Baird Investment Banking Pitch Book

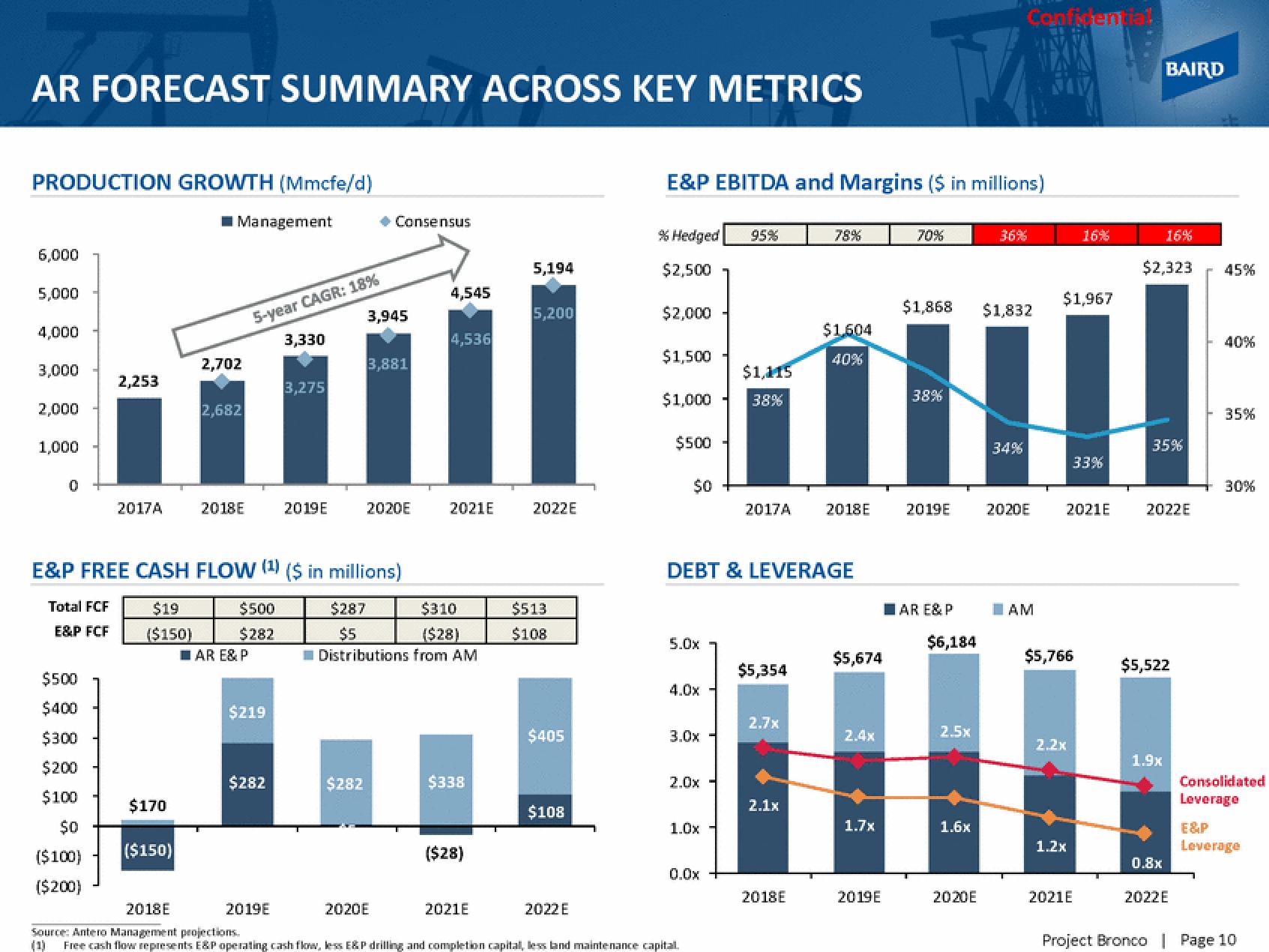

AR FORECAST SUMMARY ACROSS KEY METRICS

PRODUCTION GROWTH (Mmcfe/d)

6,000

5,000

4,000

3,000

2,000

1,000

0

2,253

$500

$400

$300

$200

$100

$0

($100)

($200)

2017A

$170

■Management

($150)

2,702

2,682

2018E

$500

$282

AR E& P

5-year CAGR: 18%

$219

E&P FREE CASH FLOW (¹) ($ in millions)

Total FCF

$19

($150)

E&P FCF

$282

3,330

3,275

2019E

2019E

$287

$5

→ Consensus

3,945

$282

3,881

2020E

Distributions from

2020E

4,545

4,536

2021E

$310

($28)

$338

($28)

2021E

5,194

5,200

2022E

$513

$108

$405

$108

2022 E

E&P EBITDA and Margins ($ in millions)

% Hedged

$2,500

$2,000

$1,500

$1,000

$500

$0

5.0x

4.0x

2018E

Source: Antero Management projections.

Free cash flow represents E&P operating cash flow, less E&P drilling and completion capital, less land maintenance capital.

(1)

3.0x -

2.0x

1.0x

DEBT & LEVERAGE

0.0x

95%

$1,115

38%

2017A

$5,354

2.7x

2.1x

78%

2018E

$1,604

40%

2018E

$5,674

2.4x

1.7x

2019E

70%

$1,868

38%

2019E

AR E& P

$6,184

2.5x

1.6x

2020E

Confidential

36%

$1,832

34%

2020E

AM

$1,967

2021E

$5,766

2.2x

16%

33%

1.2x

2021E

BAIRD

$2,323

16%

35%

2022E

1.9x

$5,522

0.8x

2022E

45%

40%

35%

30%

Consolidated

Leverage

E&P

Leverage

Project Bronco | Page 10View entire presentation