Vroom Mergers and Acquisitions Presentation Deck

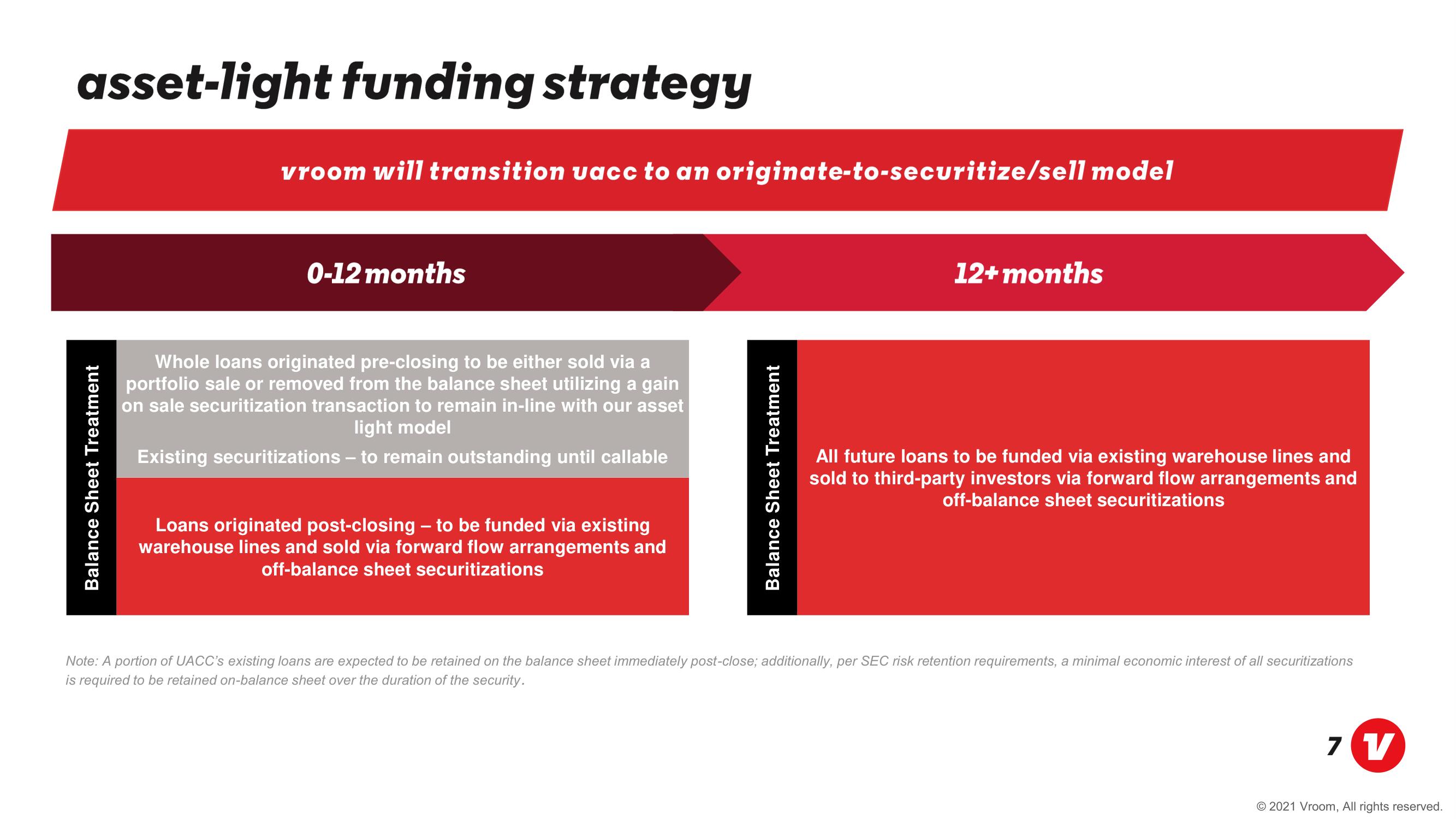

asset-light funding strategy

Balance Sheet Treatment

vroom will transition uacc to an originate-to-securitize/sell model

0-12 months

Whole loans originated pre-closing to be either sold via a

portfolio sale or removed from the balance sheet utilizing a gain

on sale securitization transaction to remain in-line with our asset

light model

Existing securitizations to remain outstanding until callable

Loans originated post-closing - to be funded via existing

warehouse lines and sold via forward flow arrangements and

off-balance sheet securitizations

Balance Sheet Treatment

12+ months

All future loans to be funded via existing warehouse lines and

sold to third-party investors via forward flow arrangements and

off-balance sheet securitizations

Note: A portion of UACC's existing loans are expected to be retained on the balance sheet immediately post-close; additionally, per SEC risk retention requirements, a minimal economic interest of all securitizations

is required to be retained on-balance sheet over the duration of the security.

7 V

2021 Vroom, All rights reserved.View entire presentation