Melrose Results Presentation Deck

Engines: increasing RRSP contribution

■

■

H

OEM decision

to invest

I

Melrose

Programme

launch

Technology

development

7 years

Portfolio value

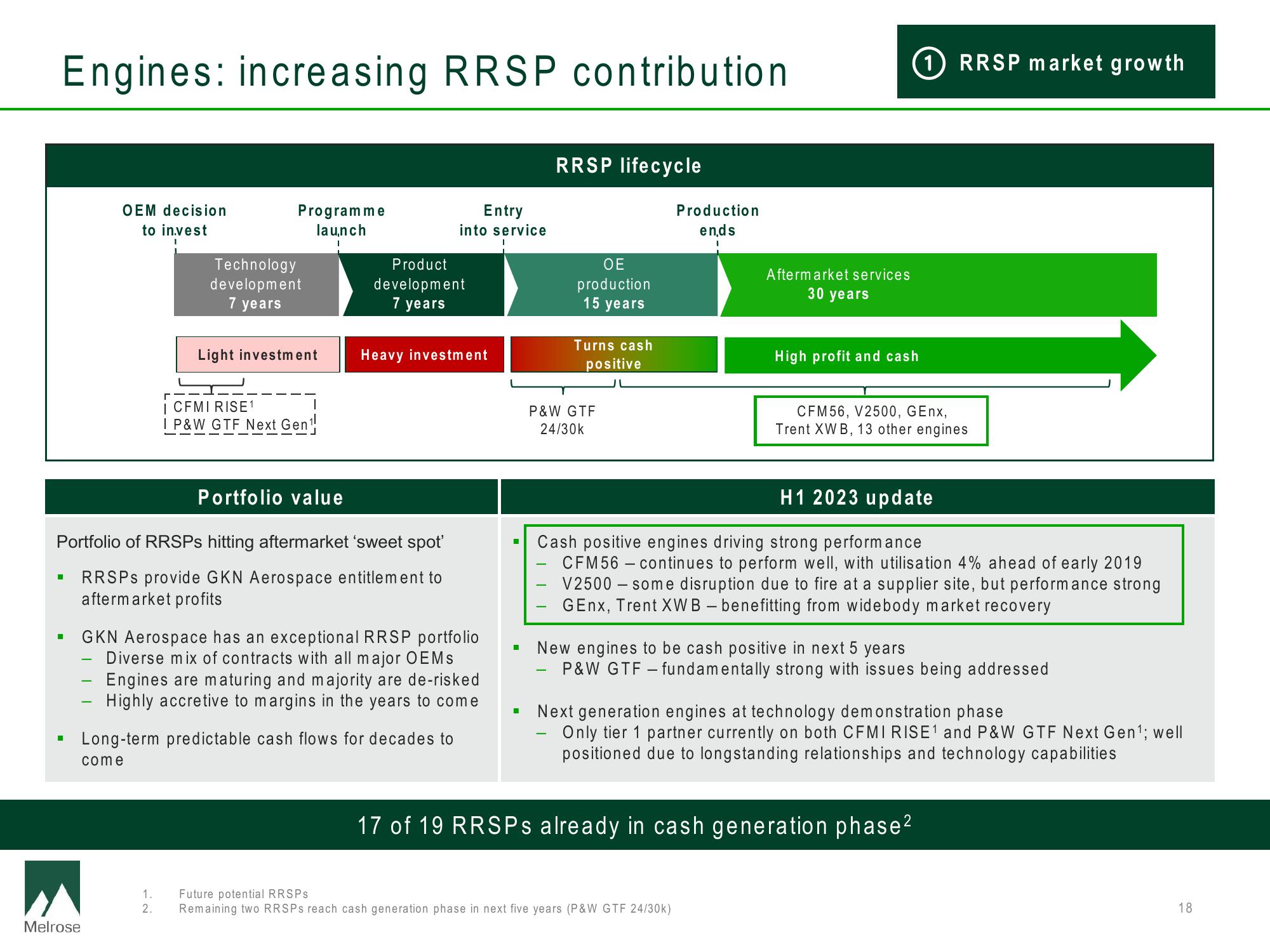

Portfolio of RRSPs hitting aftermarket 'sweet spot'

RRSPs provide GKN Aerospace entitlement to

aftermarket profits

Light investment

1.

2.

| CFMI RISE1

I P&W GTF Next Gen¹

Product

development

7 years

Entry

into service

Heavy investment

GKN Aerospace has an exceptional RRSP portfolio

Diverse mix of contracts with all major OEMs

Engines are maturing and majority are de-risked

Highly accretive to margins in the years to come

Long-term predictable cash flows for decades to

come

RRSP lifecycle

OE

production

15 years

Turns cash

positive

P&W GTF

24/30k

Production

ends

I

Aftermarket services

years

High profit and cash

Future potential RRSPs

Remaining two RRSPS reach cash generation phase in next five years (P&W GTF 24/30k)

RRSP market growth

CFM56, V2500, GEnx,

Trent XWB, 13 other engines

H1 2023 update

Cash positive engines driving strong performance

CFM56- continues to perform well, with utilisation 4% ahead of early 2019

V2500 - some disruption due to fire at a supplier site, but performance strong

GEnx, Trent XWB - benefitting from widebody market recovery

New engines to be cash positive in next 5 years

P&W GTF - fundamentally strong with issues being addressed

Next generation engines at technology demonstration phase

Only tier 1 partner currently on both CFMI RISE¹ and P&W GTF Next Gen¹; well

positioned due to longstanding relationships and technology capabilities

17 of 19 RRSPs already in cash generation phase²

18View entire presentation