First Foundation Investor Presentation Deck

Non-GAAP Return on Average Tangible Common Equity

(ROATCE), Adjusted Return on Average Assets and Net Income

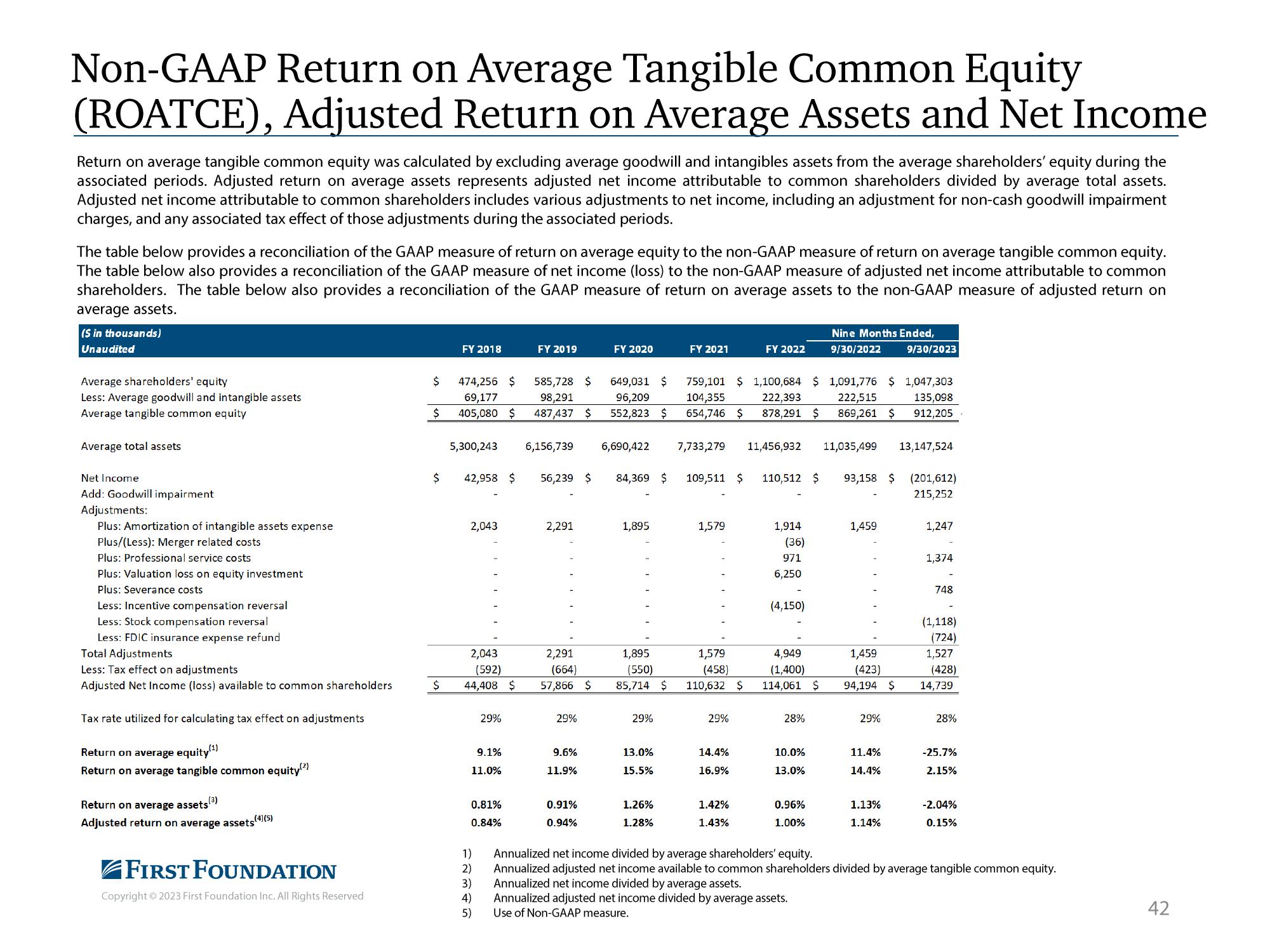

Return on average tangible common equity was calculated by excluding average goodwill and intangibles assets from the average shareholders' equity during the

associated periods. Adjusted return on average assets represents adjusted net income attributable to common shareholders divided by average total assets.

Adjusted net income attributable to common shareholders includes various adjustments to net income, including an adjustment for non-cash goodwill impairment

charges, and any associated tax effect of those adjustments during the associated periods.

The table below provides a reconciliation of the GAAP measure of return on average equity to the non-GAAP measure of return on average tangible common equity.

The table below also provides a reconciliation of the GAAP measure of net income (loss) to the non-GAAP measure of adjusted net income attributable to common

shareholders. The table below also provides a reconciliation of the GAAP measure of return on average assets to the non-GAAP measure of adjusted return on

average assets.

(S in thousands)

Unaudited

Average shareholders' equity

Less: Average goodwill and intangible assets

Average tangible common equity

Average total assets

Net Income

Add: Goodwill impairment

Adjustments:

Plus: Amortization of intangible assets expense

Plus/(Less): Merger related costs

Plus: Professional service costs

Plus: Valuation loss on equity investment

Plus: Severance costs

Less: Incentive compensation reversal

Less: Stock compensation reversal

Less: FDIC insurance expense refund

Total Adjustments

Less: Tax effect on adjustments

Adjusted Net Income (loss) available to common shareholders

Tax rate utilized for calculating tax effect on adjustments

Return on average equity(¹)

Return on average tangible common equity(²)

Return on average assets (3)

Adjusted return on average assets

(4)(5)

FIRST FOUNDATION

Copyright © 2023 First Foundation Inc. All Rights Reserved

$

474,256 $

69,177

585,728 $

98,291

$ 405,080 $ 487,437 $

$

FY 2018

$

5,300,243

42,958 $

2,043

2,043

(592)

44,408 $

9.1%

11.0%

0.81%

0.84%

12345

29%

3)

FY 2019

5)

6,156,739

2,291

2,291

(664)

57,866 $

29%

9.6%

11.9%

FY 2020

0.91%

0.94%

649,031 $

96,209

552,823 $

56,239 $ 84,369 $ 109,511 $

6,690,422

1,895

29%

FY 2021

13.0%

15.5%

1.26%

1.28%

759,101 $ 1,100,684 $ 1,091,776 $ 1,047,303

104,355

222,393 222,515 135,098

654,746 $ 878,291 $ 869,261 $

912,205

7,733,279 11,456,932 11,035,499

1,579

1,579

(458)

FY 2022

29%

1,895

4,949

(1,400)

(550)

85,714 $ 110,632 $ 114,061 $

14.4%

16.9%

1.42%

1.43%

110,512 $

1,914

(36)

971

6,250

(4,150)

28%

10.0%

13.0%

Nine Months Ended,

9/30/2022 9/30/2023

0.96%

1.00%

4) Annualized adjusted net income divided by average assets.

Use of Non-GAAP measure.

93,158 $

1,459

1,459

(423)

94,194 $

29%

11.4%

14.4%

1.13%

1.14%

13,147,524

(201,612)

215,252

1,247

1,374

748

(1,118)

(724)

1,527

(428)

14,739

28%

-25.7%

2.15%

-2.04%

0.15%

Annualized net income divided by average shareholders' equity.

Annualized adjusted net income available to common shareholders divided by average tangible common equity.

Annualized net income divided by average assets.

42View entire presentation