Liberty Global Results Presentation Deck

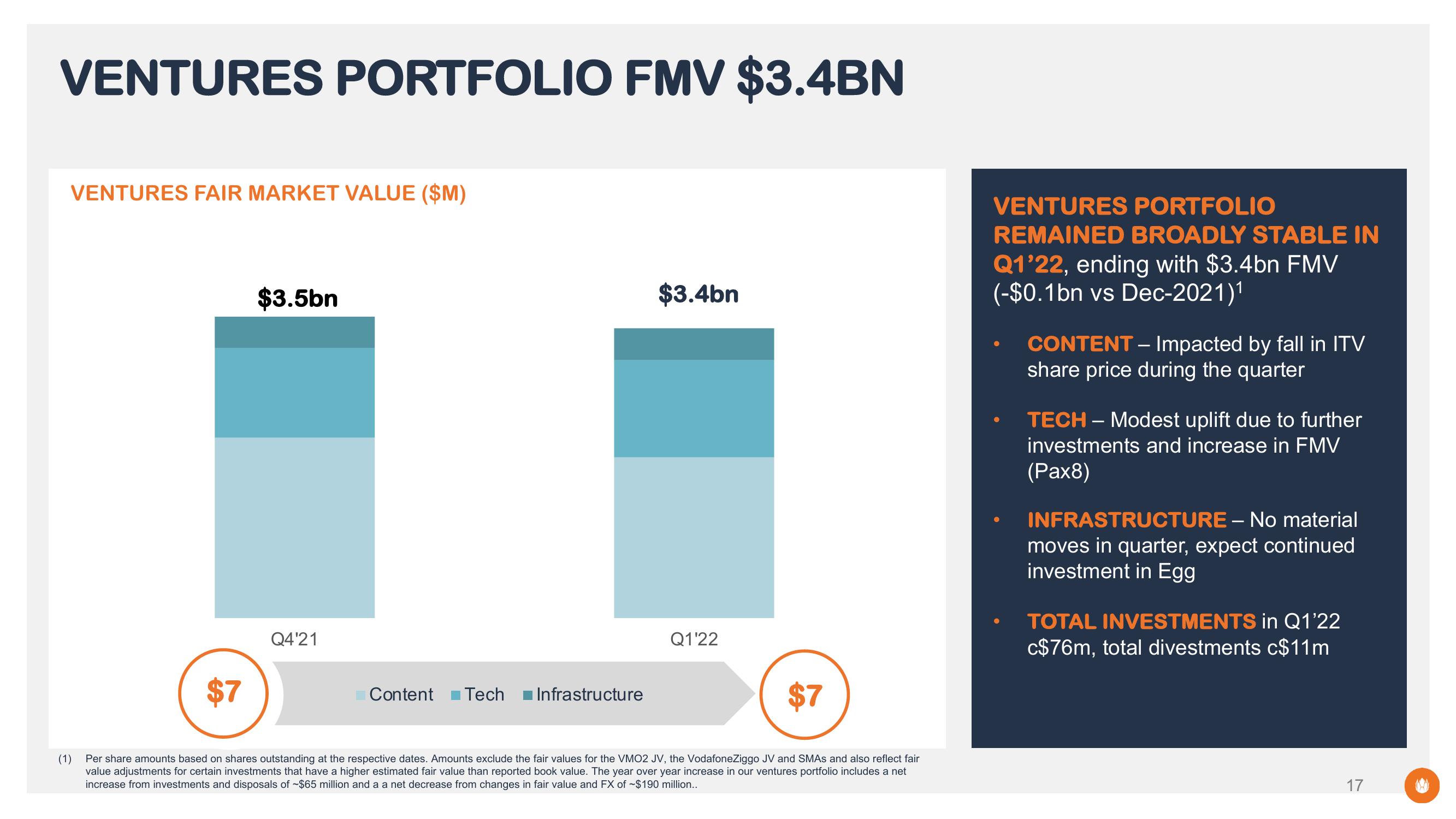

VENTURES PORTFOLIO FMV $3.4BN

VENTURES FAIR MARKET VALUE ($M)

$3.5bn

Q4'21

Content

$3.4bn

$7

$7

(1)

Per share amounts based on shares outstanding at the respective dates. Amounts exclude the fair values for the VMO2 JV, the VodafoneZiggo JV and SMAs and also reflect fair

value adjustments for certain investments that have a higher estimated fair value than reported book value. The year over year increase in our ventures portfolio includes a net

increase from investments and disposals of ~$65 million and a a net decrease from changes in fair value and FX of $190 million..

Tech Infrastructure

Q1'22

VENTURES PORTFOLIO

REMAINED BROADLY STABLE IN

Q1'22, ending with $3.4bn FMV

(-$0.1bn vs Dec-2021)¹

CONTENT - Impacted by fall in ITV

share price during the quarter

TECH - Modest uplift due to further

investments and increase in FMV

(Pax8)

INFRASTRUCTURE - No material

moves in quarter, expect continued

investment in Egg

TOTAL INVESTMENTS in Q1'22

c$76m, total divestments c$11m

17View entire presentation