Zegna Results Presentation Deck

●

●

●

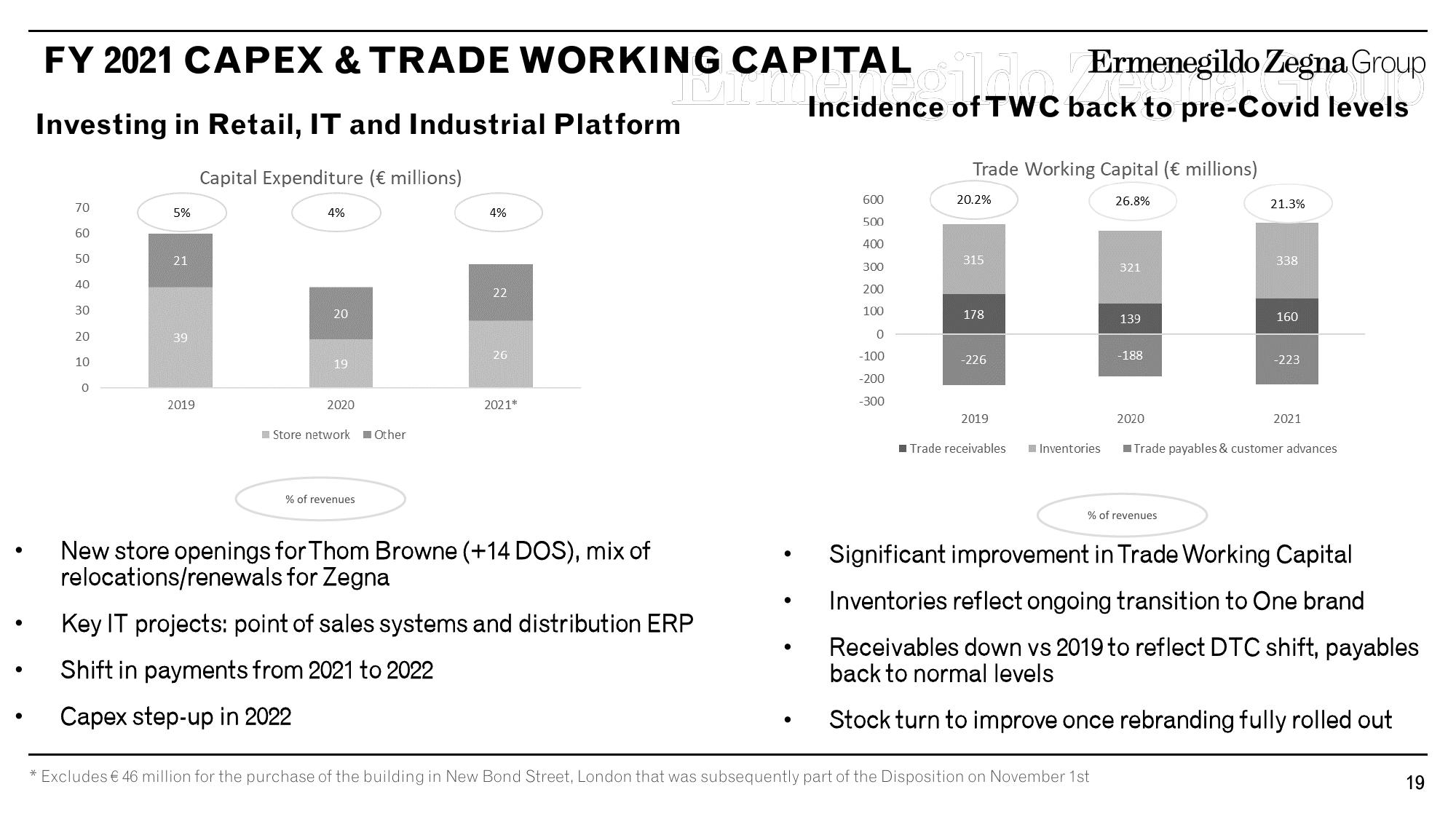

FY 2021 CAPEX & TRADE WORKING CAPITALdo Ermenegildo Zegna Group

of

Incidence of TWC back to pre-Covid levels

Investing in Retail, IT and Industrial Platform

70

60

50

40

30

20

10

0

5%

21

39

2019

Capital Expenditure (€ millions)

4%

20

19

2020

Store network Other

% of revenues

4%

22

26

2021*

New store openings for Thom Browne (+14 DOS), mix of

relocations/renewals for Zegna

Key IT projects: point of sales systems and distribution ERP

Shift in payments from 2021 to 2022

Capex step-up in 2022

●

●

600

500

400

300

200

100

0

-100

-200

-300

Trade Working Capital (€ millions)

26.8%

20.2%

315

178

-226

2019

Trade receivables

Inventories

321

139

* Excludes € 46 million for the purchase of the building in New Bond Street, London that was subsequently part of the Disposition on November 1st

-188

2020

% of revenues

21.3%

338

160

-223

2021

■Trade payables & customer advances

Significant improvement in Trade Working Capital

Inventories reflect ongoing transition to One brand

Receivables down vs 2019 to reflect DTC shift, payables

back to normal levels

Stock turn to improve once rebranding fully rolled out

19View entire presentation