Cytek IPO Presentation Deck

Thought Leadership

1.

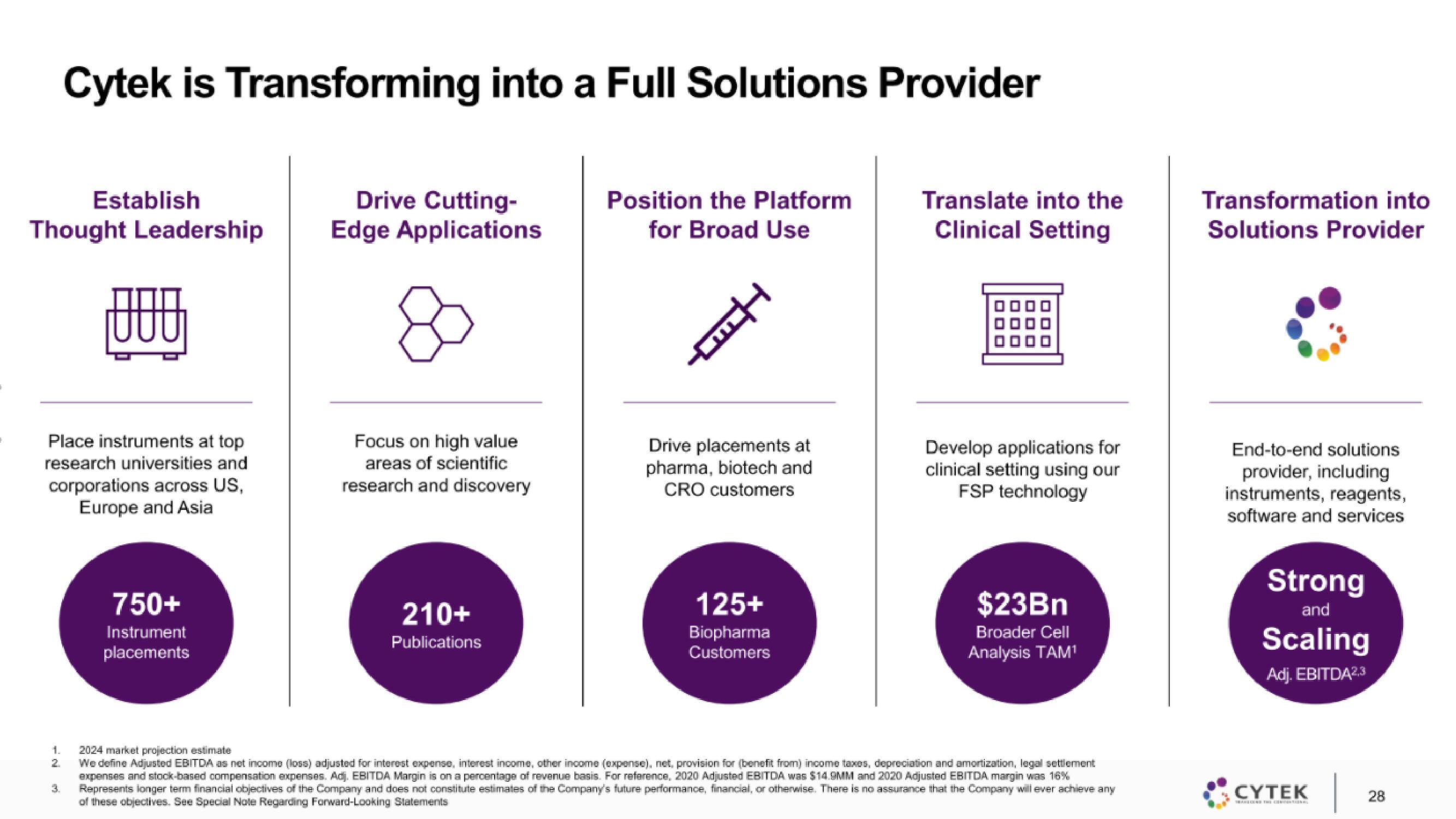

Cytek is Transforming into a Full Solutions Provider

2

Establish

Place instruments at top

research universities and

corporations across US,

Europe and Asia

3.

000

750+

Instrument

placements

Drive Cutting-

Edge Applications

Focus on high value

areas of scientific

research and discovery

210+

Publications

Position the Platform

for Broad Use

H™

Drive placements at

pharma, biotech and

CRO customers

125+

Biopharma

Customers

Translate into the

Clinical Setting

Develop applications for

clinical setting using our

FSP technology

$23Bn

Broader Cell

Analysis TAM¹

2024 market projection estimate

We define Adjusted EBITDA as net income (loss) adjusted for interest expense, interest income, other income (expense), net, provision for (benefit from) income taxes, depreciation and amortization, legal settlement

expenses and stock-based compensation expenses. Adj. EBITDA Margin is on a percentage of revenue basis. For reference, 2020 Adjusted EBITDA was $14.9MM and 2020 Adjusted EBITDA margin was 16%

Represents longer term financial objectives of the Company and does not constitute estimates of the Company's future performance, financial, or otherwise. There is no assurance that the Company will ever achieve any

of these objectives. See Special Note Regarding Forward-Looking Statements

Transformation into

Solutions Provider

End-to-end solutions

provider, including

instruments, reagents,

software and services

Strong

and

Scaling

Adj. EBITDA2,3

CYTEK

|

28View entire presentation