Evercore Investment Banking Pitch Book

Preliminary Financial Analysis

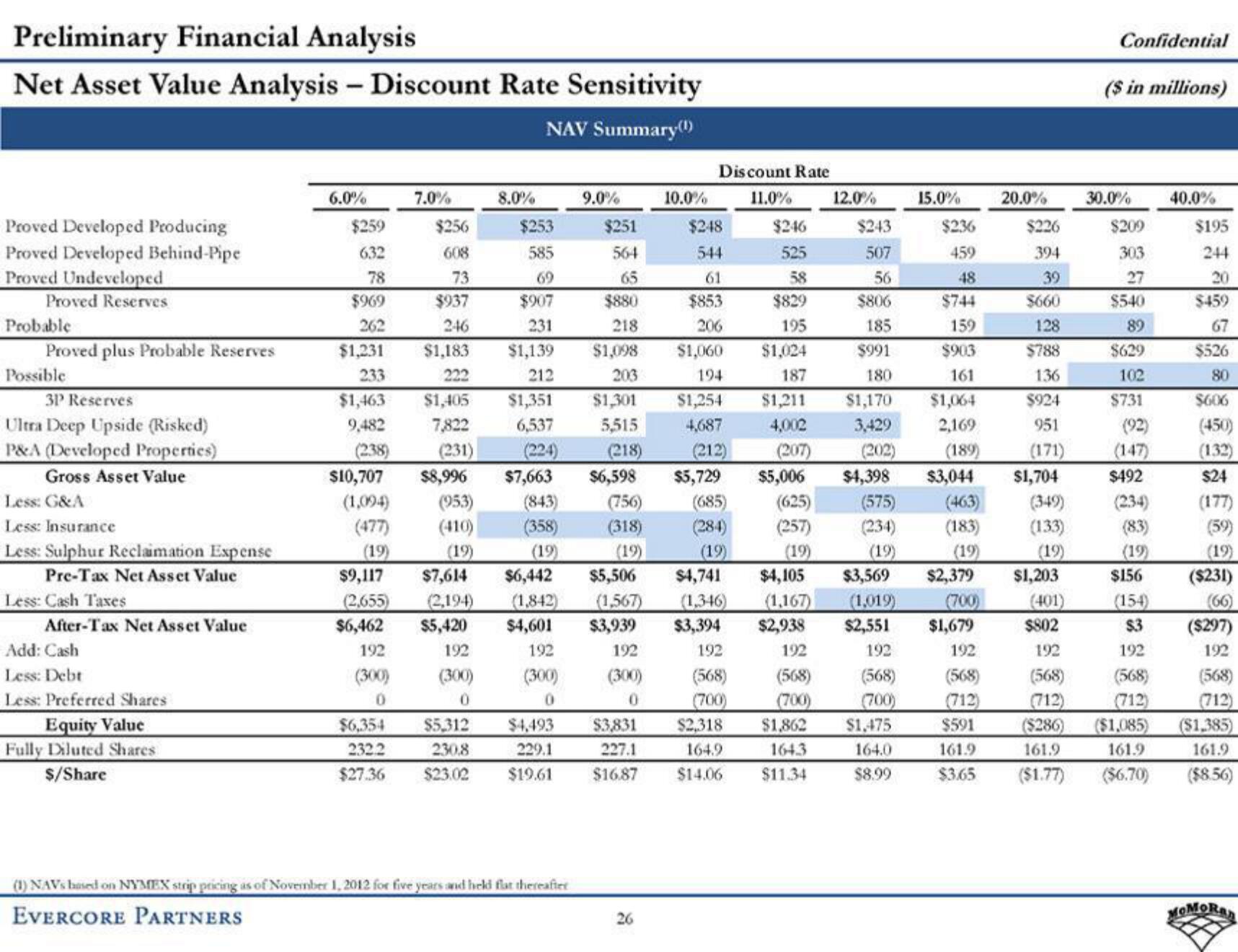

Net Asset Value Analysis - Discount Rate Sensitivity

NAV Summary(¹)

Proved Developed Producing

Proved Developed Behind-Pipe

Proved Undeveloped

Proved Reserves

Probable

Proved plus Probable Reserves

Possible

3P Reserves

Ultra Deep Upside (Risked)

P&A (Developed Properties)

Gross Asset Value

Less: G&A

Less: Insurance

Less: Sulphur Reclaimation Expense

Pre-Tax Net Asset Value

Less: Cash Taxes

After-Tax Net Asset Value

Add: Cash

Less: Debt

Less: Preferred Shares

Equity Value

Fully Diluted Shares

$/Share

6.0%

$259

632

78

$969

262

$1,231

233

$1,463

9,482

(238)

$10,707

(1,094)

(477)

(19)

$9,117

(2,655)

$6,462

192

(300)

0

$6,354

232.2

$27.36

7.0%

$256

608

73

$937

246

$1,183

222

$1,405

7,822

(231)

$8,996

8.0%

192

(300)

0

$253

585

$907

231

$1,139

212

$1,351

6,537

(224)

$7,663

(843)

(358)

(19)

$5,312

230.8

$4,493

229.1

$23.02 $19.61

9.0%

(1) NAVs based on NYMEX strip pricing as of November 1, 2012 for five years and held flat thereafter

EVERCORE PARTNERS

$251

564

65

$880

218

$1,098

203

(953)

(410)

(19)

$7,614 $6,442 $5,506 $4,741

(2,194) (1,842) (1,567) (1,346)

$5,420 $4,601 $3,939 $3,394

192

192

192

(300)

(300)

(568)

0

0

(700)

$246

525

58

$829

195

$1,024

187

$1,301 $1,254

$1,211

5,515

4,687

4,002

(218)

(212)

(207)

$6,598 $5,729 $5,006 $4,398

(685)

(625)

(575)

(284) (257)

(234)

(19)

(19)

(19)

(756)

(318)

(19)

10.0%

$3,831

227.1

$16.87

Discount Rate

11.0%

26

$248

544

61

$853

206

$1,060

194

$2,318

164.9

$14.06

12.0%

192

(568)

(700)

$243

507

56

$806

185

$991

180

$1,170

3,429

(202)

$1,862

1643

$11.34

15.0%

$1,475

164.0

$8.99

$236

459

48

$744

159

$903

161

$1,064

2,169

(189)

$4,105 $3,569 $2,379

(1,167) (1,019)

$2,938

$2,551

192

(568)

(700)

$3,044

(463)

(183)

(19)

(700)

$1,679

192

(568)

(712)

$591

161.9

$3.65

20.0%

$226

394

39

$660

128

$788

136

$924

951

(171)

$1,704

(349)

(133)

$1,203

(401)

$802

Confidential

($ in millions)

30.0%

$209

303

27

$540

89

$629

102

$731

(92)

(147)

$492

(234)

(83)

(19)

$156

(154)

$3

192

(568)

(712)

192

(568)

(712)

($286) ($1,085)

161.9

161.9

($1.77)

($6.70)

40.0%

$195

244

20

$459

67

$526

80

$606

(450)

(132)

$24

(177)

(59)

(19)

($231)

(66)

($297)

192

(568)

(712)

($1,385)

161.9

($8.56)

MOMORANView entire presentation