Melrose Results Presentation Deck

£m

750

650

550

450

350

250

150

50

-50

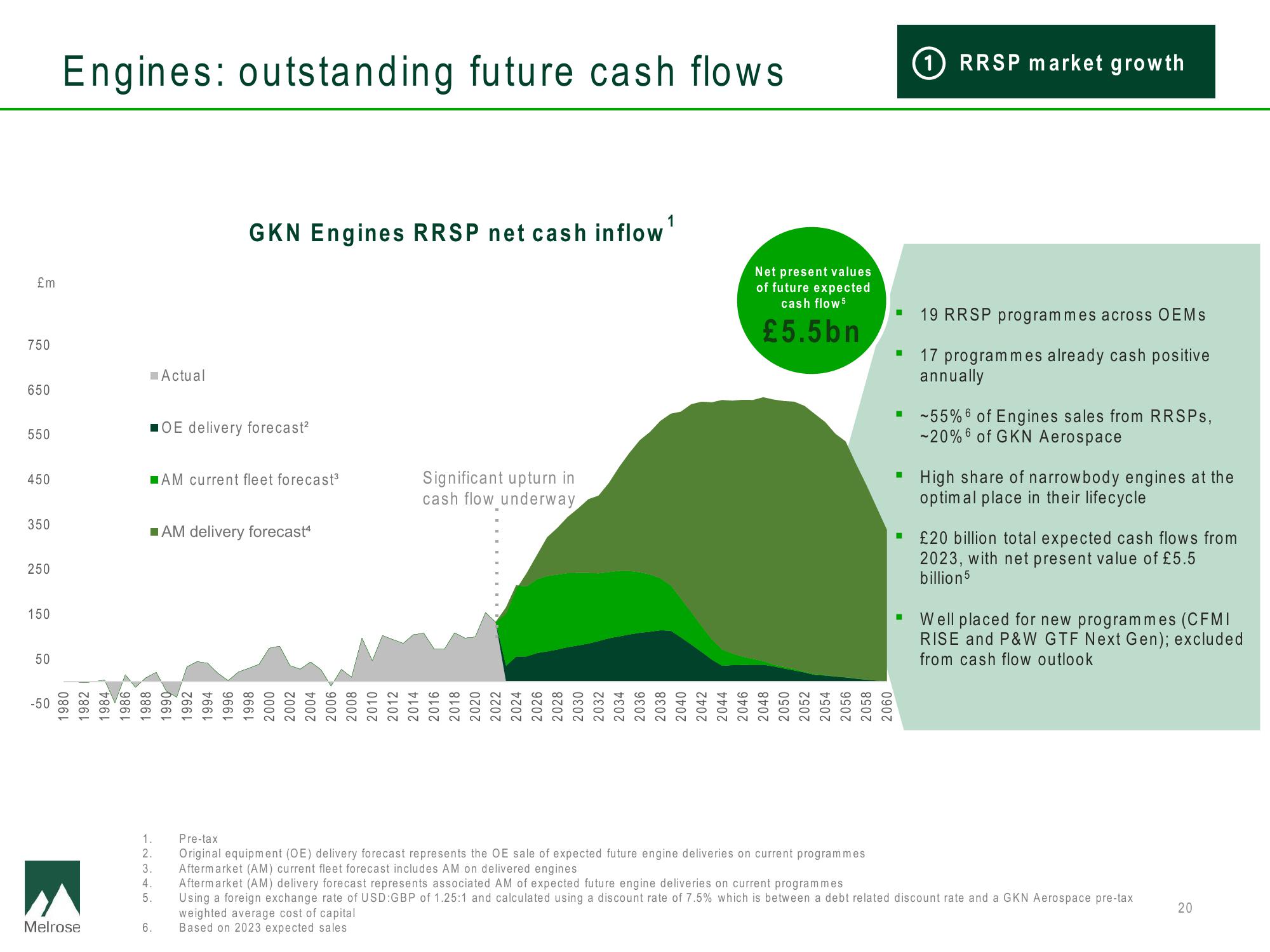

Engines: outstanding future cash flows

1980

1982

1984

Melrose

you

000

1986

■OE delivery forecast²

1988

■AM current fleet forecast³

Actual

■AM delivery forecast4

www

1.

2.

3.

4.

5.

6.

666

1992

1994

GKN Engines RRSP net cash inflow

900k

1996

000k

1998

0007

2000

2002

20

www

2004

0003

2006

0007

2008

2010

0107

7107

2012

Significant upturn in

cash flow underway

2014

2016

P

2018

2010

2020

0707

2022

2022

2024

2024

2026

2026

Be

2028

2028

2030

2032

2034

2036

2038

2040

2042

3103

LLOZ

2044

Net present values

of future expected

cash flow 5

£5.5bn

D

2046

2048

CLOT

2007

2050

2052

2002

2054

2056

2058

2060

Pre-tax

Original equipment (OE) delivery forecast represents the OE sale of expected future engine deliveries on current programmes

Aftermarket (AM) current fleet forecast includes AM on delivered engines

■

RRSP market growth

19 RRSP programmes across OEMs

17 programmes already cash positive

annually

▪ ~55% of Engines sales from RRSPs,

-20% of GKN Aerospace

▪ High share of narrowbody engines at the

optimal place in their lifecycle

■ £20 billion total expected cash flows from

2023, with net present value of £5.5

billion 5

▪ Well placed for new programmes (CFMI

RISE and P&W GTF Next Gen); excluded

from cash flow outlook

Aftermarket (AM) delivery forecast represents associated AM of expected future engine deliveries on current programmes

Using a foreign exchange rate of USD:GBP of 1.25:1 and calculated using a discount rate of 7.5% which is between a debt related discount rate and a GKN Aerospace pre-tax

weighted average cost of capital

Based on 2023 expected sales

20View entire presentation