Bank of America Investment Banking Pitch Book

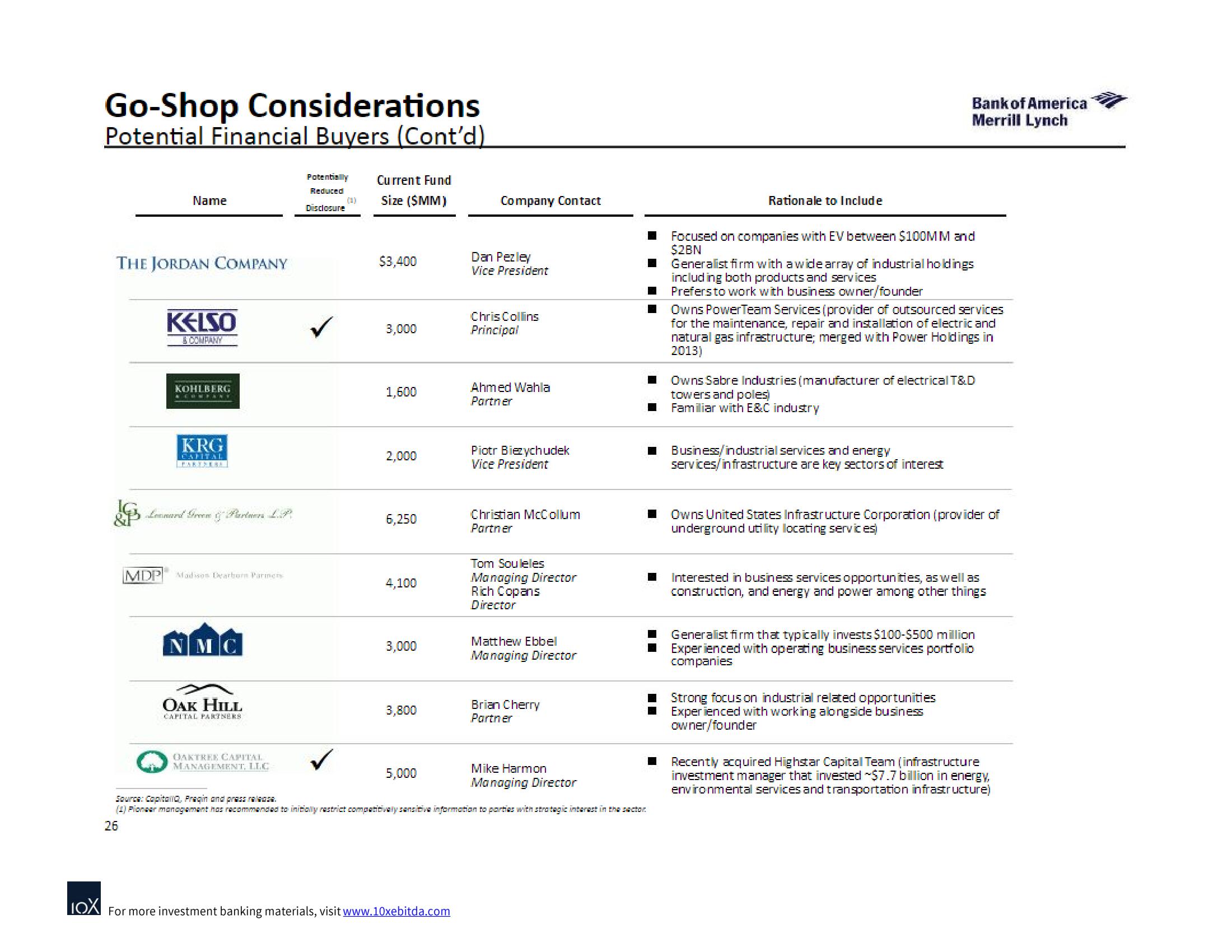

Go-Shop Considerations

Potential Financial Buyers (Cont'd)

THE JORDAN COMPANY

始

Name

MDP

KELSO

& COMPANY

KOHLBERG

KRG

9

Madison Dearborn Parmers

NMC

OAK HILL

CAPITAL PARTNERS

OAKTREE CAPITAL

MANAGEMENT, LLC

Potentially Current Fund

Reduced

Size (SMM)

Disclosure

✓

$3,400

3,000

1,600

2,000

6,250

4,100

3,000

3,800

5,000

Company Contact

LOX For more investment banking materials, visit www.10xebitda.com

Dan Pezley

Vice President

Chris Collins

Principal

Ahmed Wahla

Partner

Piotr Biezychudek

Vice President

Christian McCollum

Partner

Tom Souleles

Managing Director

Rich Copans

Director

Matthew Ebbel

Managing Director

Brian Cherry

Partner

Mike Harmon

Managing Director

Source: Capitala, Pragin and press release.

(4) Pioneer management has recommended to initially restrict competitivaly sensitive information to parties with strategic interest in the sector

26

Rationale to Include

7

Focused on companies with EV between $100MM and

$2BN

0 Generalist firm with a wide array of industrial holdings

including both products and services

Prefers to work with business owner/founder

Bank of America

Merrill Lynch

Owns PowerTeam Services (provider of outsourced services

for the maintenance, repair and installation of electric and

natural gas infrastructure; merged with Power Holdings in

2013)

■ Owns Sabre Industries (manufacturer of electrical T&D

towers and poles)

Familiar with E&C industry

Business/industrial services and energy

services/infrastructure are key sectors of interest

Owns United States Infrastructure Corporation (provider of

underground utility locating services)

2 Interested in business services opportunities, as well as

construction, and energy and power among other things

Generalist firm that typically invests $100-$500 million

Experienced with operating business services portfolio

companies

Strong focus on industrial related opportunities

Experienced with working alongside business

owner/founder

Recently acquired Highstar Capital Team (infrastructure

investment manager that invested $7.7 billion in energy,

environmental services and transportation infrastructure)View entire presentation