EVE SPAC Presentation Deck

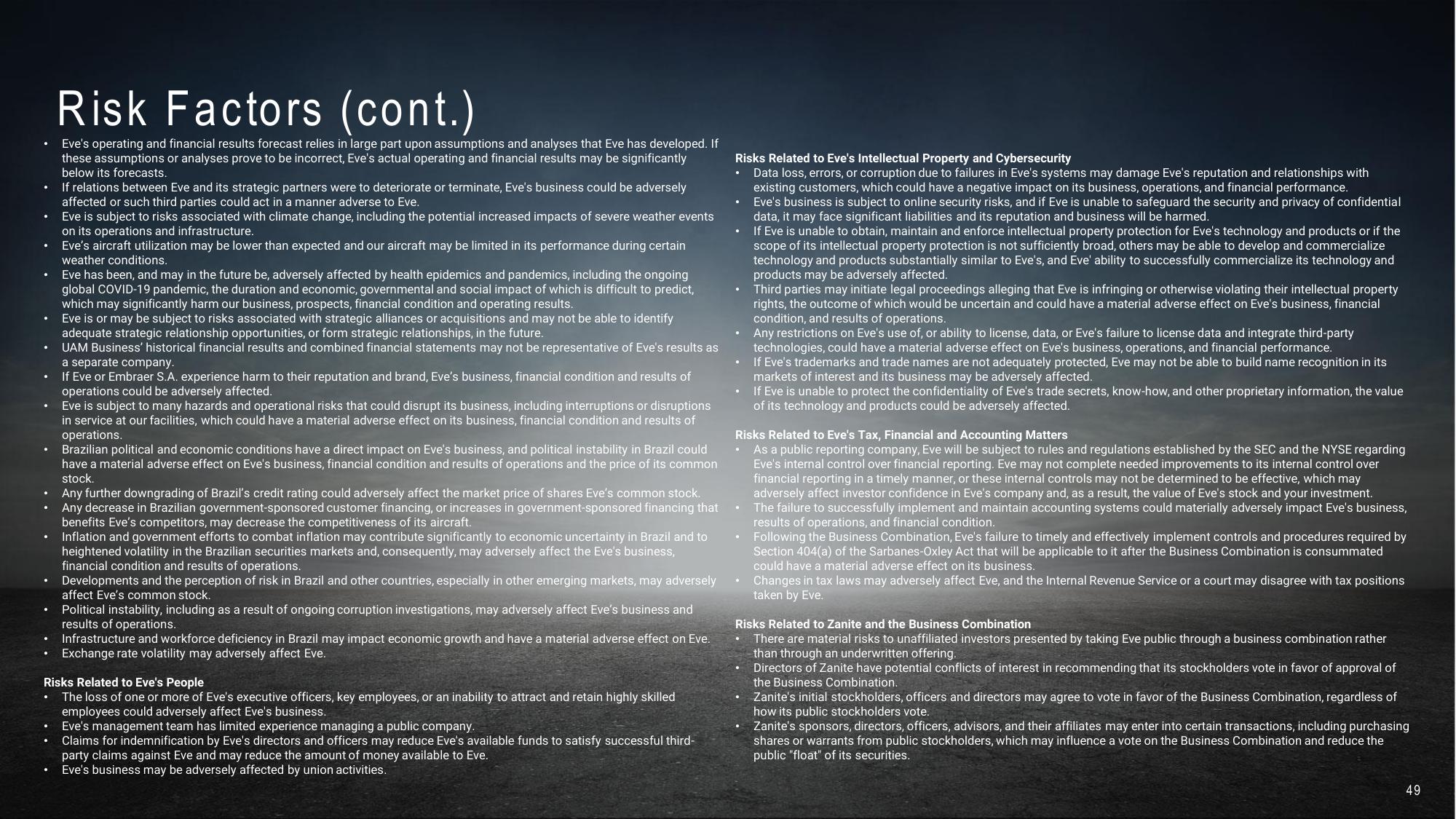

Risk Factors (cont.)

Eve's operating and financial results forecast relies in large part upon assumptions and analyses that Eve has developed. If

these assumptions or analyses prove to be incorrect, Eve's actual operating and financial results may be significantly

below its forecasts.

If relations between Eve and its strategic partners were to deteriorate or terminate, Eve's business could be adversely

affected or such third parties could act in a manner adverse to Eve.

Eve is subject to risks associated with climate change, including the potential increased impacts of severe weather events

on its operations and infrastructure.

Eve's aircraft utilization may be lower than expected and our aircraft may be limited in its performance during certain

weather conditions.

Eve has been, and may in the future be, adversely affected by health epidemics and pandemics, including the ongoing

global COVID-19 pandemic, the duration and economic, governmental and social impact of which is difficult to predict,

which may significantly harm our business, prospects, financial condition and operating results.

Eve is or may be subject to risks associated with strategic alliances or acquisitions and may not be able to identify

adequate strategic relationship opportunities, or form strategic relationships, in the future.

UAM Business' historical financial results and combined financial statements may not be representative of Eve's results as

a separate company.

If Eve or Embraer S.A. experience harm to their reputation and brand, Eve's business, financial condition and results of

operations could be adversely affected.

Eve is subject to many hazards and operational risks that could disrupt its business, including interruptions or disruptions

in service at our facilities, which could have a material adverse effect on its business, financial condition and results of

operations.

Brazilian political and economic conditions have a direct impact on Eve's business, and political instability Brazil could

have a material adverse effect on Eve's business, financial condition and results of operations and the price of its common

stock.

Any further downgrading of Brazil's credit rating could adversely affect the market price of shares Eve's common stock.

Any decrease in Brazilian government-sponsored customer financing, or increases in government-sponsored financing that

benefits Eve's competitors, may decrease the competitiveness of its aircraft.

Inflation and government efforts to combat inflation may contribute significantly to economic uncertainty in Brazil and to

heightened volatility in the Brazilian securities markets and, consequently, may adversely affect the Eve's business,

financial condition and results of operations.

Developments and the perception of risk in Brazil and other countries, especially in other emerging markets, may adversely

affect Eve's common stock.

Political instability, including as a result of ongoing corruption investigations, may adversely affect Eve's business and

results of operations.

Infrastructure and workforce deficiency in Brazil may impact economic growth and have a material adverse effect on Eve.

Exchange rate volatility may adversely affect Eve.

Risks Related to Eve's People

The loss of one or more of Eve's executive officers, key employees, or an inability to attract and retain highly skilled

employees could adversely affect Eve's business.

Eve's management team has limited experience managing a public company.

Claims for indemnification by Eve's directors and officers may reduce Eve's available funds to satisfy successful third-

party claims against Eve and may reduce the amount of money available to Eve.

Eve's business may be adversely affected by union activities.

Risks Related to Eve's Intellectual Property and Cybersecurity

Data loss, errors, or corruption due to failures in Eve's systems may damage Eve's reputation and relationships with

existing customers, which could have a negative impact on its business, operations, and financial performance.

Eve's business is subject to online security risks, and if Eve is unable to safeguard the security and privacy of confidential

data, it may face significant liabilities and its reputation and business will be harmed.

.

If Eve is unable to obtain, maintain and enforce intellectual property protection for Eve's technology and products or if the

scope of its intellectual property protection is not sufficiently broad, others may be able to develop and commercialize

technology and products substantially similar to Eve's, and Eve' ability to successfully commercialize its technology and

products may be adversely affected.

Third parties may initiate legal proceedings alleging that Eve is infringing or otherwise violating their intellectual property

rights, the outcome of which would be uncertain and could have a material adverse effect on Eve's business, financial

condition, and results of operations.

Any restrictions on Eve's use of, or ability to license, data, or Eve's failure to license data and integrate third-party

technologies, could have a material adverse effect on Eve's business, operations, and financial performance.

If Eve's trademarks and trade names are not adequately protected, Eve may not be able to build name recognition in its

markets of interest and its business may be adversely affected.

Risks Related to Eve's Tax, Financial and Accounting Matters

As a public reporting company, Eve will be subject to rules and regulations established by the SEC and the NYSE regarding

Eve's internal control over financial reporting. Eve may not complete needed improvements to its internal control over

financial reporting in a timely manner, or these internal controls may not be determined to be effective, which may

adversely affect investor confidence in Eve's company and, as a result, the value of Eve's stock and your investment.

The failure to successfully implement and maintain accounting systems could materially adversely impact Eve's business,

results of operations, and financial condition.

.

If Eve is unable to protect the confidentiality of Eve's trade secrets, know-how, and other proprietary information, the value

of its technology and products could be adversely affected.

Following the Business Combination, Eve's failure to timely and effectively implement controls and procedures required by

Section 404(a) of the Sarbanes-Oxley Act that will be applicable to it after the Business Combination is consummated

could have a material adverse effect on its business.

Changes in tax laws may adversely affect Eve, and the Internal Revenue Service or a court may disagree with tax positions

taken by Eve.

Risks Related to Zanite and the Business Combination

There are material risks to unaffiliated investors presented by taking Eve public through a business combination rather

than through an underwritten offering.

Directors of Zanite have potential conflicts of interest in recommending that its stockholders vote in favor of approval of

the Business Combination.

Zanite's initial stockholders, officers and directors may agree to vote in favor of the Business Combination, regardless of

how its public stockholders vote.

Zanite's sponsors, directors, officers, advisors, and their affiliates may enter into certain transactions, including purchasing

shares or warrants from public stockholders, which may influence a vote on the Business Combination and reduce the

public "float" of its securities.

49View entire presentation