Antero Midstream Partners Investor Presentation Deck

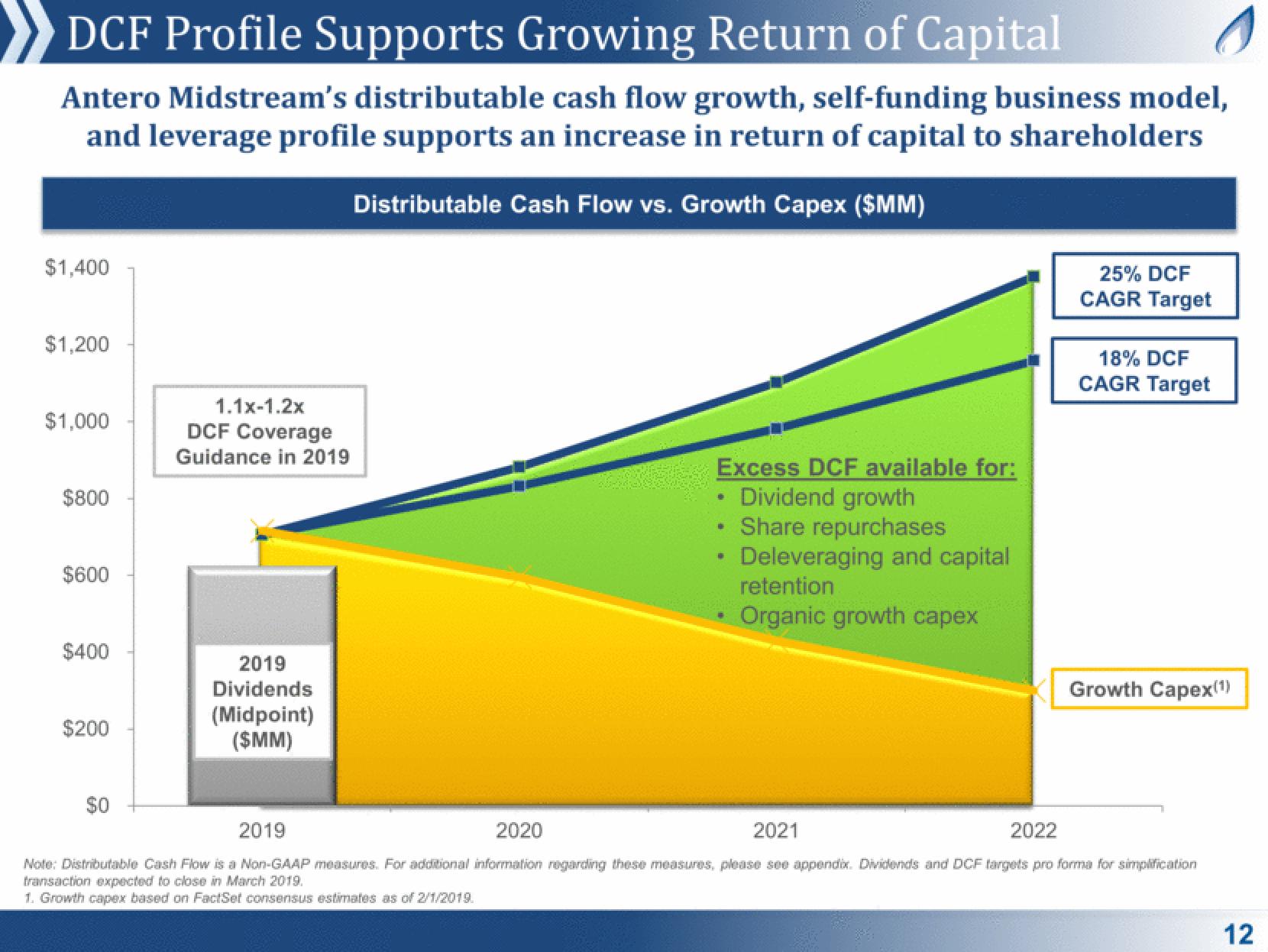

DCF Profile Supports Growing Return of Capital

Antero Midstream's distributable cash flow growth, self-funding business model,

and leverage profile supports an increase in return of capital to shareholders

Distributable Cash Flow vs. Growth Capex ($MM)

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

1.1x-1.2x

DCF Coverage

Guidance in 2019

2019

Dividends

(Midpoint)

($MM)

Excess DCF available for:

Dividend growth

Share repurchases

·

L

Deleveraging and capital

retention

Organic growth capex

25% DCF

CAGR Target

18% DCF

CAGR Target

Growth Capex(1)

2019

2020

2021

2022

Note: Distributable Cash Flow is a Non-GAAP measures. For additional information regarding these measures, please see appendix. Dividends and DCF targets pro forma for simplification

transaction expected to close in March 2019.

1. Growth capex based on FactSet consensus estimates as of 2/1/2019.

12View entire presentation