Hilltop Holdings Results Presentation Deck

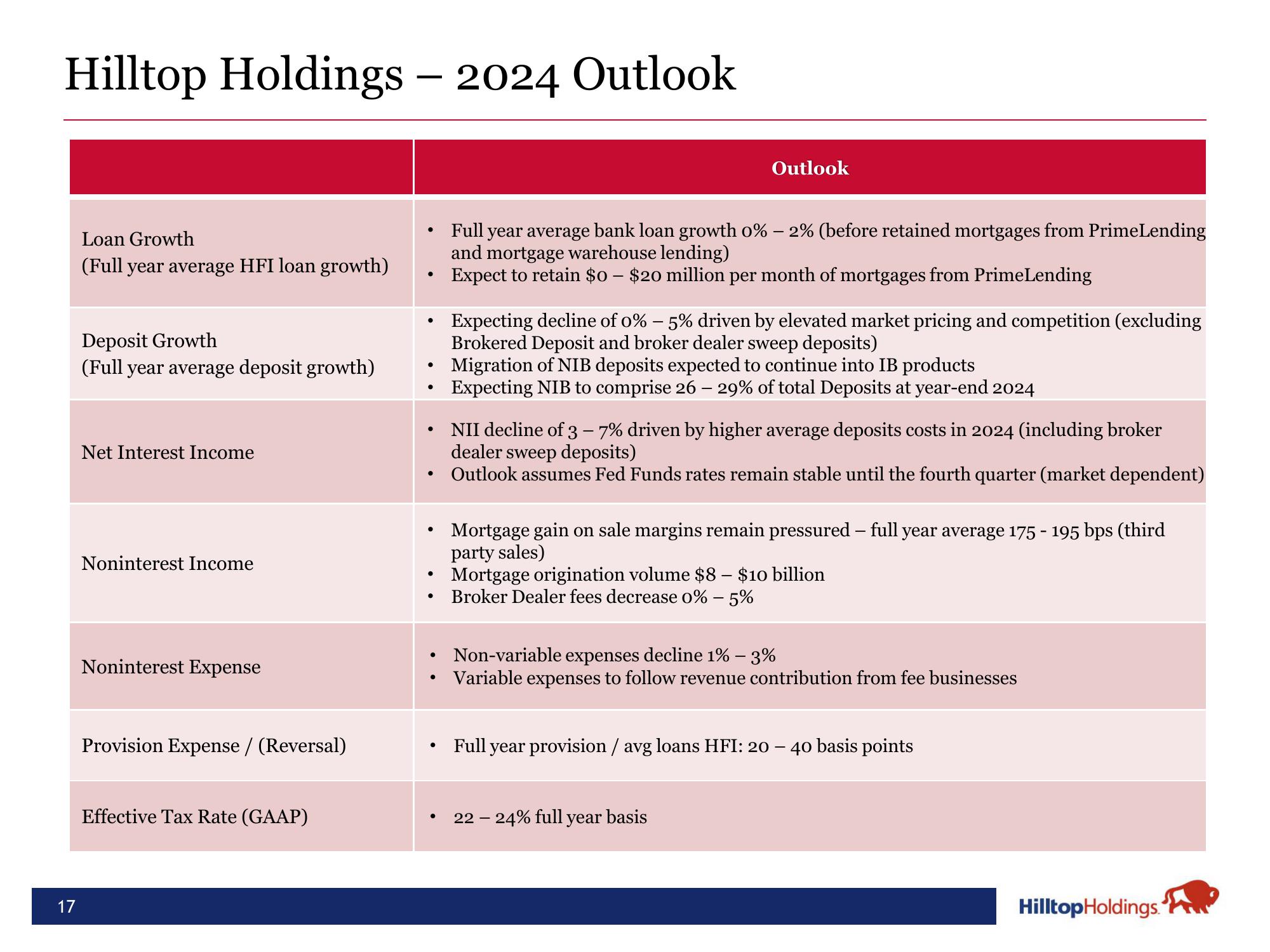

Hilltop Holdings – 2024 Outlook

17

Loan Growth

(Full year average HFI loan growth)

Deposit Growth

(Full year average deposit growth)

Net Interest Income

Noninterest Income

Noninterest Expense

Provision Expense / (Reversal)

Effective Tax Rate (GAAP)

●

●

●

●

●

• NII decline of 3 - 7% driven by higher average deposits costs in 2024 (including broker

dealer sweep deposits)

Outlook assumes Fed Funds rates remain stable until the fourth quarter (market dependent)

●

●

●

●

●

Outlook

Full year average bank loan growth 0% -2% (before retained mortgages from PrimeLending

and mortgage warehouse lending)

Expect to retain $0 – $20 million per month of mortgages from PrimeLending

Expecting decline of 0% - 5% driven by elevated market pricing and competition (excluding

Brokered Deposit and broker dealer sweep deposits)

Migration of NIB deposits expected to continue into IB products

Expecting NIB to comprise 26 – 29% of total Deposits at year-end 2024

Mortgage gain on sale margins remain pressured - full year average 175 - 195 bps (third

party sales)

Mortgage origination volume $8 - $10 billion

Broker Dealer fees decrease 0% - 5%

Non-variable expenses decline 1% - 3%

Variable expenses to follow revenue contribution from fee businesses

Full year provision / avg loans HFI: 20 - 40 basis points

22 - 24% full year basis

Hilltop Holdings.View entire presentation