Evercore Investment Banking Pitch Book

SIRE Situation Analysis

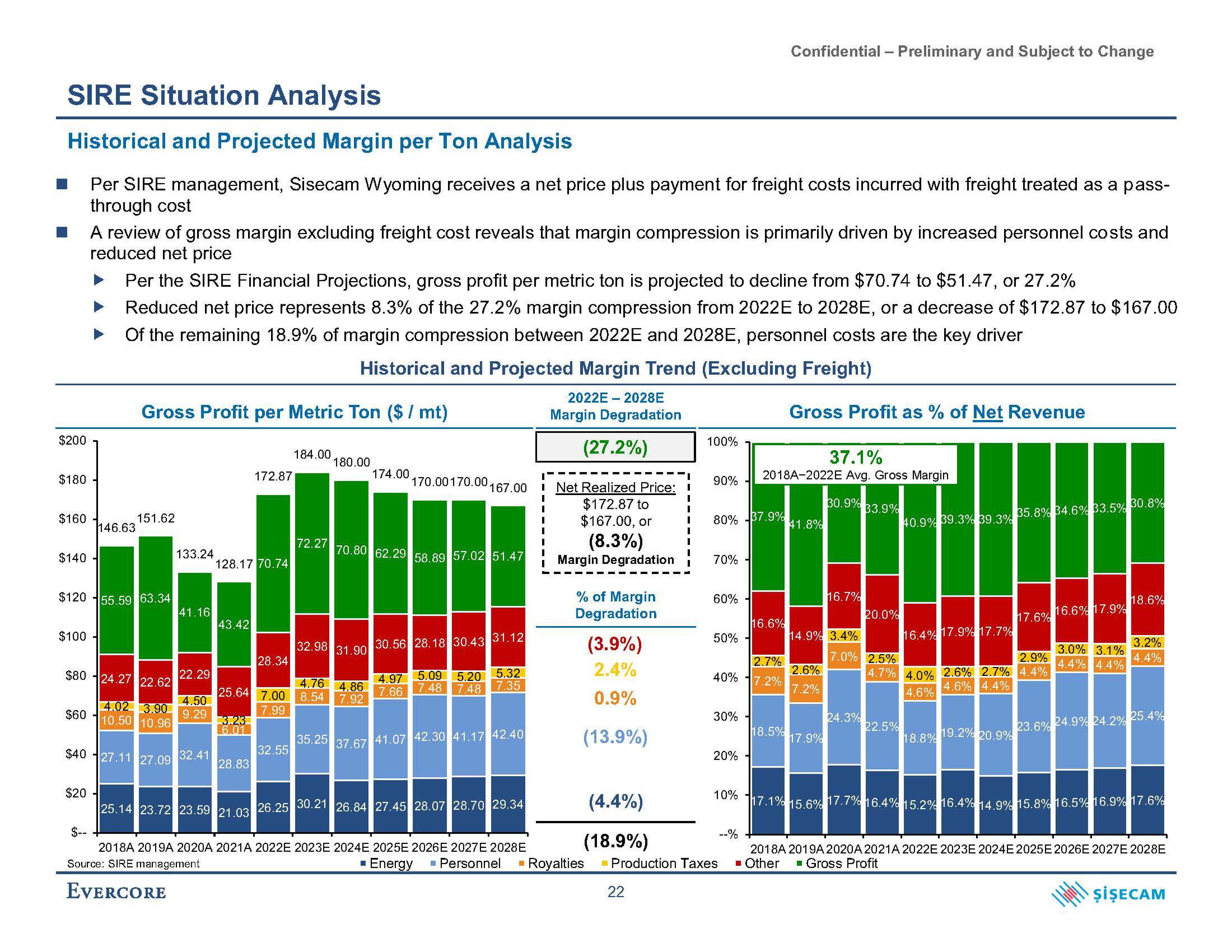

Historical and Projected Margin per Ton Analysis

Per SIRE management, Sisecam Wyoming receives a net price plus payment for freight costs incurred with freight treated as a pass-

through cost

$200

$180

$160

$140

$100

$80

A review of gross margin excluding freight cost reveals that margin compression is primarily driven by increased personnel costs and

reduced net price

$60

146.63

$12055.59 63.34

Per the SIRE Financial Projections, gross profit per metric ton is projected to decline from $70.74 to $51.47, or 27.2%

Reduced net price represents 8.3% of the 27.2% margin compression from 2022E to 2028E, or a decrease of $172.87 to $167.00

Of the remaining 18.9% of margin compression between 2022E and 2028E, personnel costs are the key driver

Historical and Projected Margin Trend (Excluding Freight)

2022E-2028E

Margin Degradation

(27.2%)

Gross Profit per Metric Ton ($ / mt)

$20-

151.62

133.24

24.27 22.62

4.02 3.90

10.50 10.96

$40 27.11 27.09 32.41

41.16

22.29

4.50

9.29

128.17 70.74

43.42

25.64

3.23

6.01

28.83

172.87

25.14 23.72 23.59 21.03

28.34

184.00

32.55

72.27

180.00

32.98 31.90

4.76 4.86

7.00 8.54 7.92

7.99

35.25

174.00

70.80 62.29 58.89 57.02 51.47

37.67

170.00 170.00.

167.00

30.56 28.18 30.43 31.12

5.09 5.20 5.32

4.97

7.66

7.48 7.48 7.35

41.07 42.30 41.17 42.40

26.25 30.21 26.84 27.45 28.07 28.70 29.34

2018A 2019A 2020A 2021A 2022E 2023E 2024E 2025E 2026E 2027E 2028E

Source: SIRE management

EVERCORE

I

Net Realized Price: 1

$172.87 to

I

$167.00, or

(8.3%)

Margin Degradation

% of Margin

Degradation

(3.9%)

2.4%

0.9%

(13.9%)

(4.4%)

(18.9%)

▪ Energy ■ Personnel ■ Royalties

100%

22

90%

80% -37.9%

70%-

60% -

50% -

30%

2.7%

40% 17.2%

20%

10%

Production Taxes

Confidential - Preliminary and Subject to Change

--%

37.1%

2018A-2022E Avg. Gross Margin

16.6%

Gross Profit as % of Net Revenue

141.8%

18.5%

2.6%

7.2%

14.9% 3.4%

17.9%

30.9%

17.1% 15.6%

16.7%

33.9%

24.3%

20.0%

40.9% 39.3% 39.3%

22.5%

16.4% 17.9% 17.7%

7.0% 2.5%

4.7% 4.0% 2.6% 2.7% 4.4%

4.6%

4.6% 4.4%

18.8%

35.8% 34.6% 33.5% 30.8%

19.2% 20.9%

17.6% 16.6% 17.9%

3.0% 3.1%

2.9% 4.4% 4.4%

18.6%

3.2%

4.4%

23.6% 24.9% 24.2% 25.4%

17.7% 16.4% 15.2 % 16.4% 14.9% 15.8% 16.5% 16.9% 17.6%

2018A 2019A 2020A 2021A 2022E 2023E 2024E 2025E 2026E 2027E 2028E

■ Other ■ Gross Profit

ŞİŞECAMView entire presentation