Lyft Results Presentation Deck

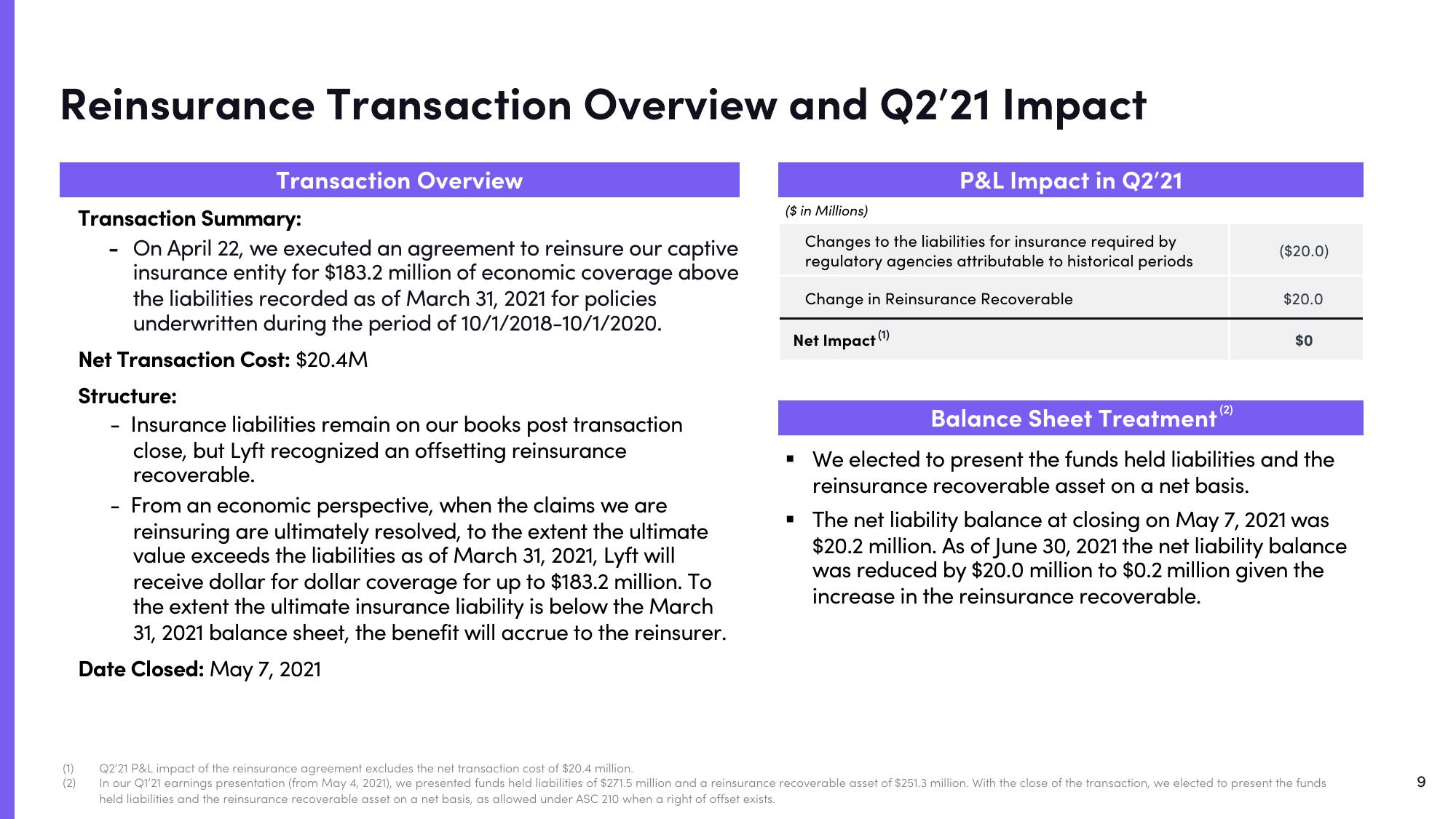

Reinsurance Transaction Overview and Q2'21 Impact

(1)

(2)

Transaction Overview

Transaction Summary:

On April 22, we executed an agreement to reinsure our captive

insurance entity for $183.2 million of economic coverage above

the liabilities recorded as of March 31, 2021 for policies

underwritten during the period of 10/1/2018-10/1/2020.

Net Transaction Cost: $20.4M

-

Structure:

- Insurance liabilities remain on our books post transaction

close, but Lyft recognized an offsetting reinsurance

recoverable.

- From an economic perspective, when the claims we are

reinsuring are ultimately resolved, to the extent the ultimate

value exceeds the liabilities as of March 31, 2021, Lyft will

receive dollar for dollar coverage for up to $183.2 million. To

the extent the ultimate insurance liability is below the March

31, 2021 balance sheet, the benefit will accrue to the reinsurer.

Date Closed: May 7, 2021

P&L Impact in Q2'21

($ in Millions)

Changes to the liabilities for insurance required by

regulatory agencies attributable to historical periods

Change in Reinsurance Recoverable

Net Impact (1)

■

($20.0)

$20.0

$0

Balance Sheet Treatment (²)

We elected to present the funds held liabilities and the

reinsurance recoverable asset on a net basis.

▪ The net liability balance at closing on May 7, 2021 was

$20.2 million. As of June 30, 2021 the net liability balance

was reduced by $20.0 million to $0.2 million given the

increase in the reinsurance recoverable.

Q2'21 P&L impact of the reinsurance agreement excludes the net transaction cost of $20.4 million.

In our Q1'21 earnings presentation (from May 4, 2021), we presented funds held liabilities of $271.5 million and a reinsurance recoverable asset of $251.3 million. With the close of the transaction, we elected to present the funds

held liabilities and the reinsurance recoverable asset on a net basis, as allowed under ASC 210 when a right of offset exists.

9View entire presentation