Accel Entertaiment Results Presentation Deck

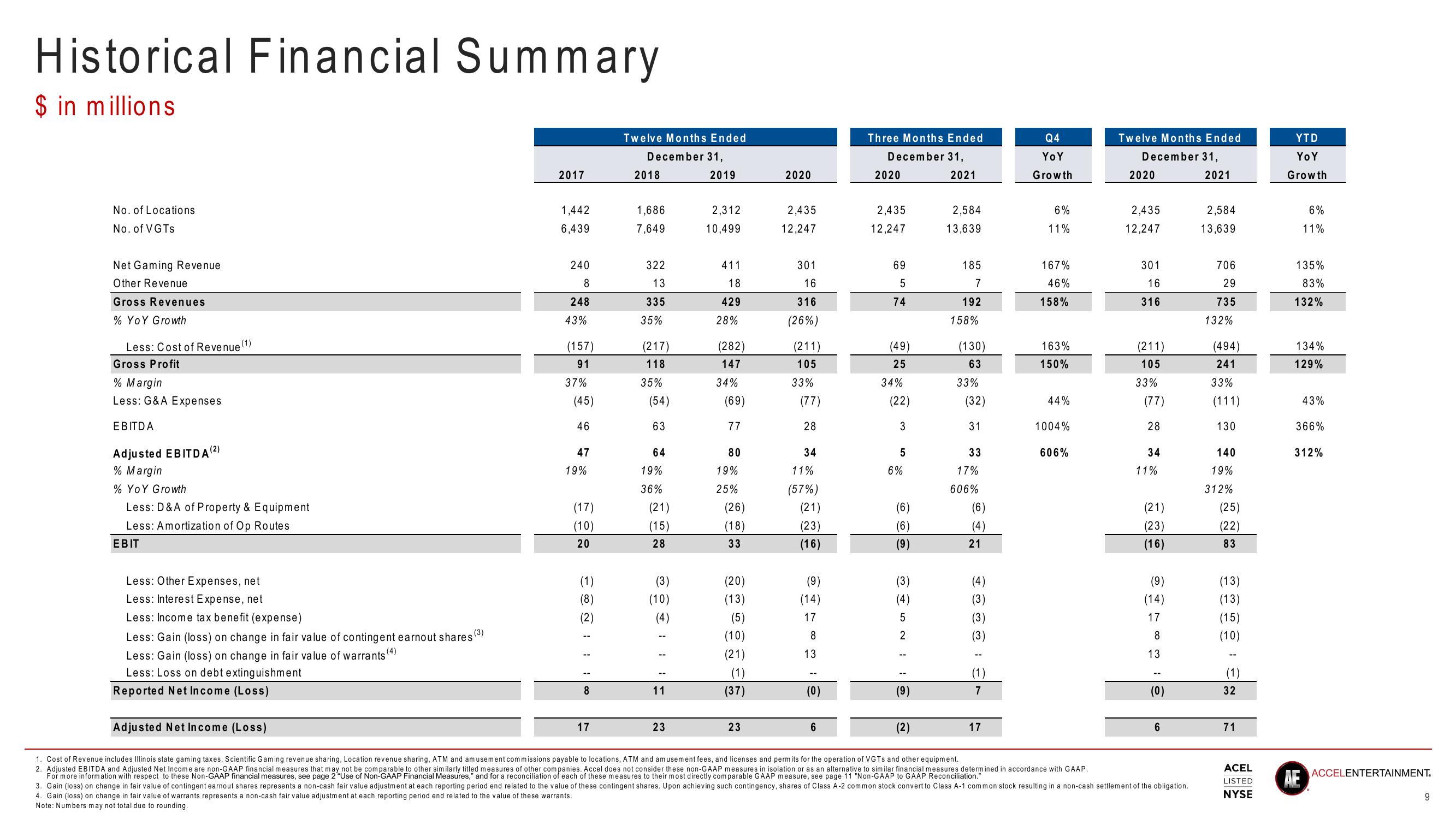

Historical Financial Summary

$ in millions

No. of Locations

No. of VGTs

Net Gaming Revenue

Other Revenue

Gross Revenues

% YoY Growth

Less: Cost of Revenue (1)

Gross Profit

% Margin

Less: G&A Expenses

EBITDA

Adjusted EBITDA (2)

% Margin

% YoY Growth

Less: D&A of Property & Equipment

Less: Amortization of Op Routes

EBIT

Less: Other Expenses, net

Less: Interest Expense, net

Less: Income tax benefit (expense)

(3)

Less: Gain (loss) on change in fair value of contingent earnout shares

Less: Gain (loss) on change in fair value of warrants (4)

Less: Loss on debt extinguishment

Reported Net Income (Loss)

2017

1,442

6,439

240

8

248

43%

(157)

91

37%

(45)

46

47

19%

(17)

(10)

20

(1)

(8)

1 1 I

8

Twelve Months Ended

December 31,

2019

17

2018

1,686

7,649

322

13

335

35%

(217)

118

35%

(54)

63

64

19%

36%

(21)

(15)

28

(3)

(10)

11

2,312

10,499

23

411

18

429

28%

(282)

147

34%

(69)

77

80

19%

25%

(26)

(18)

33

(20)

(13)

(5)

(10)

(21)

(1)

(37)

2020

23

2,435

12,247

301

16

316

(26%)

(211)

105

33%

(77)

28

34

11%

(57%)

(21)

(23)

(16)

(9)

(14)

17

8

13

--

(0)

Three Months Ended

December 31,

2021

6

2020

2,435

12,247

69

5

74

(49)

25

34%

(22)

3

5

6%

(6)

(6)

(9)

(3)

(4)

5

2

(9)

2,584

13,639

(2)

185

7

192

158%

(130)

63

33%

(32)

31

33

17%

606%

(6)

(4)

21

(4)

(3)

(3)

(3)

(1)

7

Q4

Yo Y

Growth

Adjusted Net Income (Loss)

1. Cost of Revenue includes Illinois state gaming taxes, Scientific Gaming revenue sharing, Location revenue sharing, ATM and amusement commissions payable to locations, ATM and amusement fees, and licenses and permits for the operation of VGTs and other equipment.

2. Adjusted EBITDA and Adjusted Net Income are non-GAAP financial measures that may not be comparable to other similarly titled measures of other companies. Accel does not consider these non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP.

For more information with respect to these Non-GAAP financial measures, see page 2 "Use of Non-GAAP Financial Measures," and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 11 "Non-GAAP to GAAP Reconciliation."

17

6%

11%

167%

46%

158%

163%

150%

44%

1004%

606%

Twelve Months Ended

December 31,

2021

2020

2,435

12,247

301

16

316

(211)

105

33%

(77)

28

34

11%

(21)

(23)

(16)

(9)

(14)

17

8

13

(0)

6

3. Gain (loss) on change in fair value of contingent earnout shares represents a non-cash fair value adjustment at each reporting period end related to the value of these contingent shares. Upon achieving such contingency, shares of Class A-2 common stock convert to Class A-1 common stock resulting in a non-cash settlement of the obligation.

4. Gain (loss) on change in fair value of warrants represents a non-cash fair value adjustment at each reporting period end related to the value of these warrants.

Note: Numbers may not total due to rounding.

2,584

13,639

706

29

735

132%

(494)

241

33%

(111)

130

140

19%

312%

(25)

(22)

83

(13)

(13)

(15)

(10)

32

71

ACEL

LISTED

NYSE

YTD

Yo Y

Growth

6%

11%

135%

83%

132%

134%

129%

43%

366%

312%

AE

ACCELENTERTAINMENT.

9View entire presentation