PJT Partners Investment Banking Pitch Book

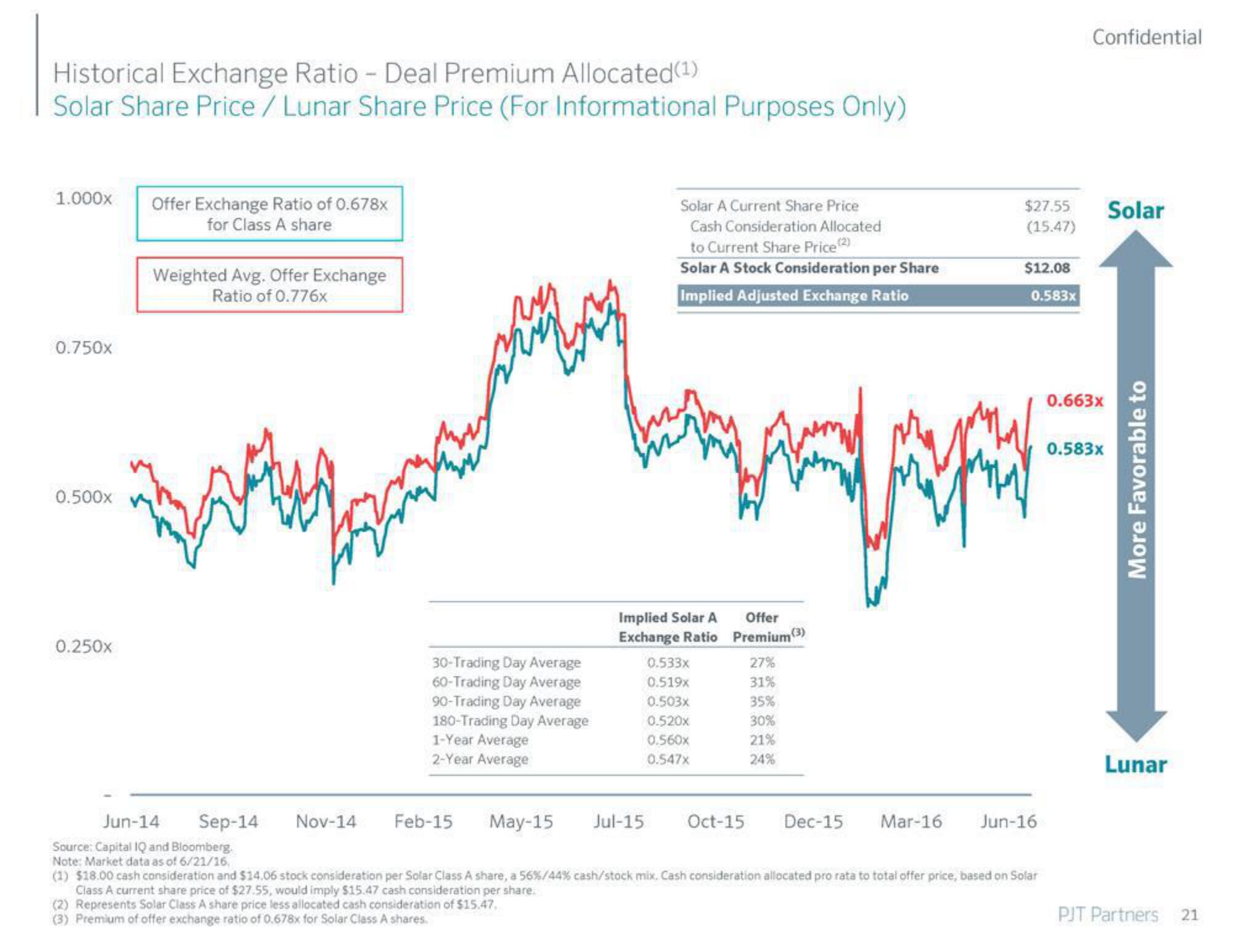

Historical Exchange Ratio - Deal Premium Allocated(1)

Solar Share Price / Lunar Share Price (For Informational Purposes Only)

1.000x Offer Exchange Ratio of 0.678x

for Class A share

0.750x

0.500x

0.250x

Weighted Avg. Offer Exchange

Ratio of 0.776x

Jun-14

Source: Capital IQ and Bloomberg.

Note: Market data as of 6/21/16,

Foren

Sep-14 Nov-14

www

30-Trading Day Average

60-Trading Day Average

90-Trading Day Average

180-Trading Day Average

1-Year Average

2-Year Average

Feb-15

May-15

Solar A Current Share Price

Cash Consideration Allocated

to Current Share Price (2)

Solar A Stock Consideration per Share

Implied Adjusted Exchange Ratio

Implied Solar A

Exchange Ratio

Jul-15

0.533x

0.519x

0.503X

0.520x

0.560x

0.547x

Offer

Premium (3)

27%

31%

35%

30%

21%

24%

f

Oct-15 Dec-15 Mar-16

$27.55

(15.47)

$12.08

0.583x

Jun-16

(1) $18.00 cash consideration and $14.06 stock consideration per Solar Class A share, a 56% /44% cash/stock mix. Cash consideration allocated pro rata to total offer price, based on Solar

Class A current share price of $27.55, would imply $15.47 cash consideration per share.

(2) Represents Solar Class A share price less allocated cash consideration of $15.47.

(3) Premium of offer exchange ratio of 0.678x for Solar Class A shares.

Confidential

0.663x

0.583x

Solar

More Favorable to

Lunar

PJT Partners

21View entire presentation