HSBC Investor Day Presentation Deck

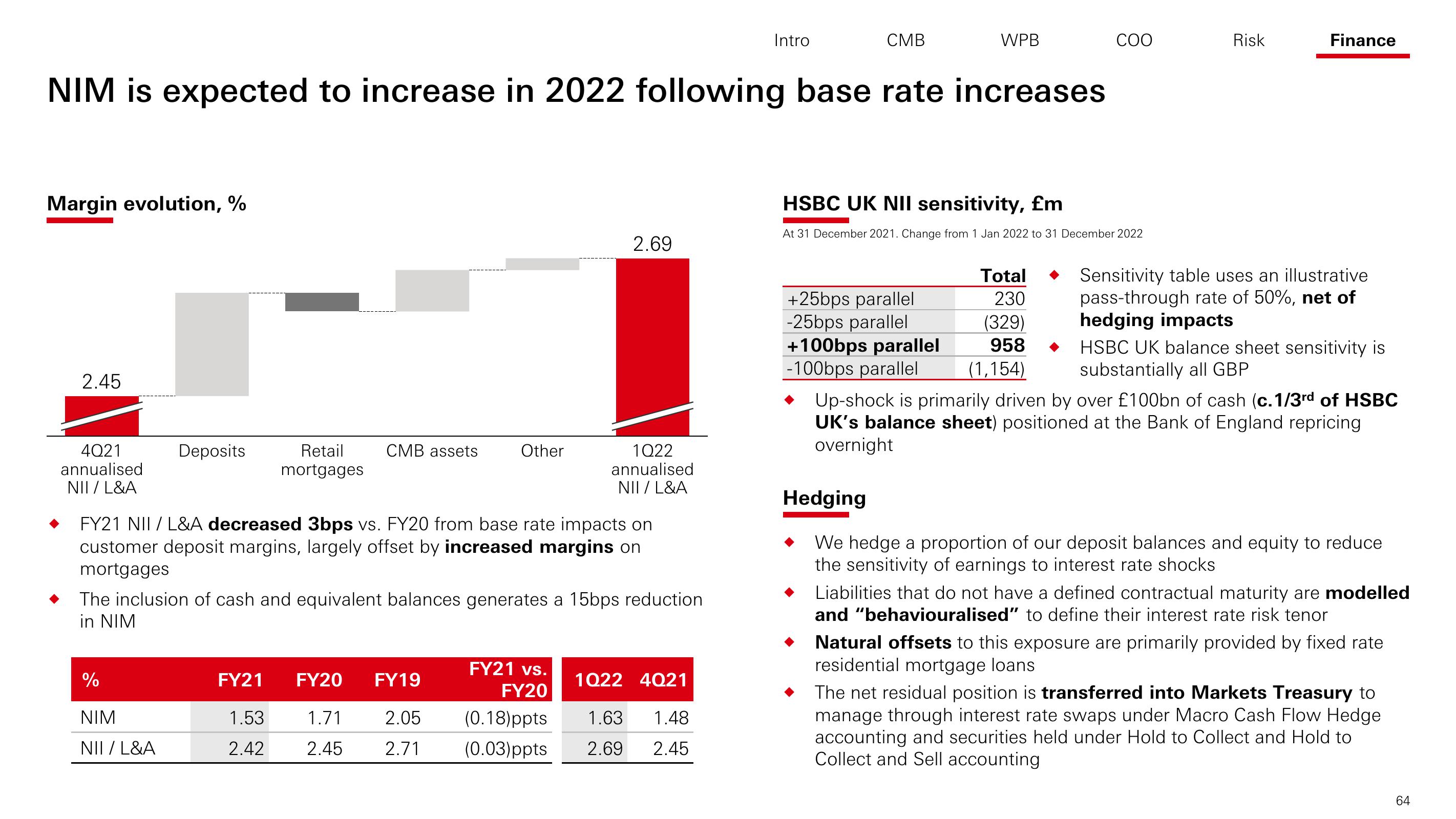

Margin evolution, %

2.45

NIM is expected to increase in 2022 following base rate increases

4021

annualised

NII / L&A

Deposits

%

NIM

NII / L&A

Retail

mortgages

CMB assets

FY21

1.53

2.42

Other

FY21 NII / L&A decreased 3bps vs. FY20 from base rate impacts on

customer deposit margins, largely offset by increased margins on

mortgages

2.69

The inclusion of cash and equivalent balances generates a 15bps reduction

in NIM

FY20 FY19

1.71 2.05

2.45 2.71

1Q22

annualised

NII / L&A

Intro

FY21 vs.

1022 4021

FY20

(0.18)ppts 1.63 1.48

(0.03)ppts 2.69 2.45

CMB

WPB

COO

HSBC UK NII sensitivity, £m

At 31 December 2021. Change from 1 Jan 2022 to 31 December 2022

+25bps parallel

-25bps parallel

Risk

Finance

Total

Sensitivity table uses an illustrative

pass-through rate of 50%, net of

230

(329)

hedging impacts

+100bps parallel

958

HSBC UK balance sheet sensitivity is

-100bps parallel (1,154) substantially all GBP

Up-shock is primarily driven by over £100bn of cash (c.1/3rd of HSBC

UK's balance sheet) positioned at the Bank of England repricing

overnight

Hedging

We hedge a proportion of our deposit balances and equity to reduce

the sensitivity of earnings to interest rate shocks

Liabilities that do not have a defined contractual maturity are modelled

and "behaviouralised" to define their interest rate risk tenor

Natural offsets to this exposure are primarily provided by fixed rate

residential mortgage loans

The net residual position is transferred into Markets Treasury to

manage through interest rate swaps under Macro Cash Flow Hedge

accounting and securities held under Hold to Collect and Hold to

Collect and Sell accounting

64View entire presentation