

Highly predictable revenue

stream independent of

program success

Note: Illustrative economics; variation exists between programs

Yr 4

Downstream Value

Value sharing via customer equity and/or

royalties on completed programs

Royalty Stream

Yr 5

Yr 6

Yr 7

Yr 8...

OR

Yr 0

Equity

Equity represents the risk- adjusted NPV of

a potential royalty stream

T--I

Yr 4

Yr 5

I

Yr 6

I

I

I

1

Yr 7

I

1

Yr 8...

Cash flows from value share are typically 100% contribution margin

as Ginkgo incurs minimal ongoing support or delivery costs

The choice to structure downstream economics as royalties or

equity is typically based on customer size

2021

RAYMOND JAMES | JUNE

GINKGO BIOWORKS

34View entire presentation