Paysafe SPAC Presentation Deck

Strong operating leverage: Growth at scale

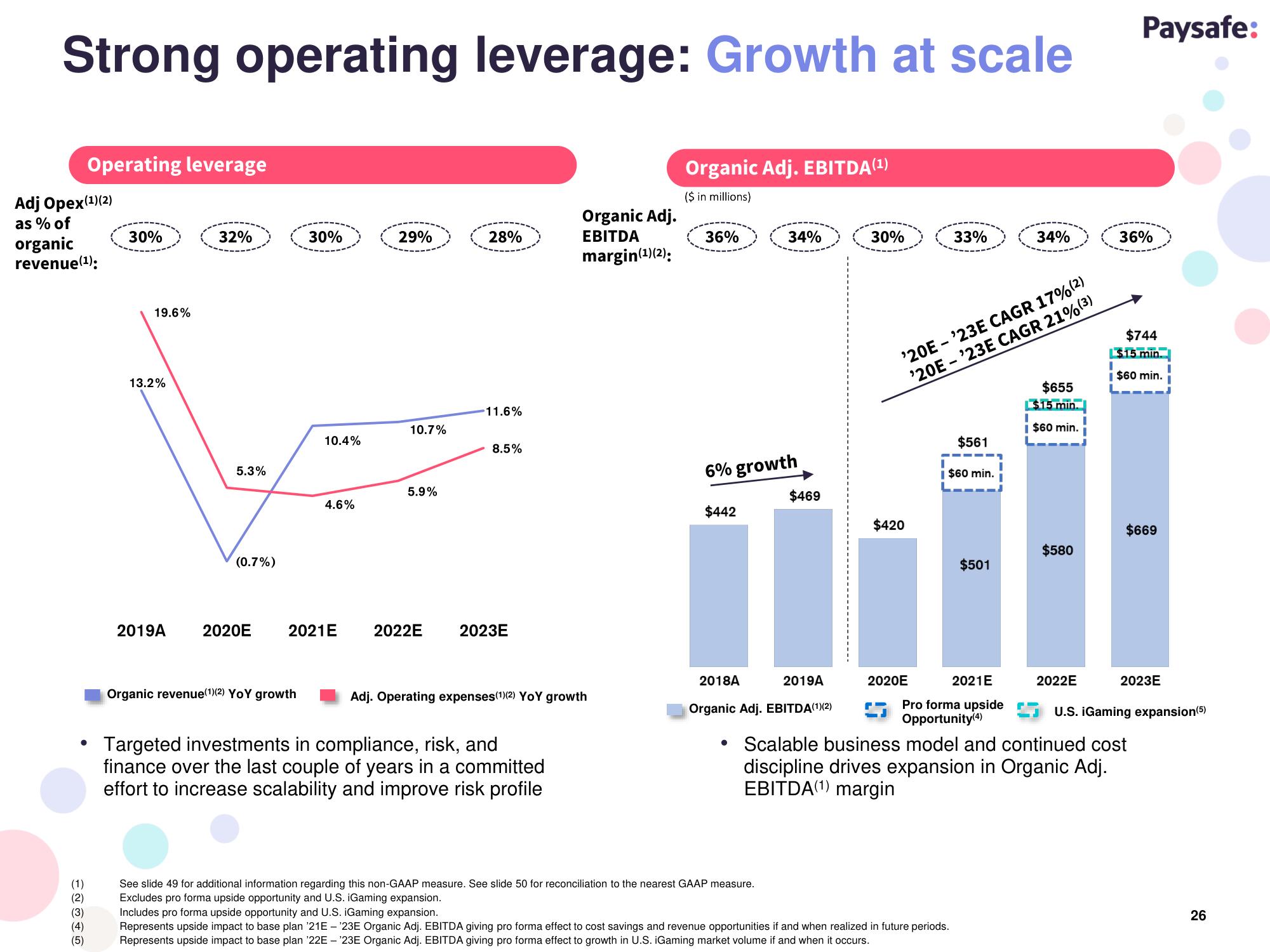

Operating leverage

Adj Opex(¹)(2)

as % of

organic

revenue (¹):

●

(1)

(2)

(3)

(4)

(5)

30%

19.6%

13.2%

32%

5.3%

(0.7%)

2019A 2020E

30%

Organic revenue(1)(2) YoY growth

10.4%

4.6%

2021 E

29%

10.7%

5.9%

2022E

28%

11.6%

8.5%

2023E

Organic Adj.

EBITDA

margin(¹)(2):

Adj. Operating expenses (¹)(2) YoY growth

Targeted investments in compliance, risk, and

finance over the last couple of years in a committed

effort to increase scalability and improve risk profile

Organic Adj. EBITDA (¹)

($ in millions)

36%

34%

6% growth

$442

$469

2018A

2019A

Organic Adj. EBITDA(1)(2)

30%

$420

'20E -'23E CAGR 17%(2)

'20E-'23E CAGR 21% (³)

2020E

33%

$561

$60 min.

See slide 49 for additional information regarding this non-GAAP measure. See slide 50 for reconciliation to the nearest GAAP measure.

Excludes pro forma upside opportunity and U.S. iGaming expansion.

Includes pro forma upside opportunity and U.S. iGaming expansion.

Represents upside impact to base plan '21E - '23E Organic Adj. EBITDA giving pro forma effect to cost savings and revenue opportunities if and when realized in future periods.

Represents upside impact to base plan '22E - ¹23E Organic Adj. EBITDA giving pro forma effect to growth in U.S. iGaming market volume if and when it occurs.

$501

2021E

Pro forma upside

Opportunity (4)

34%

$655

$15 min.

i $60 min.

$580

2022E

Paysafe:

36%

$744

$15 min.

I

I $60 min.

$669

2023E

• Scalable business model and continued cost

discipline drives expansion in Organic Adj.

EBITDA(1) margin

U.S. iGaming expansion (5)

26View entire presentation