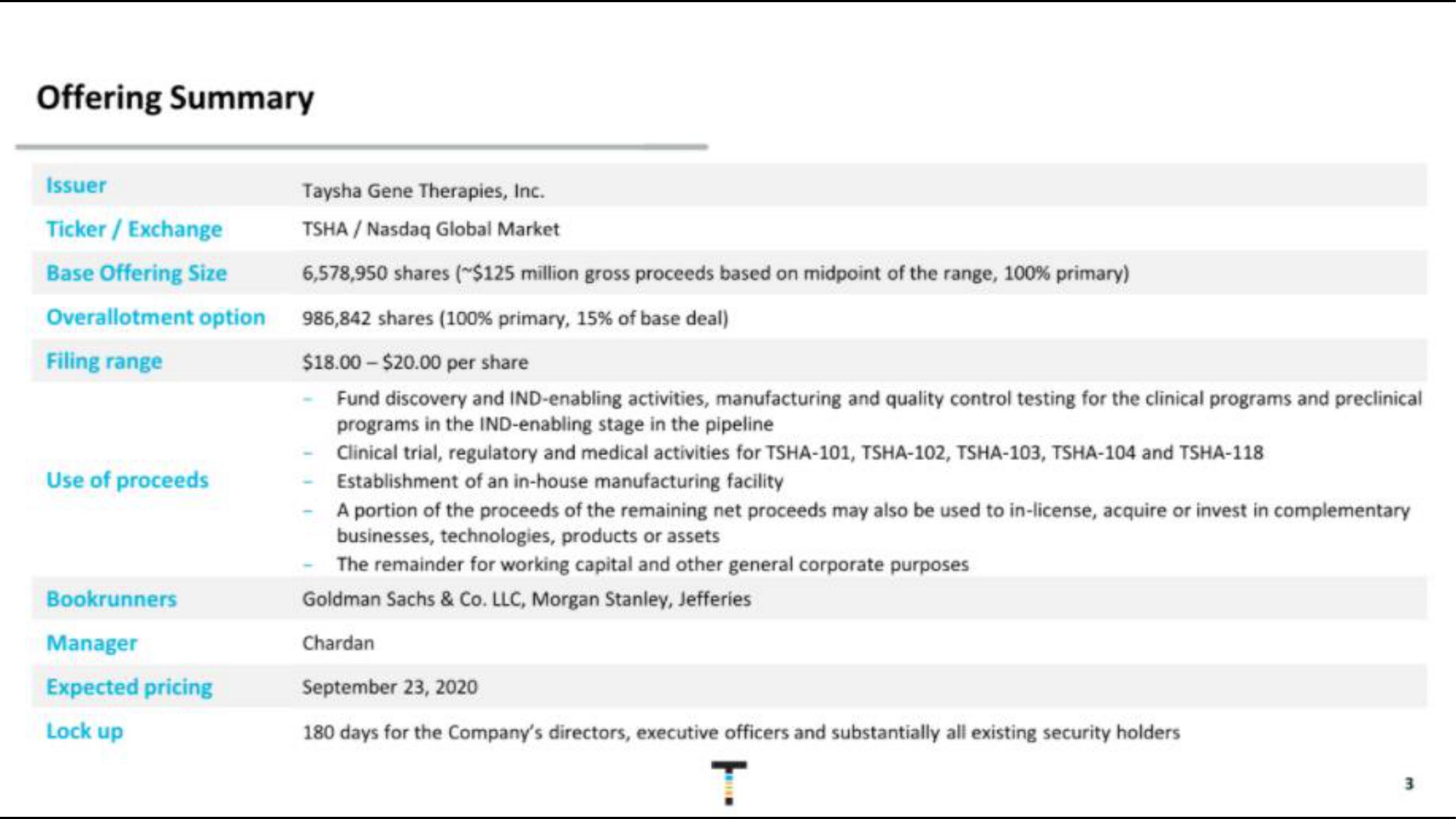

Taysha IPO Presentation Deck

Offering Summary

Issuer

Ticker/ Exchange

Base Offering Size

Overallotment option

Filing range

Use of proceeds

Bookrunners

Manager

Expected pricing

Lock up

Taysha Gene Therapies, Inc.

TSHA / Nasdaq Global Market

6,578,950 shares (~$125 million gross proceeds based on midpoint of the range, 100% primary)

986,842 shares (100% primary, 15% of base deal)

$18.00-$20.00 per share

Fund discovery and IND-enabling activities, manufacturing and quality control testing for the clinical programs and preclinical

programs in the IND-enabling stage in the pipeline

Clinical trial, regulatory and medical activities for TSHA-101, TSHA-102, TSHA-103, TSHA-104 and TSHA-118

Establishment of an in-house manufacturing facility

A portion of the proceeds of the remaining net proceeds may also be used to in-license, acquire or invest in complementary

businesses, technologies, products or assets

The remainder for working capital and other general corporate purposes

Goldman Sachs & Co. LLC, Morgan Stanley, Jefferies

Chardan

September 23, 2020

180 days for the Company's directors, executive officers and substantially all existing security holders

3View entire presentation