Aeva Investor Presentation Deck

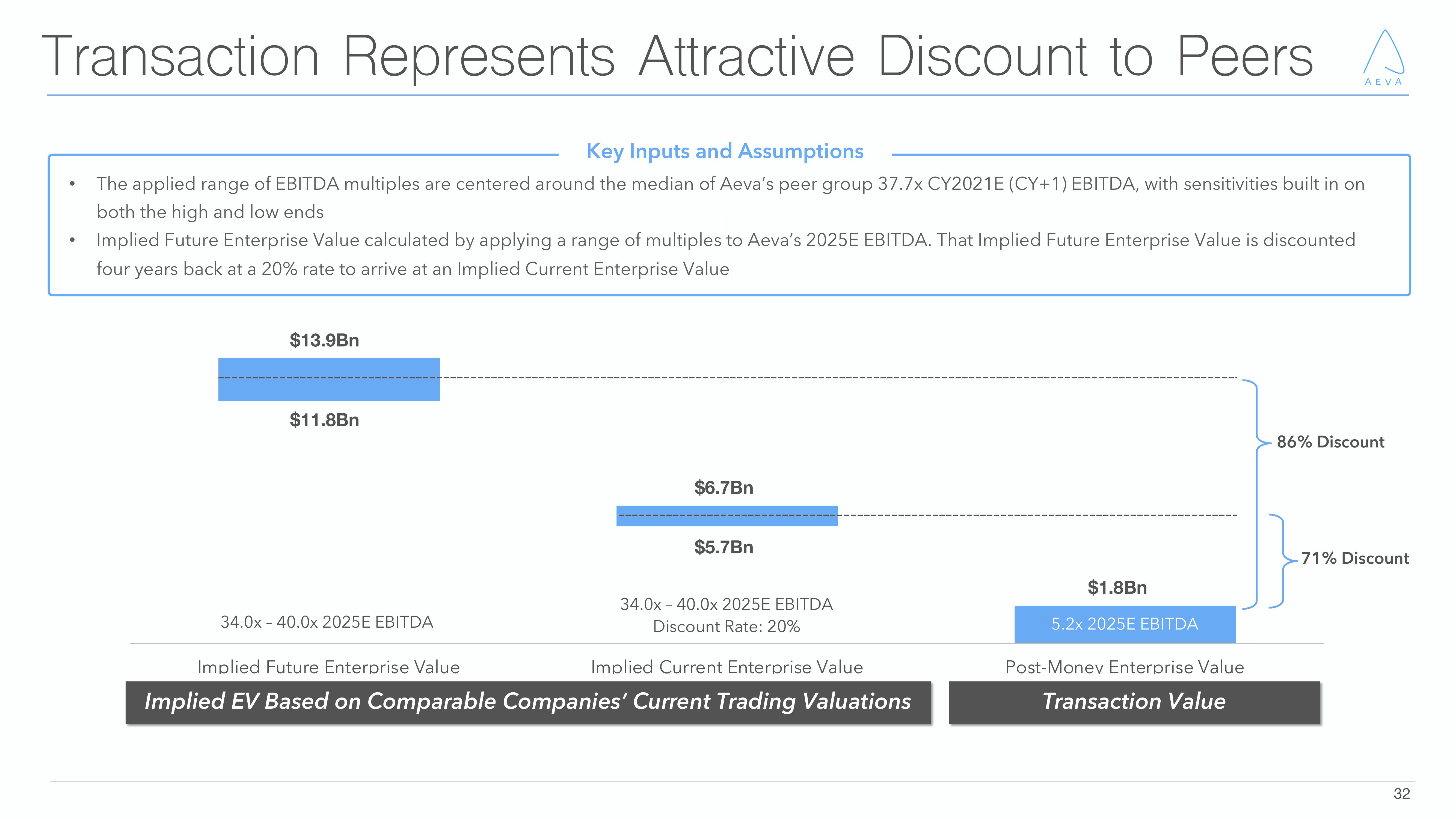

Transaction Represents Attractive Discount to Peers

●

Key Inputs and Assumptions

The applied range of EBITDA multiples are centered around the median of Aeva's peer group 37.7x CY2021E (CY+1) EBITDA, with sensitivities built in on

both the high and low ends

Implied Future Enterprise Value calculated by applying a range of multiples to Aeva's 2025E EBITDA. That Implied Future Enterprise Value is discounted

four

years back at a 20% rate to arrive at an Implied Current Enterprise Value

$13.9Bn

$11.8Bn

34.0x 40.0x 2025E EBITDA

$6.7Bn

$5.7Bn

34.0x 40.0x 2025E EBITDA

Discount Rate: 20%

Implied Future Enterprise Value

Implied Current Enterprise Value

Implied EV Based on Comparable Companies' Current Trading Valuations

$1.8Bn

5.2x 2025E EBITDA

s

AEVA

Post-Money Enterprise Value

Transaction Value

86% Discount

71% Discount

32View entire presentation