Babylon SPAC Presentation Deck

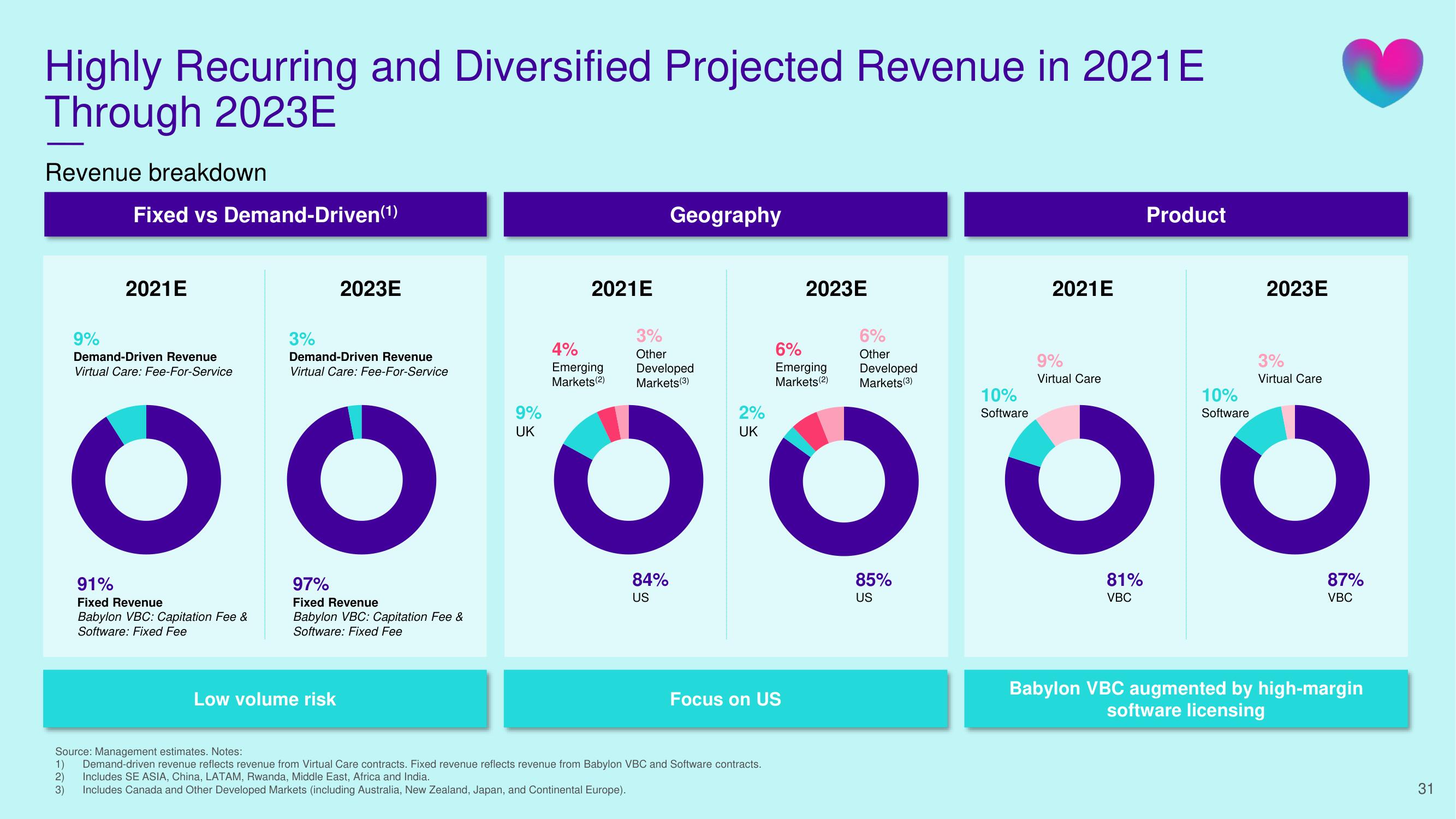

Highly Recurring and Diversified Projected Revenue in 2021 E

Through 2023E

Revenue breakdown

Fixed vs Demand-Driven(¹)

2021E

9%

Demand-Driven Revenue

Virtual Care: Fee-For-Service

3%

91%

Fixed Revenue

Babylon VBC: Capitation Fee &

Software: Fixed Fee

2023E

Demand-Driven Revenue

Virtual Care: Fee-For-Service

ОО

97%

Fixed Revenue

Babylon VBC: Capitation Fee &

Software: Fixed Fee

Low volume risk

9%

UK

2021E

4%

Emerging

Markets (2)

Geography

3%

Other

Developed

Markets (3)

84%

US

2023E

6%

Emerging

Markets (2)

2%

UK

OO

Focus on US

Source: Management estimates. Notes:

1) Demand-driven revenue reflects revenue from Virtual Care contracts. Fixed revenue reflects revenue from Babylon VBC and Software contracts.

Includes SE ASIA, China, LATAM, Rwanda, Middle East, Africa and India.

2)

3)

Includes Canada and Other Developed Markets (including Australia, New Zealand, Japan, and Continental Europe).

6%

Other

Developed

Markets (3)

85%

US

10%

Software

2021 E

9%

Virtual Care

81%

VBC

Product

10%

Software

2023E

3%

Virtual Care

87%

VBC

Babylon VBC augmented by high-margin

software licensing

31View entire presentation