KKR Real Estate Finance Trust Results Presentation Deck

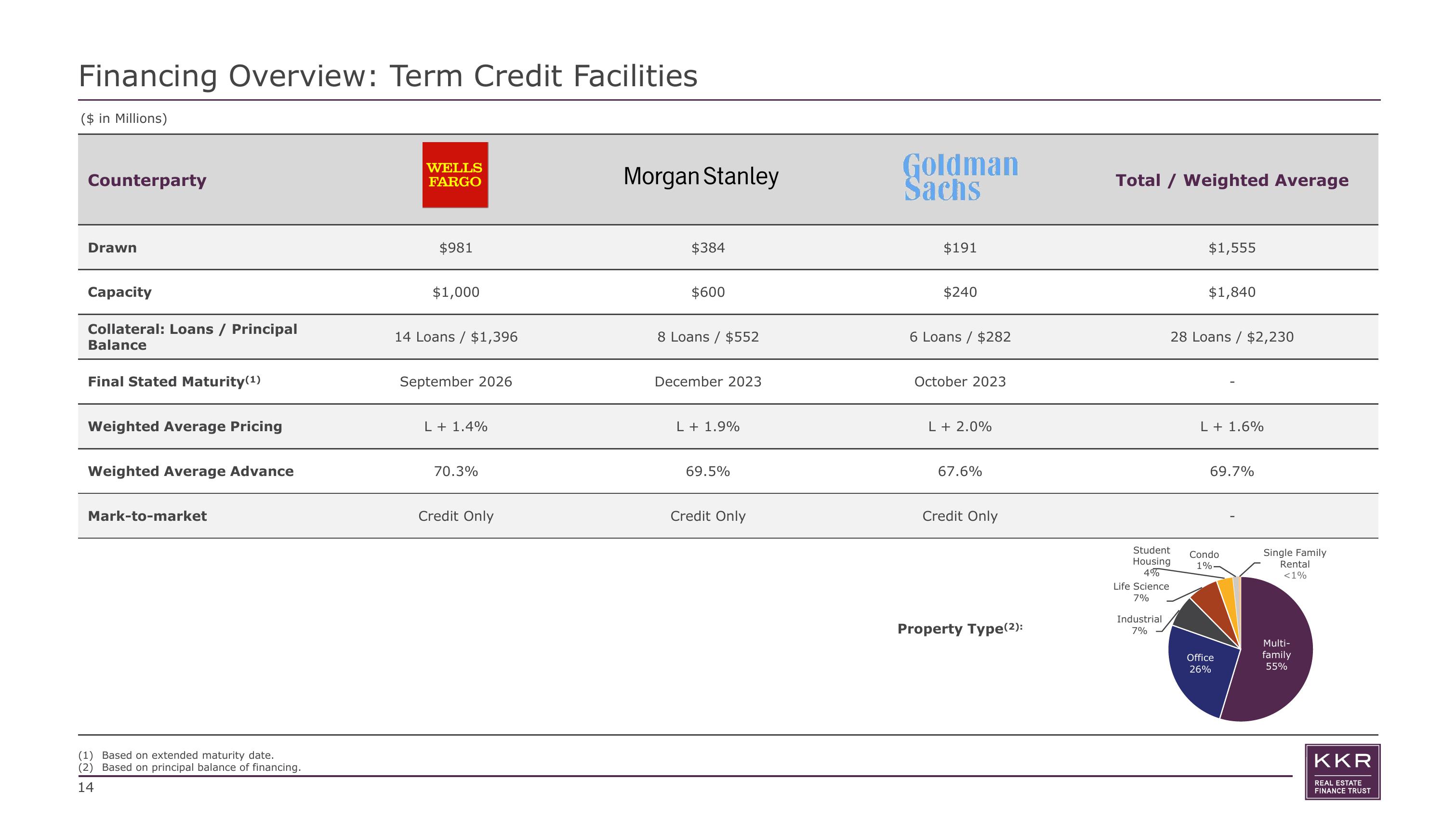

Financing Overview: Term Credit Facilities

($ in Millions)

Counterparty

Drawn

Capacity

Collateral: Loans / Principal

Balance

Final Stated Maturity (¹)

Weighted Average Pricing

Weighted Average Advance

Mark-to-market

(1) Based on extended maturity date.

(2) Based on principal balance of financing.

14

WELLS

FARGO

$981

$1,000

14 Loans / $1,396

September 2026

L + 1.4%

70.3%

Credit Only

Morgan Stanley

$384

$600

8 Loans / $552

December 2023

L +1.9%

69.5%

Credit Only

Goldman

Sachs

$191

$240

6 Loans / $282

October 2023

L + 2.0%

67.6%

Credit Only

Property Type(2):

Total / Weighted Average

$1,555

Student

Housing

4%

Life Science

7%

Industrial

7%

$1,840

28 Loans / $2,230

L + 1.6%

69.7%

Condo

1%-

Office

26%

Single Family

Rental

<1%

Multi-

family

55%

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation