Corecentric Investor Presentation Deck

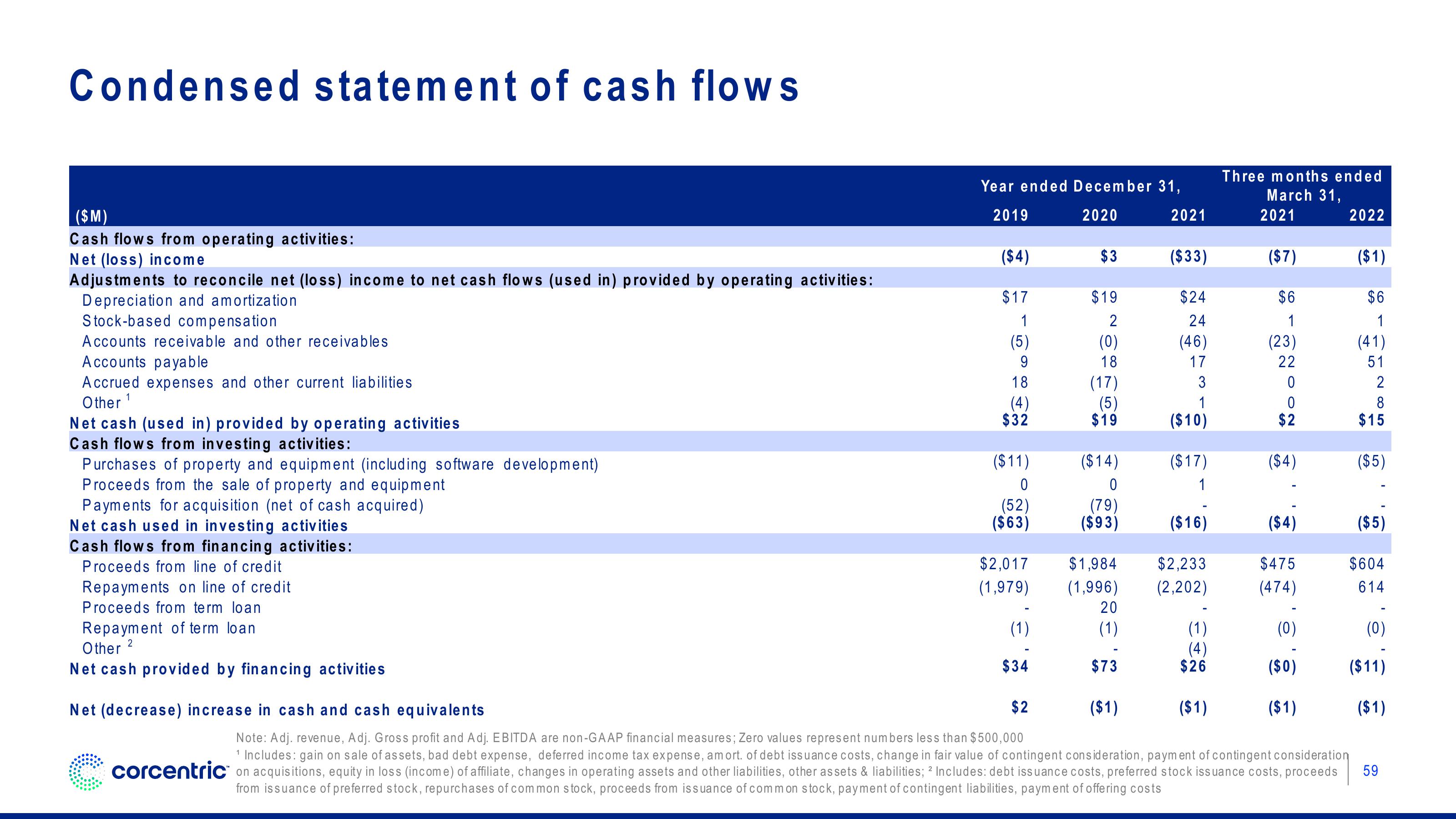

Condensed statement of cash flows

($M)

Cash flows from operating activities:

Net (loss) income

Adjustments to reconcile net (loss) income to net cash flows (used in) provided by operating activities:

Depreciation and amortization

Stock-based compensation

Accounts receivable and other receivables

Accounts payable

Accrued expenses and other current liabilities

Other ¹

Net cash (used in) provided by operating activities

Cash flows from investing activities:

Purchases of property and equipment (including software development)

Proceeds from the sale of property and equipment

Payments for acquisition (net of cash acquired)

Net cash used in investing activities

Cash flows from financing activities:

Proceeds from line of credit

Repayments on line of credit

Proceeds from term loan

Repayment of term loan

Other ²

Net cash provided by financing activities

Year ended December 31,

2020

2019

($4)

$17

1

(5)

9

18

(4)

$32

($11)

0

(52)

($63)

$2,017

(1,979)

(1)

$34

$3

$19

2

(0)

18

(17)

(5)

$19

($14)

0

(79)

($93)

$1,984

(1,996)

20

(1)

$73

($1)

2021

($33)

$24

24

(46)

17

3

1

($10)

($17)

1

($16)

$2,233

(2,202)

(1)

(4)

$26

Three months ended

March 31,

2021

($1)

($7)

$6

1

(23)

22

0

0

$2

($4)

($4)

$475

(474)

(0)

($0)

($1)

2022

($1)

$2

Net (decrease) increase in cash and cash equivalents

Note: Adj. revenue, Adj. Gross profit and Adj. EBITDA are non-GAAP financial measures; Zero values represent numbers less than $500,000

¹ Includes: gain on sale of assets, bad debt expense, deferred income tax expense, amort. of debt issuance costs, change in fair value of contingent consideration, payment of contingent consideration

corcentric on acquisitions, equity in loss (income) of affiliate, changes in operating assets and other liabilities, other assets & liabilities; ² Includes: debt issuance costs, preferred stock issuance costs, proceeds

from issuance of preferred stock, repurchases of common stock, proceeds from issuance of common stock, payment of contingent liabilities, payment of offering costs

$6

1

(41)

51

2

8

$15

($5)

($5)

$604

614

(0)

($11)

($1)

59View entire presentation