LSE Investor Presentation Deck

Notes

excludes

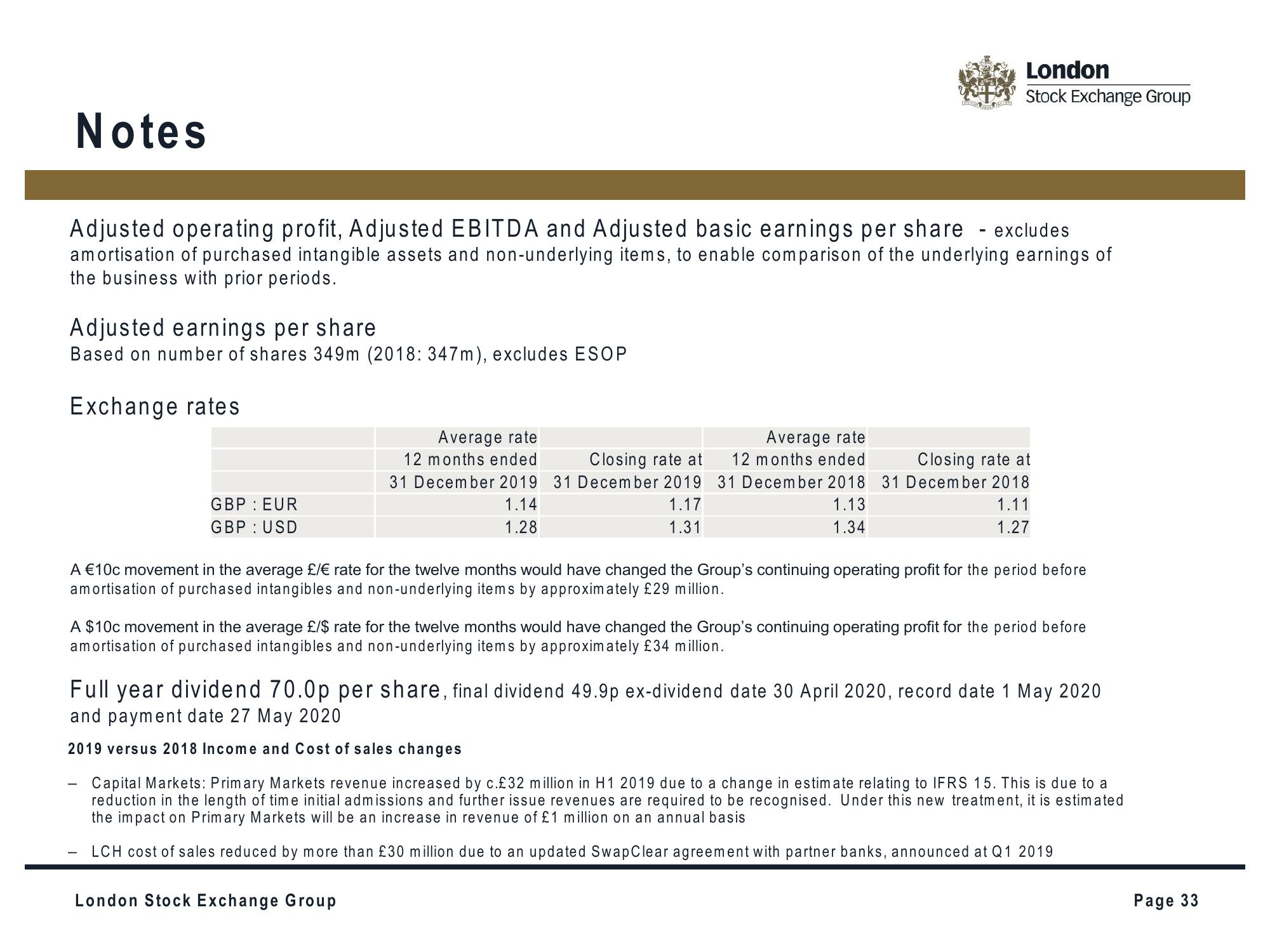

Adjusted operating profit, Adjusted EBITDA and Adjusted basic earnings per share

amortisation of purchased intangible assets and non-underlying items, to enable comparison of the underlying earnings of

the business with prior periods.

Adjusted earnings per share

Based on number of shares 349m (2018: 347m), excludes ESOP

Exchange rates

GBP

EUR

GBP USD

Average rate

12 months ended

Closing rate at

31 December 2019 31 December 2019

1.14

1.28

1.17

1.31

London

Stock Exchange Group

Average rate

12 months ended

London Stock Exchange Group

Closing rate at

31 December 2018 31 December 2018

1.13

1.34

1.11

1.27

A €10c movement in the average £/€ rate for the twelve months would have changed the Group's continuing operating profit for the period before

amortisation of purchased intangibles and non-underlying items by approximately £29 million.

A $10c movement in the average £/$ rate for the twelve months would have changed the Group's continuing operating profit for the period before

amortisation of purchased intangibles and non-underlying items by approximately £34 million.

Full year dividend 70.0p per share, final dividend 49.9p ex-dividend date 30 April 2020, record date 1 May 2020

and payment date 27 May 2020

2019 versus 2018 Income and Cost of sales changes

Capital Markets: Primary Markets revenue increased by c.£32 million in H1 2019 due to a change in estimate relating to IFRS 15. This is due to a

reduction in the length of time initial admissions and further issue revenues are required to be recognised. Under this new treatment, it is estimated

the impact on Primary Markets will be an increase in revenue of £1 million on an annual basis

LCH cost of sales reduced by more than £30 million due to an updated SwapClear agreement with partner banks, announced at Q1 2019

Page 33View entire presentation